Dex a clothing line Company acquired all of the common stock of Rex, a shoe Company on January 1, 2022. During 2022, Rex reported

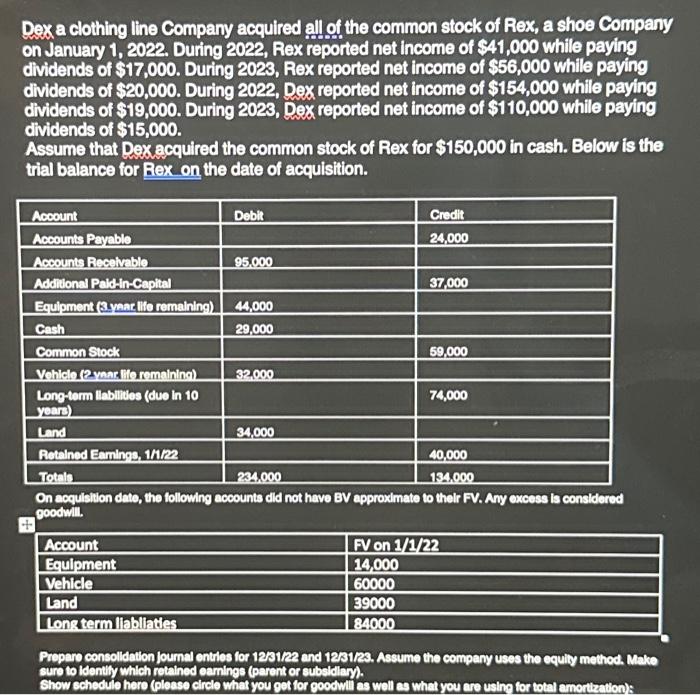

Dex a clothing line Company acquired all of the common stock of Rex, a shoe Company on January 1, 2022. During 2022, Rex reported net income of $41,000 while paying dividends of $17,000. During 2023, Rex reported net income of $56,000 while paying dividends of $20,000. During 2022, Dex reported net income of $154,000 while paying dividends of $19,000. During 2023, Dex reported net income of $110,000 while paying dividends of $15,000. Assume that Dex acquired the common stock of Rex for $150,000 in cash. Below is the trial balance for Rex on the date of acquisition. Account Accounts Payable Accounts Receivable Additional Paid-in-Capital Equipment (3.year life remaining) 44,000 Cash 29,000 Common Stock Vehicle (2 year life remaining) Long-term liabilities (due in 10 years) Land Retained Earnings, 1/1/22 40,000 Totals 234,000 134.000 on acquisition date, the following accounts did not have BV approximate to their FV. Any excess is considered goodwill Debit Account Equipment Vehicle Land Long term liabliaties 95.000 32.000 Credit 24,000 34,000 37,000 59,000 74,000 FV on 1/1/22 14,000 60000 39000 84000 Prepare consolidation Journal entries for 12/31/22 and 12/31/23. Assume the company uses the equity method. Make sure to identify which retained earnings (parent or subsidiary). Show schedule here (please circle what you get for goodwill as well as what you are using for total amortization):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare consolidation journal entries for 123122 and 123123 using the equity method we need to ca...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started