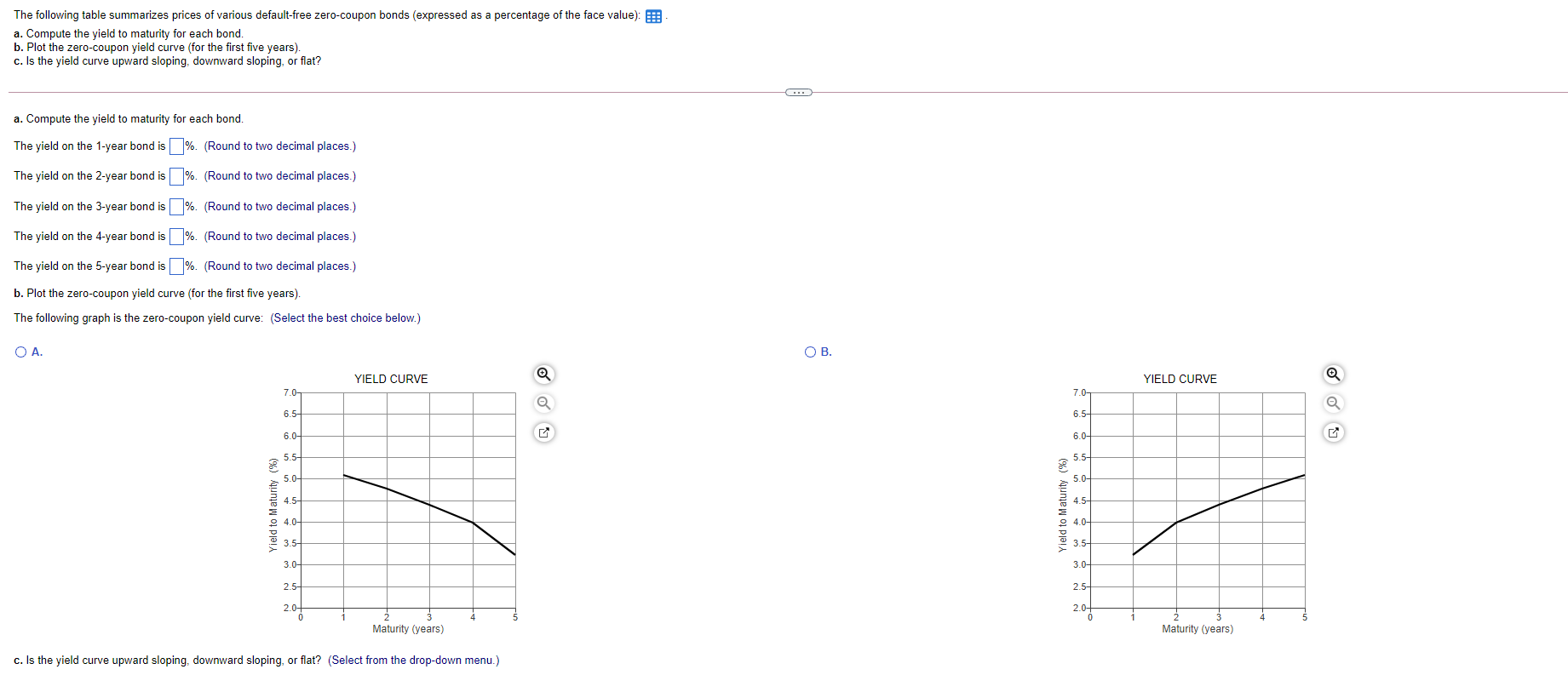

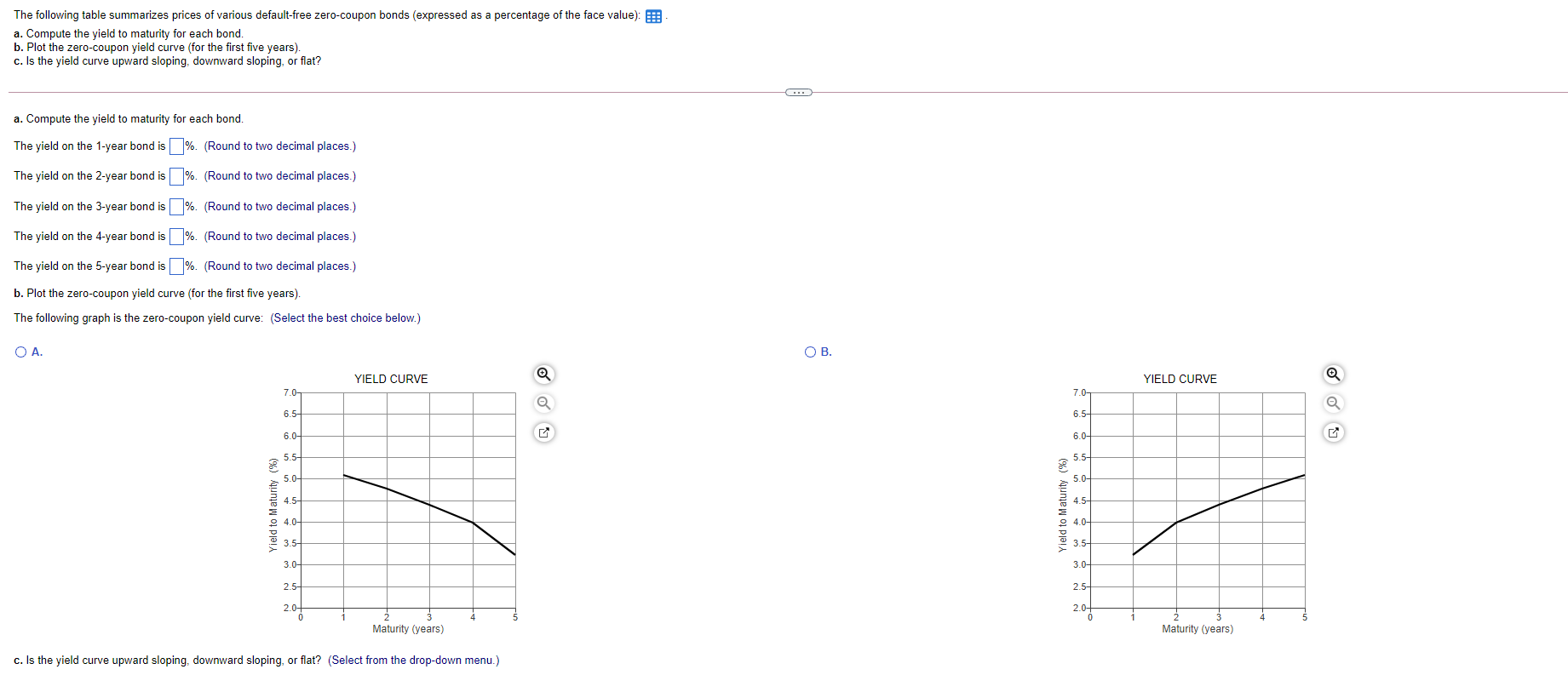

The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): E a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? ... a. Compute the yield to maturity for each bond. The yield on the 1-year bond is %. (Round to two decimal places.) The yield on the 2-year bond is %. (Round to two decimal places.) The yield on the 3-year bond is%. (Round to two decimal places.) The yield on the 4-year bond is %. (Round to two decimal places.) The yield on the 5-year bond is \%. (Round to two decimal places.) b. Plot the zero-coupon yield curve (for the first five years). The following graph is the zero-coupon yield curve: (Select the best choice below.) OA. OB. YIELD CURVE Q YIELD CURVE 7.0 7.0 Q 6.5 6.5 6.0 6.0 5.5 5.5 5.0 5.0 4.5 45. ield to Maturity (%) Yield to Maturity (%) 9 4.0 9 4.0 3.5 3.5 3.0- 3.0- 2.5- 25 2.0- 2.0+ Maturity (years) Maturity (years) c. Is the yield curve upward sloping, downward sloping, or flat? (Select from the drop-down menu.) The following table summarizes prices of various default-free zero-coupon bonds (expressed as a percentage of the face value): E a. Compute the yield to maturity for each bond. b. Plot the zero-coupon yield curve (for the first five years). c. Is the yield curve upward sloping, downward sloping, or flat? ... a. Compute the yield to maturity for each bond. The yield on the 1-year bond is %. (Round to two decimal places.) The yield on the 2-year bond is %. (Round to two decimal places.) The yield on the 3-year bond is%. (Round to two decimal places.) The yield on the 4-year bond is %. (Round to two decimal places.) The yield on the 5-year bond is \%. (Round to two decimal places.) b. Plot the zero-coupon yield curve (for the first five years). The following graph is the zero-coupon yield curve: (Select the best choice below.) OA. OB. YIELD CURVE Q YIELD CURVE 7.0 7.0 Q 6.5 6.5 6.0 6.0 5.5 5.5 5.0 5.0 4.5 45. ield to Maturity (%) Yield to Maturity (%) 9 4.0 9 4.0 3.5 3.5 3.0- 3.0- 2.5- 25 2.0- 2.0+ Maturity (years) Maturity (years) c. Is the yield curve upward sloping, downward sloping, or flat? (Select from the drop-down menu.)