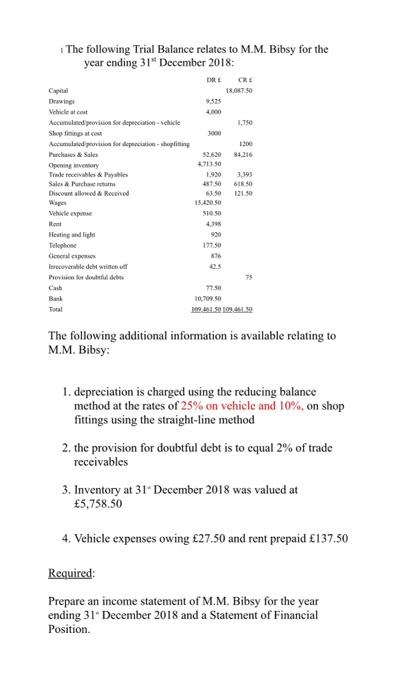

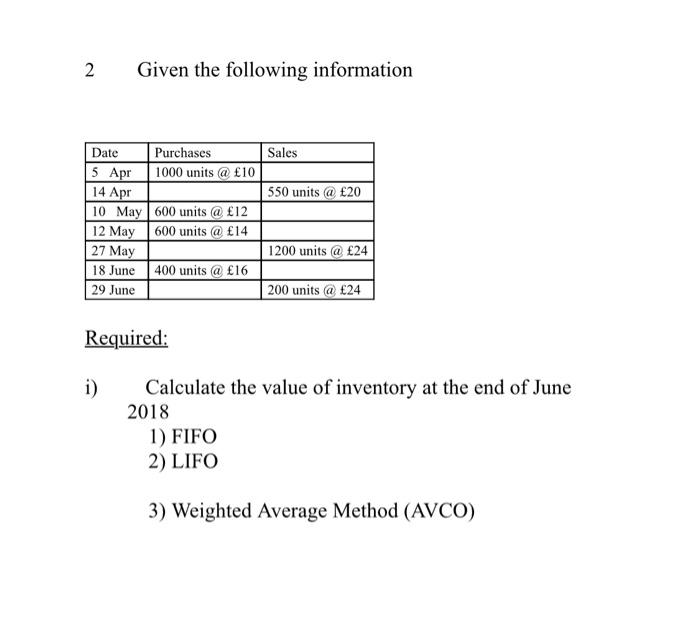

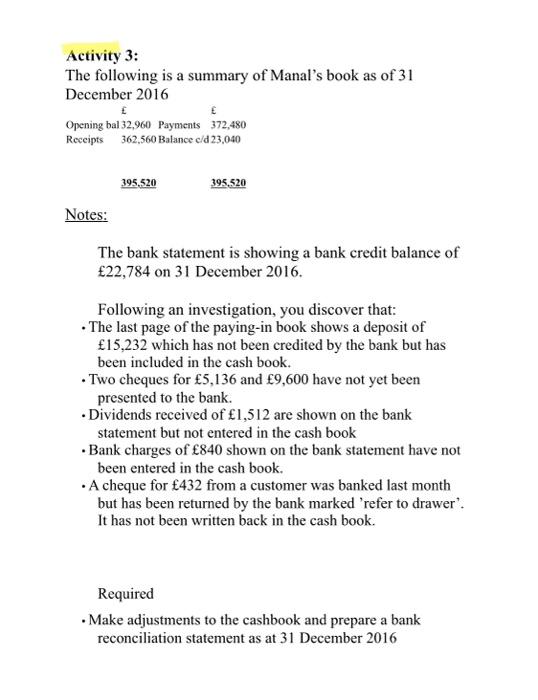

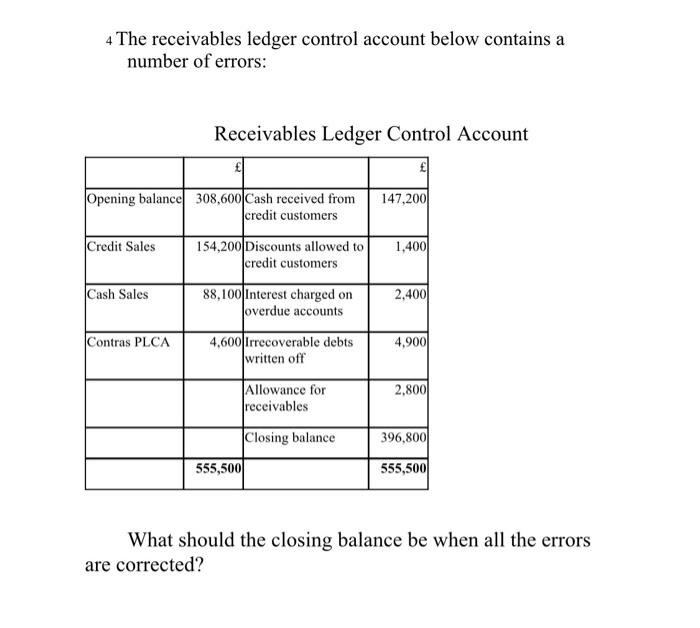

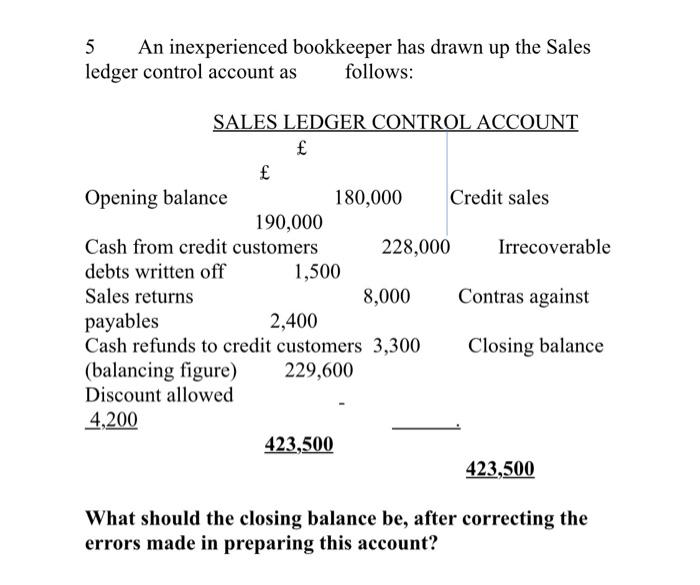

The following Trial Balance relates to M.M. Bibsy for the year ending 31" December 2018: DE CE 18.087.50 4.000 1.750 3000 Drawing Vehicle at cost Accumulatorio Sox depectationschile Shop finns atest Accumulated posto odpection - hoplifting Purchase & Sales Opening very Trade receivables & Payable Salt Puchosem Discount allowed Recenved Wager 1200 84.216 4.713.30 1.930 48750 3.393 6180 121.50 15,420 SO SIS Mont Hosting and light Telephone tamil euppan is coverable debt wiene Previous Cash 177.50 176 es 75 77.50 10.700.50 9251.50 109 1.9 Total The following additional information is available relating to M.M. Bibsy: I. depreciation is charged using the reducing balance method at the rates of 25% on vehicle and 10%, on shop fittings using the straight-line method 2. the provision for doubtful debt is to equal 2% of trade receivables 3. Inventory at 31 December 2018 was valued at 5,758.50 4. Vehicle expenses owing 27.50 and rent prepaid 137.50 Required: Prepare an income statement of M.M. Bibsy for the year ending 31" December 2018 and a Statement of Financial Position 2 Given the following information Sales 550 units @ 20 Date Purchases 5 Apr 1000 units @ 10 14 Apr 10 May 600 units @ 12 12 May 600 units @ 14 27 May 18 June 400 units @ 16 29 June 1200 units @ 24 200 units @ 24 Required: i) Calculate the value of inventory at the end of June 2018 1) FIFO ) 2) LIFO 3) Weighted Average Method (AVCO) Activity 3: The following is a summary of Manal's book as of 31 December 2016 Opening bal 32,960 Payments 372,480 Receipts 362,560 Balance c/d 23,040 395.520 395.520 Notes: The bank statement is showing a bank credit balance of 22,784 on 31 December 2016. Following an investigation, you discover that: The last page of the paying-in book shows a deposit of 15,232 which has not been credited by the bank but has been included in the cash book. Two cheques for 5,136 and 9,600 have not yet been presented to the bank. Dividends received of 1,512 are shown on the bank statement but not entered in the cash book Bank charges of 840 shown on the bank statement have not been entered in the cash book. A cheque for 432 from a customer was banked last month but has been returned by the bank marked 'refer to drawer'. It has not been written back in the cash book. Required Make adjustments to the cashbook and prepare a bank reconciliation statement as at 31 December 2016 4 The receivables ledger control account below contains a number of errors: Receivables Ledger Control Account Opening balance 308,600 Cash received from credit customers 147,200 Credit Sales 154,200 Discounts allowed to credit customers 1,400 Cash Sales 88.100 Interest charged on overdue accounts 2,400 Contras PLCA 4,600 Irrecoverable debts written off 4,900 2,800 Allowance for receivables Closing balance 396,800 555,500 555,500 What should the closing balance be when all the errors are corrected? 5 An inexperienced bookkeeper has drawn up the Sales ledger control account as follows: SALES LEDGER CONTROL ACCOUNT Opening balance 180,000 Credit sales 190,000 Cash from credit customers 228,000 Irrecoverable debts written off 1,500 Sales returns 8,000 Contras against payables 2,400 Cash refunds to credit customers 3,300 Closing balance (balancing figure) 229,600 Discount allowed 4,200 423,500 423,500 What should the closing balance be, after correcting the errors made in preparing this account