Answered step by step

Verified Expert Solution

Question

1 Approved Answer

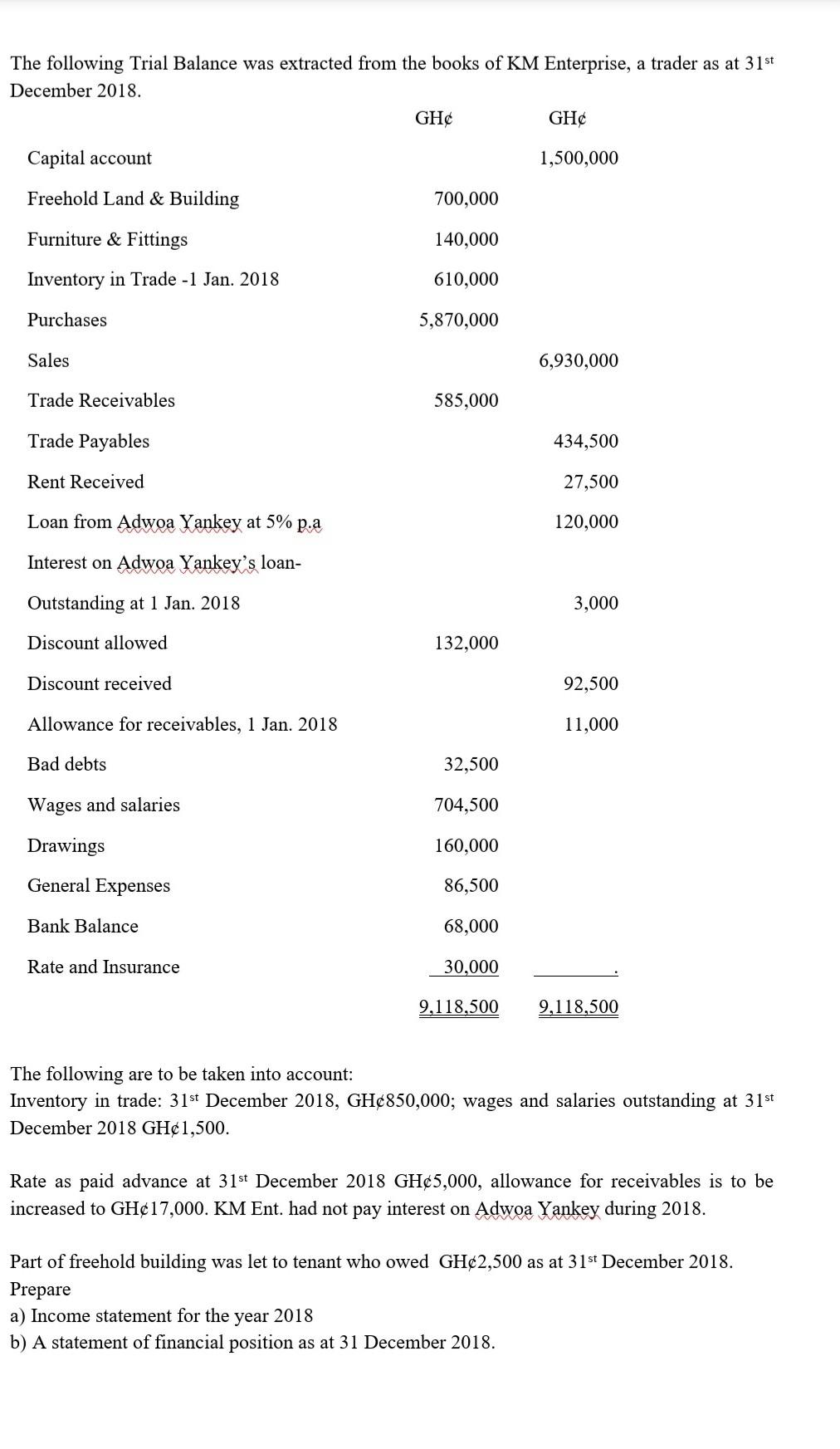

The following Trial Balance was extracted from the books of KM Enterprise, a trader as at 31st December 2018. GHC GHC Capital account 1,500,000 Freehold

The following Trial Balance was extracted from the books of KM Enterprise, a trader as at 31st December 2018. GHC GHC Capital account 1,500,000 Freehold Land & Building 700,000 Furniture & Fittings 140,000 Inventory in Trade -1 Jan. 2018 610,000 Purchases 5,870,000 Sales 6,930,000 Trade Receivables 585,000 Trade Payables 434,500 Rent Received 27,500 Loan from Adwoa Yankey at 5% p.a 120,000 Interest on Adwoa Yankey's loan- Outstanding at 1 Jan. 2018 3,000 Discount allowed 132,000 Discount received 92,500 Allowance for receivables, 1 Jan. 2018 11,000 Bad debts 32,500 Wages and salaries 704,500 Drawings 160,000 General Expenses 86,500 Bank Balance 68,000 Rate and Insurance 30,000 9,118,500 9,118,500 The following are to be taken into account: Inventory in trade: 31st December 2018, GH850,000; wages and salaries outstanding at 31st December 2018 GH1,500. Rate as paid advance at 31st December 2018 GH5,000, allowance for receivables is to be increased to GH17,000. KM Ent. had not pay interest on Adwoa Yankey during 2018. Part of freehold building was let to tenant who owed GH2,500 as at 31st December 2018. Prepare a) Income statement for the year 2018 b) A statement of financial position as at 31 December 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started