Answered step by step

Verified Expert Solution

Question

1 Approved Answer

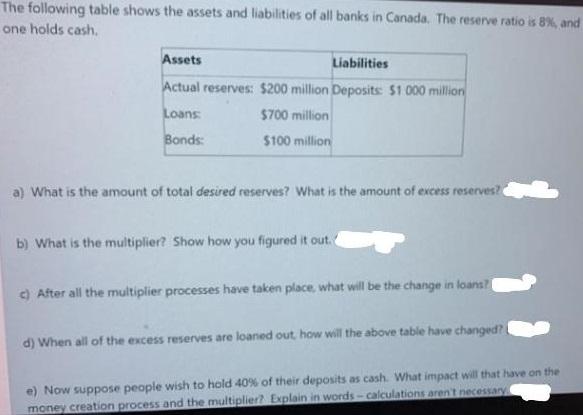

The following table shows the assets and liabilities of all banks in Canada. The reserve ratio is 8%, and one holds cash. Assets Liabilities

The following table shows the assets and liabilities of all banks in Canada. The reserve ratio is 8%, and one holds cash. Assets Liabilities Actual reserves: $200 million Deposits: $1 000 million Loans: $700 million Bonds: $100 million a) What is the amount of total desired reserves? What is the amount of excess reserves? b) What is the multiplier? Show how you figured it out. c) After all the multiplier processes have taken place, what will be the change in loans d) When all of the excess reserves are loaned out how will the above table have changed? e) Now suppose people wish to hold 40% of their deposits as cash. What impact will that have on the money creation process and the multiplier? Explain in words-calculations aren't necessary

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Desired reserve is the required reserve Desired reserve Deposits RR ratio 1000 125 125 million Ans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started