Question

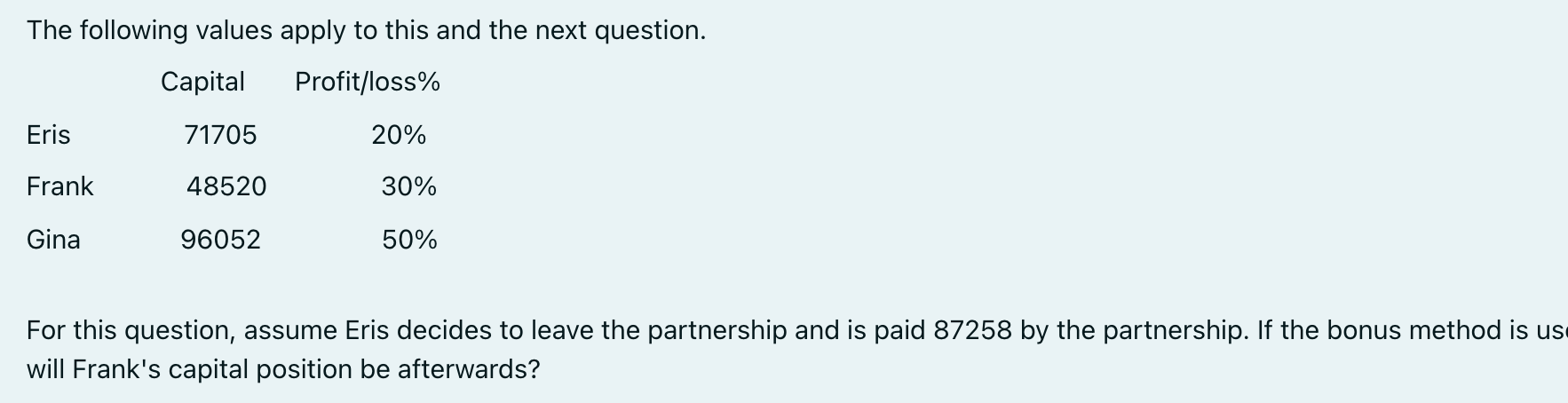

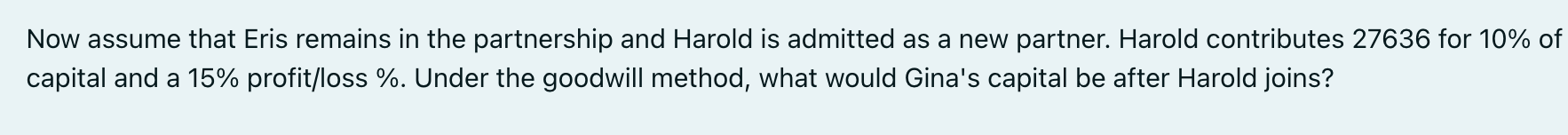

The following values apply to this and the next question. Capital Profit/loss% Eris 71705 20% Frank 48520 30% Gina 96052 50% For this question,

The following values apply to this and the next question. Capital Profit/loss% Eris 71705 20% Frank 48520 30% Gina 96052 50% For this question, assume Eris decides to leave the partnership and is paid 87258 by the partnership. If the bonus method is us will Frank's capital position be afterwards? Now assume that Eris remains in the partnership and Harold is admitted as a new partner. Harold contributes 27636 for 10% of capital and a 15% profit/loss %. Under the goodwill method, what would Gina's capital be after Harold joins?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The Values given in the question are as follows Eris Capital 71705 ProfitLoss 20 Frank Capital 48520 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones Of Cost Management

Authors: Don R. Hansen, Maryanne M. Mowen

3rd Edition

9781305147102, 1285751787, 1305147103, 978-1285751788

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App