Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bongani Ndamase retired on 31 December 2021 at the age of 65. He received the following information regarding the lump sum that his pension

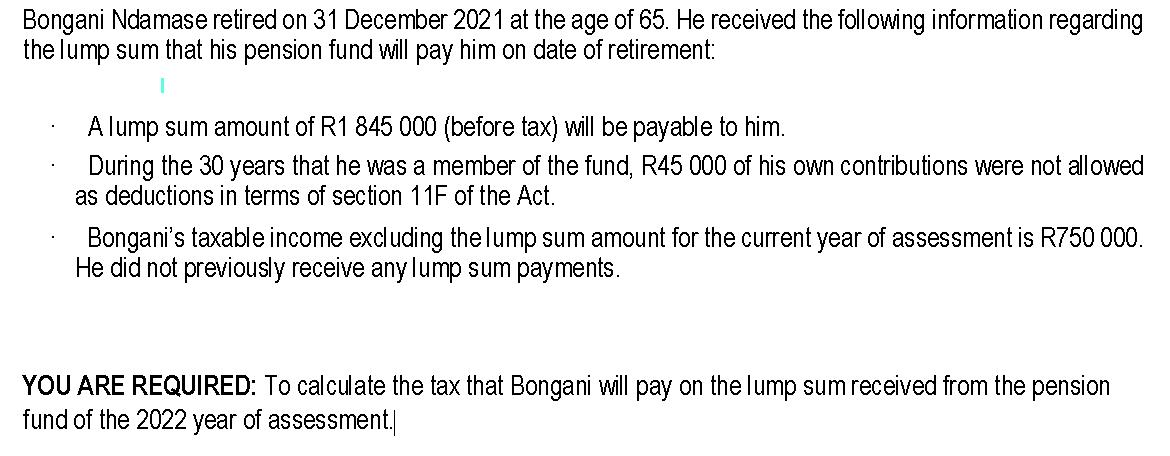

Bongani Ndamase retired on 31 December 2021 at the age of 65. He received the following information regarding the lump sum that his pension fund will pay him on date of retirement: A lump sum amount of R1 845 000 (before tax) will be payable to him. During the 30 years that he was a member of the fund, R45 000 of his own contributions were not allowed as deductions in terms of section 11F of the Act. Bongani's taxable income excluding the lump sum amount for the current year of assessment is R750 000. He did not previously receive any lump sum payments. YOU ARE REQUIRED: To calculate the tax that Bongani will pay on the lump sum received from the pension fund of the 2022 year of assessment.

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the tax that Bongani will pay on the lump sum received from the pension fund in the 202...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started