Answered step by step

Verified Expert Solution

Question

1 Approved Answer

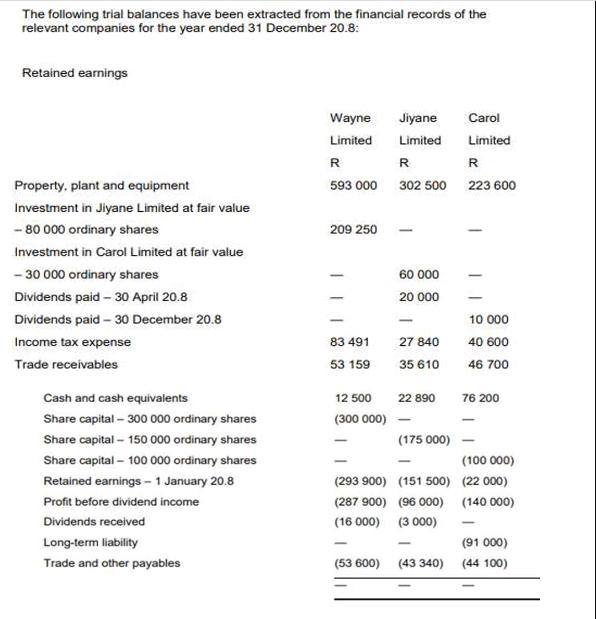

The following trial balances have been extracted from the financial records of the relevant companies for the year ended 31 December 20.8: Retained earnings

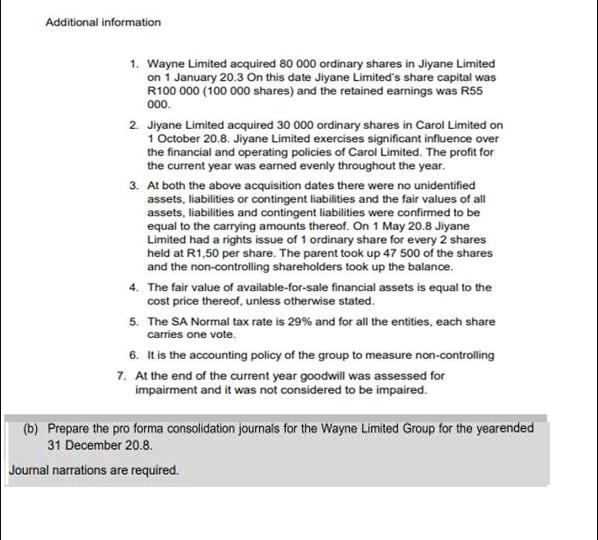

The following trial balances have been extracted from the financial records of the relevant companies for the year ended 31 December 20.8: Retained earnings Property, plant and equipment Investment in Jiyane Limited at fair value - 80 000 ordinary shares Investment in Carol Limited at fair value - 30 000 ordinary shares Dividends paid - 30 April 20.8 Dividends paid -30 December 20.8 Income tax expense Trade receivables Cash and cash equivalents Share capital - 300 000 ordinary shares Share capital - 150 000 ordinary shares Share capital - 100 000 ordinary shares Retained earnings - 1 January 20.8 Profit before dividend income Dividends received Long-term liability Trade and other payables Wayne Limited R R R 593 000 302 500 223 600 209 250 83 491 53 159 12 500 (300 000) (293 900) (287 900) (16 000) Jiyane Carol Limited Limited - I 60 000 20 000 27 840 35 610 22 890 (175 000) (151 500) (96 000) (3 000) 1 10 000 40 600 46 700 76 200 (100 000) (22 000) (140 000) (91 000) (53 600) (43 340) (44 100) Additional information 1. Wayne Limited acquired 80 000 ordinary shares in Jiyane Limited on 1 January 20.3 On this date Jiyane Limited's share capital was R100 000 (100 000 shares) and the retained earnings was R55 000. 2. Jiyane Limited acquired 30 000 ordinary shares in Carol Limited on 1 October 20.8. Jiyane Limited exercises significant influence over the financial and operating policies of Carol Limited. The profit for the current year was earned evenly throughout the year. 3. At both the above acquisition dates there were no unidentified assets, liabilities or contingent liabilities and the fair values of all assets, liabilities and contingent liabilities were confirmed to be equal to the carrying amounts thereof. On 1 May 20.8 Jiyane Limited had a rights issue of 1 ordinary share for every 2 shares held at R1,50 per share. The parent took up 47 500 of the shares and the non-controlling shareholders took up the balance. 4. The fair value of available-for-sale financial assets is equal to the cost price thereof, unless otherwise stated. 5. The SA Normal tax rate is 29% and for all the entities, each share carries one vote. 6. It is the accounting policy of the group to measure non-controlling 7. At the end of the current year goodwill was assessed for impairment and it was not considered to be impaired. (b) Prepare the pro forma consolidation journals for the Wayne Limited Group for the yearended 31 December 20.8. Journal narrations are required.

Step by Step Solution

★★★★★

3.36 Rating (137 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the pro forma consolidation journals for the Wayne Limited ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started