Question

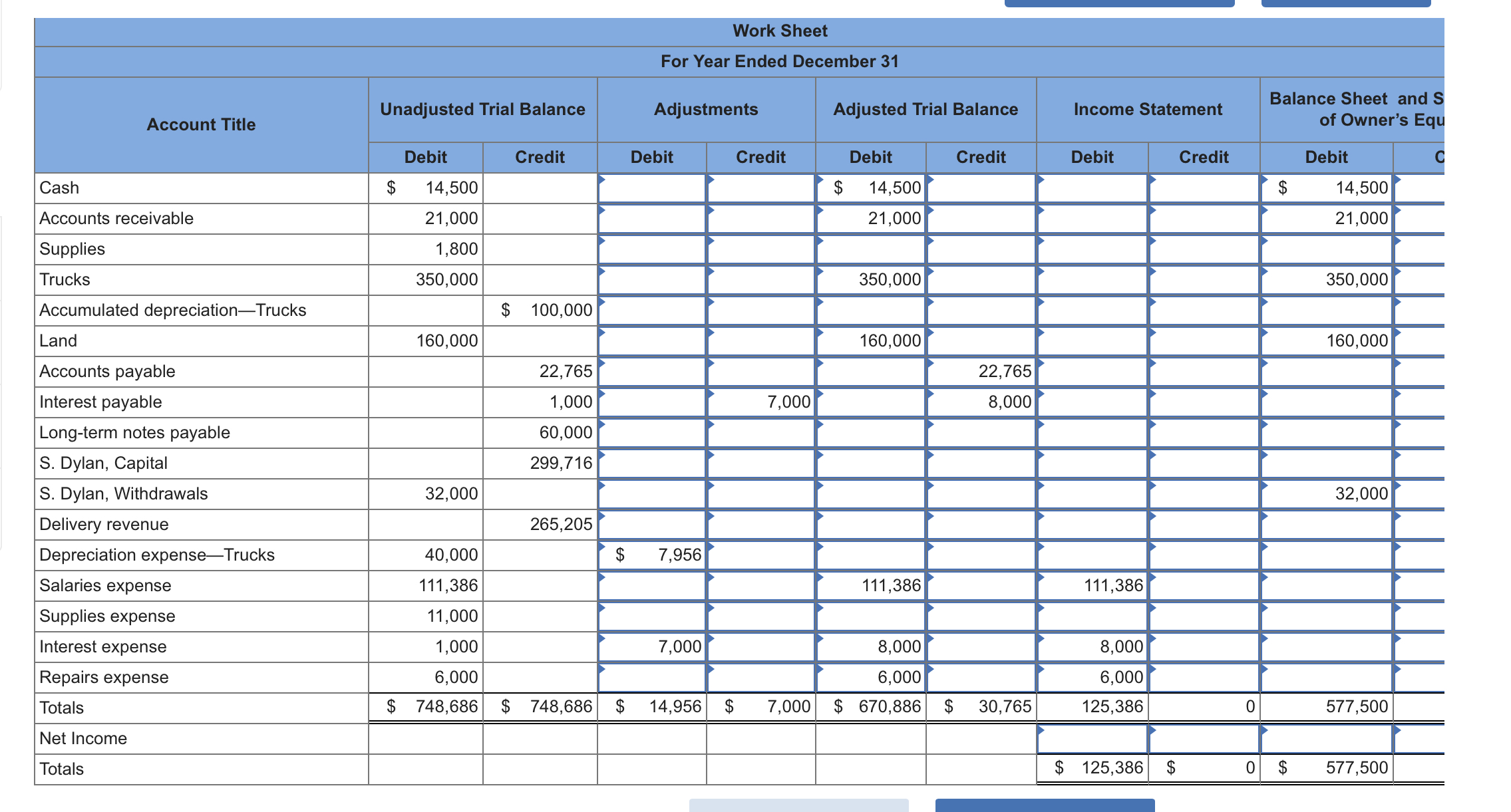

The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31. 1. Use the following information about the

The following unadjusted trial balance contains the accounts and balances of Dylan Delivery Company as of December 31.

1. Use the following information about the companys adjustments to complete a 10-column work sheet.

- Unrecorded depreciation on the trucks at the end of the year is $7,956.

- Total amount of accrued interest expense at year-end is $8,000.

- Cost of unused supplies still available at year-end is $800.

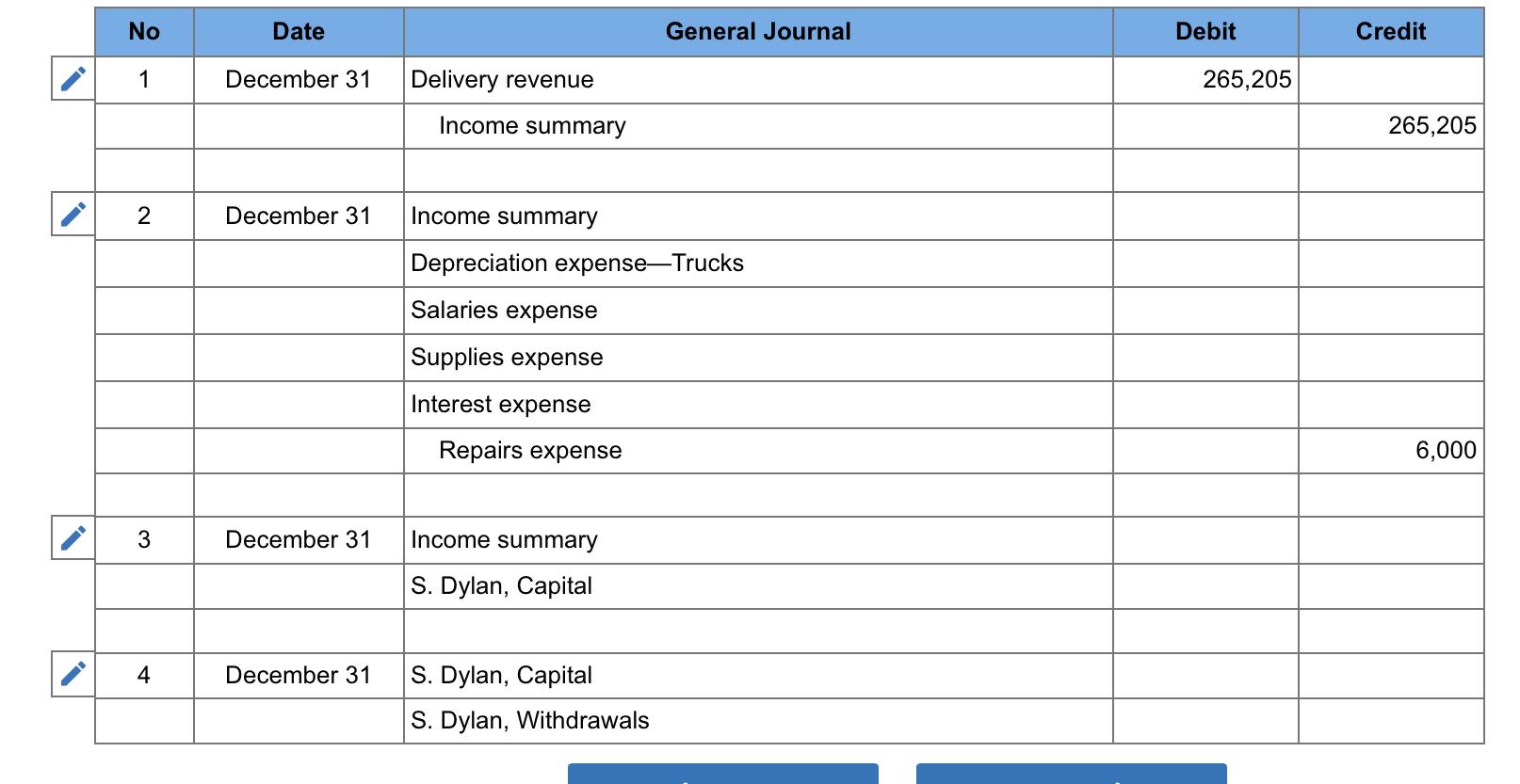

2a. Prepare the year-end closing entries for Dylan Delivery Company as of December 31.

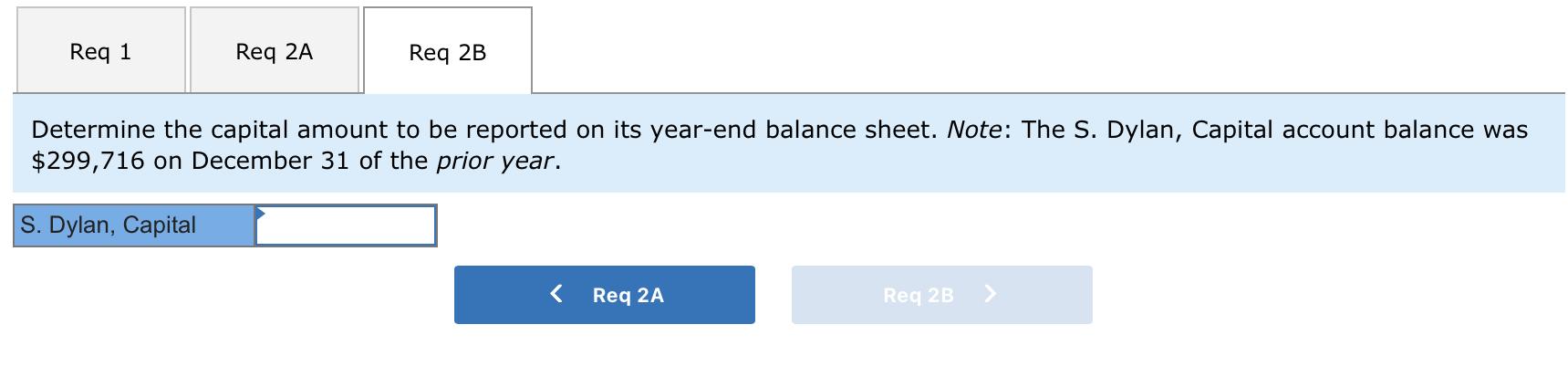

2b. Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $299,716 on December 31 of the prior year.

1.Use the following information about the companys adjustments to complete a 10-column work sheet.

2.Prepare the year-end closing entries for Dylan Delivery Company as of December 31.

3.Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $299,716 on December 31 of the prior year.

\begin{tabular}{|c|c|c|c|c|c|} \hline & No & Date & General Journal & Debit & Credit \\ \hline \multirow[t]{2}{*}{ i } & 1 & December 31 & Delivery revenue & 265,205 & \\ \hline & & & Income summary & & 265,205 \\ \hline \multirow[t]{6}{*}{%} & 2 & December 31 & Income summary & & \\ \hline & & & Depreciation expense-Trucks & & \\ \hline & & & Salaries expense & & \\ \hline & & & Supplies expense & & \\ \hline & & & Interest expense & & \\ \hline & & & Repairs expense & & 6,000 \\ \hline \multirow[t]{2}{*}{%} & 3 & December 31 & Income summary & & \\ \hline & & & S. Dylan, Capital & & \\ \hline \multirow[t]{2}{*}{>} & 4 & December 31 & S. Dylan, Capital & & \\ \hline & & & S. Dylan, Withdrawals & & \\ \hline \end{tabular} Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $299,716 on December 31 of the prior year. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{15}{|c|}{ Work Sheet } \\ \hline \multicolumn{15}{|c|}{ For Year Ended December 31} \\ \hline \multirow{2}{*}{ Account Title } & \multicolumn{4}{|c|}{ Unadjusted Trial Balance } & \multicolumn{3}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{ Adjusted Trial Balance } & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{3}{|c|}{\begin{tabular}{l} Balance Sheet and \\ of Owner's Eq \end{tabular}} \\ \hline & \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{|r|}{ Credit } & \multicolumn{2}{|r|}{ Debit } & Credit & Debit & Credit & Debit & Credit & \multicolumn{2}{|r|}{ Debit } & c \\ \hline Cash & $ & 14,500 & & & & & & $14,500 & & & & $ & 14,500 & \\ \hline Accounts receivable & & 21,000 & & & & & & 21,000 & & & & & 21,000 & \\ \hline Supplies & & 1,800 & & & & & & & & & & & & \\ \hline Trucks & & 350,000 & & & & & & 350,000 & & & & & 350,000 & \\ \hline Accumulated depreciation-Trucks & & & & 100,000 & & & & & & & & & & \\ \hline Land & & 160,000 & & & & & & 160,000 & & & & & 160,000 & \\ \hline Accounts payable & & & & 22,765 & & & & & 22,765 & & & & & \\ \hline Interest payable & & & & 1,000 & & & 7,000 & & 8,000 & & & & & \\ \hline Long-term notes payable & & & & 60,000 & & & & & & & & & & \\ \hline S. Dylan, Capital & & & & 299,716 & & & & & & & & & & \\ \hline S. Dylan, Withdrawals & & 32,000 & & & & & & & & & & & 32,000 & \\ \hline Delivery revenue & & & & 265,205 & & & & & & & & & & \\ \hline Depreciation expense-Trucks & & 40,000 & & & $ & 7,956 & & & & & & & & \\ \hline Salaries expense & & 111,386 & & & & & & 111,386 & & 111,386 & & & & \\ \hline Supplies expense & & 11,000 & & & & & & & & & & & & \\ \hline Interest expense & & 1,000 & & & & 7,000 & & 8,000 & & 8,000 & & & & \\ \hline Repairs expense & & 6,000 & & & & & & 6,000 & & 6,000 & & & & \\ \hline Totals & $ & 748,686 & $ & 748,686 & $ & 14,956 & 7,000 & $670,886 & $30,765 & 125,386 & 0 & & 577,500 & \\ \hline Net Income & & & & & & & & & & & & & & \\ \hline Totals & & & & & & & & & & $125,386 & $ & $ & 577,500 & \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|c|c|} \hline & No & Date & General Journal & Debit & Credit \\ \hline \multirow[t]{2}{*}{ i } & 1 & December 31 & Delivery revenue & 265,205 & \\ \hline & & & Income summary & & 265,205 \\ \hline \multirow[t]{6}{*}{%} & 2 & December 31 & Income summary & & \\ \hline & & & Depreciation expense-Trucks & & \\ \hline & & & Salaries expense & & \\ \hline & & & Supplies expense & & \\ \hline & & & Interest expense & & \\ \hline & & & Repairs expense & & 6,000 \\ \hline \multirow[t]{2}{*}{%} & 3 & December 31 & Income summary & & \\ \hline & & & S. Dylan, Capital & & \\ \hline \multirow[t]{2}{*}{>} & 4 & December 31 & S. Dylan, Capital & & \\ \hline & & & S. Dylan, Withdrawals & & \\ \hline \end{tabular} Determine the capital amount to be reported on its year-end balance sheet. Note: The S. Dylan, Capital account balance was $299,716 on December 31 of the prior year. \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{15}{|c|}{ Work Sheet } \\ \hline \multicolumn{15}{|c|}{ For Year Ended December 31} \\ \hline \multirow{2}{*}{ Account Title } & \multicolumn{4}{|c|}{ Unadjusted Trial Balance } & \multicolumn{3}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{ Adjusted Trial Balance } & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{3}{|c|}{\begin{tabular}{l} Balance Sheet and \\ of Owner's Eq \end{tabular}} \\ \hline & \multicolumn{2}{|c|}{ Debit } & \multicolumn{2}{|r|}{ Credit } & \multicolumn{2}{|r|}{ Debit } & Credit & Debit & Credit & Debit & Credit & \multicolumn{2}{|r|}{ Debit } & c \\ \hline Cash & $ & 14,500 & & & & & & $14,500 & & & & $ & 14,500 & \\ \hline Accounts receivable & & 21,000 & & & & & & 21,000 & & & & & 21,000 & \\ \hline Supplies & & 1,800 & & & & & & & & & & & & \\ \hline Trucks & & 350,000 & & & & & & 350,000 & & & & & 350,000 & \\ \hline Accumulated depreciation-Trucks & & & & 100,000 & & & & & & & & & & \\ \hline Land & & 160,000 & & & & & & 160,000 & & & & & 160,000 & \\ \hline Accounts payable & & & & 22,765 & & & & & 22,765 & & & & & \\ \hline Interest payable & & & & 1,000 & & & 7,000 & & 8,000 & & & & & \\ \hline Long-term notes payable & & & & 60,000 & & & & & & & & & & \\ \hline S. Dylan, Capital & & & & 299,716 & & & & & & & & & & \\ \hline S. Dylan, Withdrawals & & 32,000 & & & & & & & & & & & 32,000 & \\ \hline Delivery revenue & & & & 265,205 & & & & & & & & & & \\ \hline Depreciation expense-Trucks & & 40,000 & & & $ & 7,956 & & & & & & & & \\ \hline Salaries expense & & 111,386 & & & & & & 111,386 & & 111,386 & & & & \\ \hline Supplies expense & & 11,000 & & & & & & & & & & & & \\ \hline Interest expense & & 1,000 & & & & 7,000 & & 8,000 & & 8,000 & & & & \\ \hline Repairs expense & & 6,000 & & & & & & 6,000 & & 6,000 & & & & \\ \hline Totals & $ & 748,686 & $ & 748,686 & $ & 14,956 & 7,000 & $670,886 & $30,765 & 125,386 & 0 & & 577,500 & \\ \hline Net Income & & & & & & & & & & & & & & \\ \hline Totals & & & & & & & & & & $125,386 & $ & $ & 577,500 & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started