Answered step by step

Verified Expert Solution

Question

1 Approved Answer

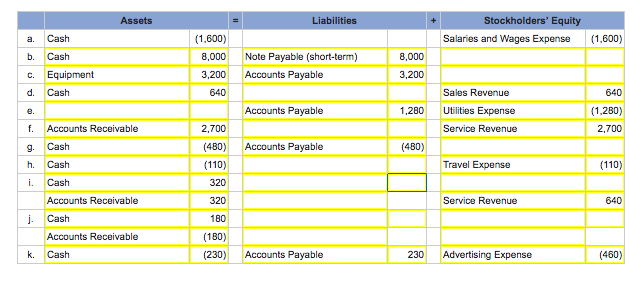

The following transactions occurred during a recent year: a. Paid wages of $1,600 for the current period (example). b. Borrowed $8,000 cash from local bank

| The following transactions occurred during a recent year: |

| a. | Paid wages of $1,600 for the current period (example). |

| b. | Borrowed $8,000 cash from local bank using a short-term note. |

| c. | Purchased $3,200 of equipment on credit. |

| d. | Earned $640 of sales revenue; collected cash. |

| e. | Received $1,280 of utilities services, on credit. |

| f. | Earned $2,700 of service revenue, on credit. |

| g. | Paid $480 cash on account to a supplier. |

| h. | Incurred $110 of travel expenses; paid cash. |

| i. | Earned $640 of service revenue; collected half in cash, with balance on credit. |

| j. | Collected $180 cash from customers on account. |

| k. | Incurred $460 of advertising costs; paid half in cash, with balance on credit. |

| Required: |

| 1. | For each of the transactions, complete the table below, indicating the account, amount, and direction of the effect (+ for increase and ? for decrease) of each transaction under the accrual basis. Include revenues and expenses as subcategories of stockholders equity, as shown for the first transaction, which is provided as an example. Also, determine the companys preliminary net income. (Enter any decreases to account balances with a minus sign.) |

| 2. | Determine the companys preliminary net income. |

| Preeliminary Net Income = __________$ |

ilities a. Cash b. Cash C. Equipment d. Cash (1,600) Salaries and Wages Expense 1600) 8,000 Note Payable (short-term) 8,000 3,200 Accounts Payable 3,200 Sales Revenue (1,280) 2,700 Accounts Payable 1,280 Utilities Expense 2,700 (480) Accounts Payable (110) Service Revenue g. Casth . Cash i. Cash 4B0) Travel Expense (110) Service Revenue Cash 180 (180) (230) Accounts Payable k. Cash 230 Advertising Expense (460)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started