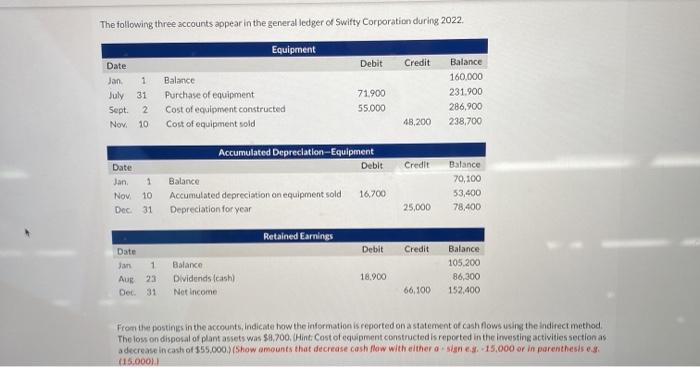

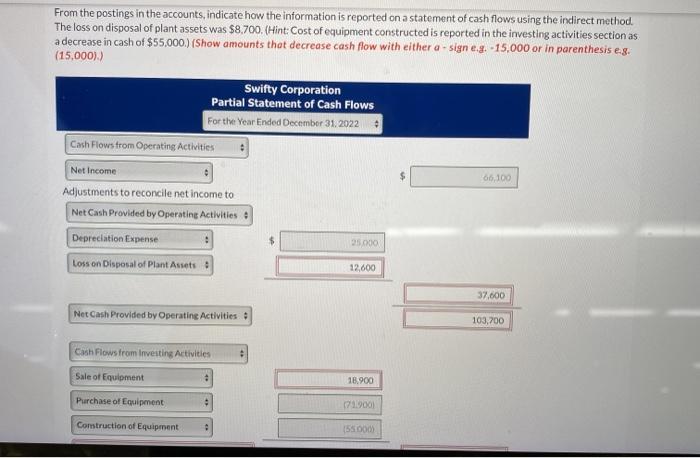

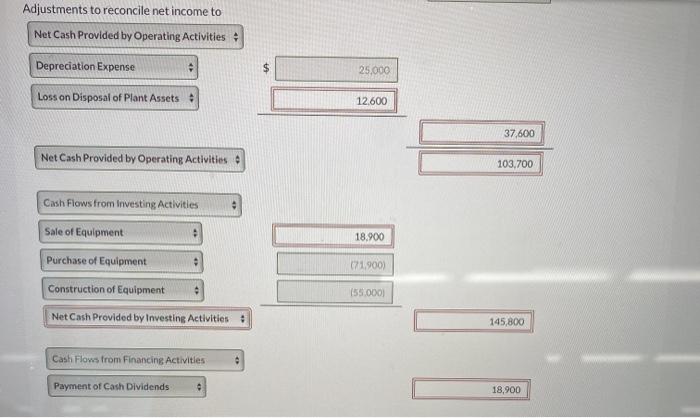

The following three accounts appear in the general ledger of Swifty Corporation during 2022 Equipment Debit Credit Date Jan 1 July 31 Sept. 2 10 Balance Purchase of equipment Cost of equipment constructed Cost of equipment sold 71.900 55.000 Balance 160,000 231.900 286,900 238,700 Now 48,200 Accumulated Depreciation-Equipment Debit Credit Date Jan 1 Nov 10 Dec 31 Balance Accumulated depreciation on equipment sold Depreciation for year Balance 70,100 53,400 78,400 16,700 25,000 Retained Earnings Debit Credit Date Jan 1 Aug 23 Det. 31 Balance Dividends cash Net Income Balance 105.200 86,300 152,400 18.900 66,100 From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the Indirect method The loss on disposal of plant assets was $8,700. (HintCost of equipment constructed is reported in the investing activities section as a decreme in cash of $55.000>(Show amounts that decrease cash flow with either signes. 15,000 or in parenthesses (15.000). From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. The loss on disposal of plant assets was $8,700. (Hint: Cost of equipment constructed is reported in the investing activities section as a decrease in cash of $55.000.) (Show amounts that decrease cash flow with either a - signe.g. - 15,000 or in parenthesis e.g. (15,000).) Swifty Corporation Partial Statement of Cash Flows For the Year Ended December 31, 2022 Cash Flows trom Operating Activities Net Income 66.100 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense Loss on Disposal of Plant Assets 95.000 12,600 37,600 Net Cash Provided by Operating Activities : 103,700 Cash Flows from Investing Activities Sale of Equipment 18.900 Purchase of Equipment (729001 Construction of Equipment 155.000 Adjustments to reconcile net income to Net Cash Provided by Operating Activities - Depreciation Expense $ 25,000 Loss on Disposal of Plant Assets 12.600 37,600 Net Cash Provided by Operating Activities 103,700 Cash Flows from Investing Activities Sale of Equipment 18.900 Purchase of Equipment (71.900) Construction of Equipment 155.000 Net Cash Provided by Investing Activities : 145,800 Cash Flows from Financing Activities Payment of Cash Dividends 18,900