Question

The following unadjusted sections of the Statement of Financial Position of Karen Incorporation as at December 31, 2018 were presented to you. Cash P 85,000

The following unadjusted sections of the Statement of Financial Position of Karen Incorporation as at December 31, 2018 were presented to you.

Cash P 85,000

Accounts Receivable 282,400

Merchandise inventory 92,000

Deferred charges 8,600

Current assets P 468,000

Trade accounts payable, net of P5, 000 debit balance P 125,000

Interest payable 3,000

Income tax payable 12,000

Money claims of Union pending final decision 45,000

Mortgage payable due in four annual installments 100,000

Current liabilities P 285, 000

A review of the above indicate that the Cash account of P85,000 included the following:

Customers check returned by the bank marked NSF amounting to P1,250

Emp1oyees IOU of P2,000

P 10,000 deposited with the regional trial court of San Carlos City Pangasinan for a case under litigation.

Accounts receivable totaling P282,400 is composed of the following:

Customers debit balances of P 18l,400

Advances to subsidiaries of P 20,000

Advances to suppliers of P 15,000

Receivables from the Karen Incorporation officers of P 18,000

Allowance for Bad Debts of P 8,000

Merchandise invoiced at 140% of cost but not yet delivered - P56,000 (goods were not included in merchandise inventory).

QUESTIONS: Based on the above and the result of your audit, answer the following:

The correct balance of current assets on December 31, 2018

The correct balance of current liabilities on December 31, 2018

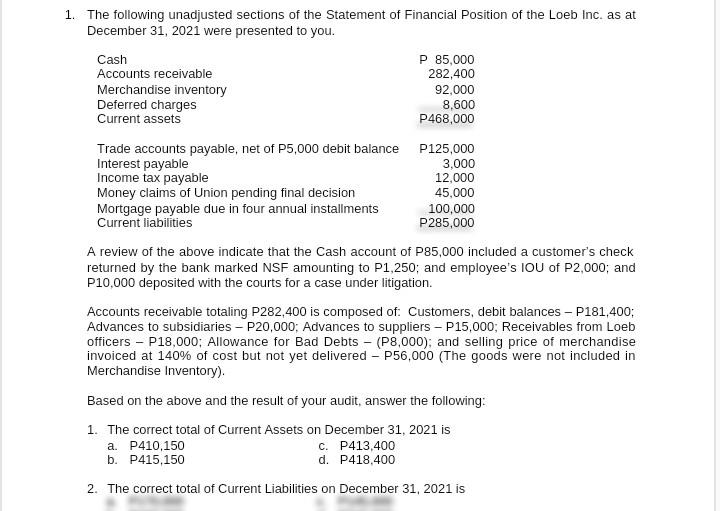

1. The following unadjusted sections of the Statement of Financial Position of the Loeb Inc. as at December 31, 2021 were presented to you. Cash P 85,000 Accounts receivable 282,400 Merchandise inventory 92,000 Deferred charges 8,600 Current assets P468,000 Trade accounts payable, net of P5,000 debit balance P125,000 Interest payable 3,000 Income tax payable 12,000 Money claims of Union pending final decision 45,000 Mortgage payable due in four annual installments 100,000 Current liabilities P285,000 A review of the above indicate that the Cash account of P85,000 included a customer's check returned by the bank marked NSF amounting to P1,250; and employee's IOU of P2,000; and P10,000 deposited with the courts for a case under litigation. Accounts receivable totaling P282,400 is composed of. Customers, debit balances - P181,400; Advances to subsidiaries - P20,000; Advances to suppliers - P15,000; Receivables from Loeb officers - P18,000; Allowance for Bad Debts - (P8,000); and selling price of merchandise invoiced at 140% of cost but not yet delivered - P56,000 (The goods were not included in Merchandise Inventory). Based on the above and the result of your audit, answer the following: 1. The correct total of Current Assets on December 31, 2021 is a. P410,150 c. P413,400 b. P415,150 d. P418,400 2. The correct total of Current Liabilities on December 31, 2021 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started