Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following transactions occurred in the order shown in 2019 for a new firm called ACCO Ltd. (The fiscal year is the same as

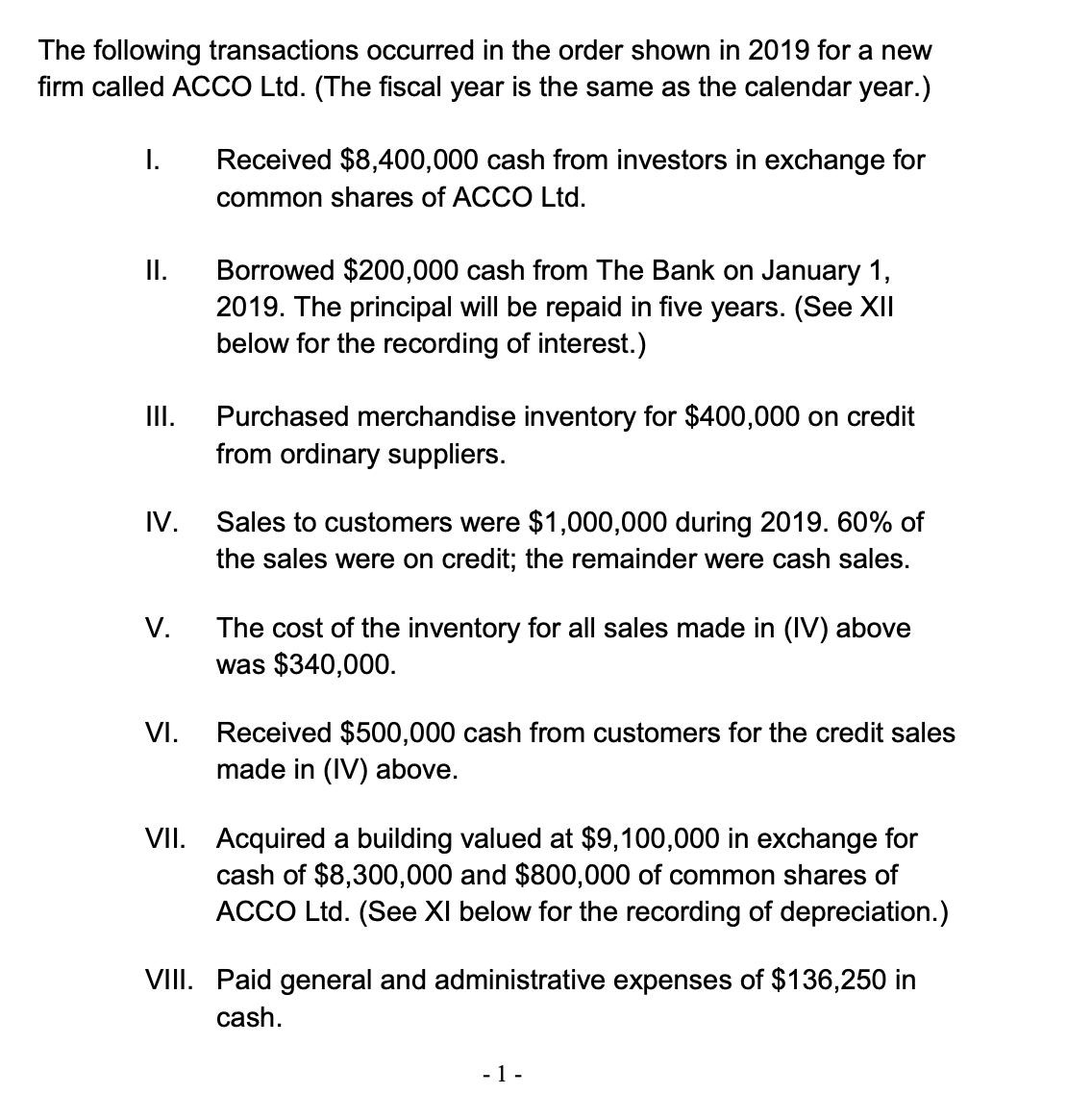

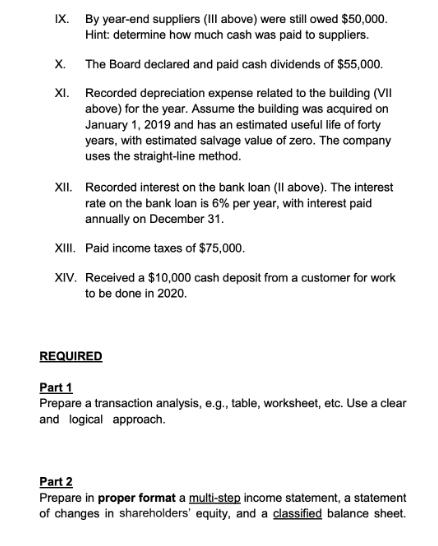

The following transactions occurred in the order shown in 2019 for a new firm called ACCO Ltd. (The fiscal year is the same as the calendar year.) I. II. III. IV. V. VI. Received $8,400,000 cash from investors in exchange for common shares of ACCO Ltd. Borrowed $200,000 cash from The Bank on January 1, 2019. The principal will be repaid in five years. (See XII below for the recording of interest.) Purchased merchandise inventory for $400,000 on credit from ordinary suppliers. Sales to customers were $1,000,000 during 2019. 60% of the sales were on credit; the remainder were cash sales. The cost of the inventory for all sales made in (IV) above was $340,000. Received $500,000 cash from customers for the credit sales made in (IV) above. VII. Acquired a Iding valued at $9,100,000 in ex for cash of $8,300,000 and $800,000 of common shares of ACCO Ltd. (See XI below for the recording of depreciation.) VIII. Paid general and administrative expenses of $136,250 in cash. - 1- IX. By year-end suppliers (III above) were still owed $50,000. Hint: determine how much cash was paid to suppliers. The Board declared and paid cash dividends of $55,000. X. XI. Recorded depreciation expense related to the building (VII above) for the year. Assume the building was acquired on January 1, 2019 and has an estimated useful life of forty years, with estimated salvage value of zero. The company uses the straight-line method. XII. Recorded interest on the bank loan (II above). The interest rate on the bank loan is 6% per year, with interest paid annually on December 31. XIII. Paid income taxes of $75,000. XIV. Received a $10,000 cash deposit from a customer for work to be done in 2020. REQUIRED Part 1 Prepare a transaction analysis, e.g., table, worksheet, etc. Use a clear and logical approach. Part 2 Prepare in proper format a multi-step income statement, a statement of changes in shareholders' equity, and a classified balance sheet.

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started