Answered step by step

Verified Expert Solution

Question

1 Approved Answer

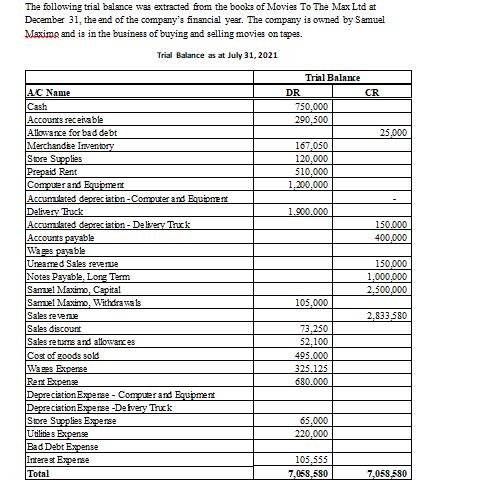

The following trial balance was extracted from the books of Movies To The Max Ltd at December 31, the end of the company's financial

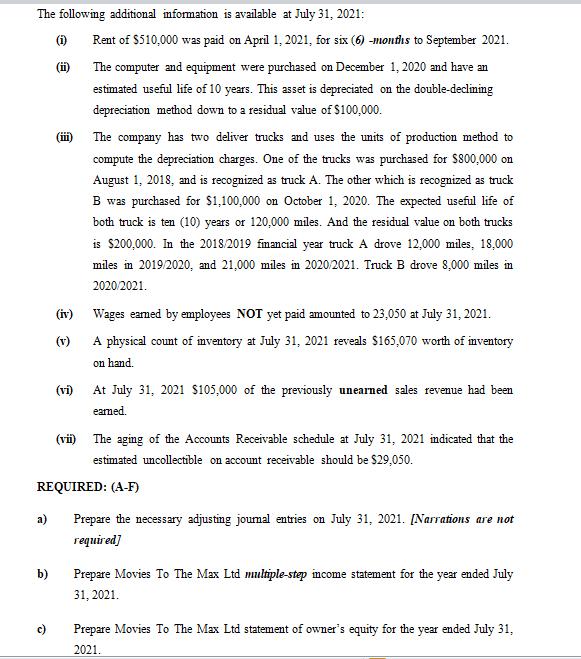

The following trial balance was extracted from the books of Movies To The Max Ltd at December 31, the end of the company's financial year. The company is owned by Samuel Maximo and is in the business of buying and selling movies on tspes. Trial Balance as at July 31, 2021 Trial Balance AC Name Cash Accounts receivable Atlowance for bad debt Merchandhe Inventory Store Supplies Prepaid Rent Compuerand Eqvipment Accumtated deprec iation -Computer and Equionen Delivery Truck Accumtated daprec iation - De livery Truck Accounts payable Wages payable Ureamed Sales revene DR CR 750,000 290,500 25,000 167,050 120,000 510,000 1,200,000 1.900.000 150.000 400,000 150,000 1,000,000 2,500,000 Notes Payable, Lorg Term Samel Maximo, Capital Samuel Maximo, Withdra wals Sales revene Sales discount 105,000 2,833,580 73,250 Sales returns and allowances 52,100 495.000 325.125 680.000 Cost of goods sold Wages Experse Rent Expense Depreciation Experse - Compuerand Equipment Depreciation Experse -Defvery Truck Sore Supplies Experse Utilities Expense Bad Debt Expense Interest Experse Total 65,000 220,000 105,555 7,058,580 7,058,580 The following additional imformation is available at July 31, 2021: (1) Rent of $510,000 was paid on April 1, 2021, for six (6) -months to September 2021. (i) The computer and equipment were purchased on December 1, 2020 and have an estimated useful life of 10 years. This asset is depreciated on the double-declining depreciation method down to a residual value of $100,000. (i) The company has two deliver trucks and uses the units of production method to compute the depreciation charges. One of the trucks was purchased for S800,000 on August 1, 2018, and is recognized as truck A. The other which is recognized as truck B was purchased for $1,100,000 on October 1, 2020. The expected useful life of both truck is ten (10) years or 120,000 miles. And the residual value on both trucks is $200,000. In the 2018.2019 fmancial year truck A drove 12,000 miles, 18,000 miles in 2019/2020, and 21,000 miles in 2020/2021. Truck B drove 8,000 miles in 2020/2021. (iv) Wages eamed by employees NOT yet paid amounted to 23,050 at July 31, 2021. (v) A physical count of inventory at July 31, 2021 reveals $165,070 worth of inventory on hand. (vi) At July 31, 2021 S105,000 of the previously unearned sales revenue had been eamed. (vii) The aging of the Accounts Receivable schedule at July 31, 2021 imdicated that the estimated uncollectible on account receivable should be $29,050. REQUIRED: (A-F) a) Prepare the necessary adjusting joumal entries on July 31, 2021. [Narrations are not required] b) Prepare Movies To The Max Ltd multiple-step income statement for the year ended July 31, 2021. c) Prepare Movies To The Max Ltd statement of owner's equity for the year ended July 31, 2021. d) Prepare Movies To The Max Ltd classified balance sheet at July 31, 2021. e) Prepare the closing entries f) Prepare the post-closing trial balance

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer The dfollouwing trial balance was July company the busines of buying tapes thial Balana as at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started