Question

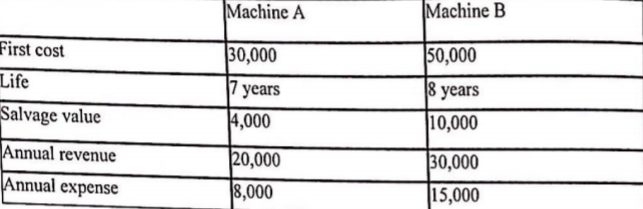

The following table shows that relevant data for two mutually exclusive alternative machines. The market interest rate is 20% compounded monthly. a) Determine the discounted

The following table shows that relevant data for two mutually exclusive alternative machines. The market interest rate is 20% compounded monthly. a) Determine the discounted payback period for machine A. b) Determine which machine should be chosen assuming that you will need the machine for only 4 years. Assume that the salvage values for Machine A and Machine B at the end of year 4 are $6000 and $15000, respectively. c) Determine which machine should be chosen assuming that you will need the machine for an indefinite amount of time. Assume that if you buy one of the machines you will use it until end of its service life and then replace it with a new one of the same type.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started