Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The forward price in the market to purchase a barrel of crude oil in 3 months is $105. The spot price of crude oil

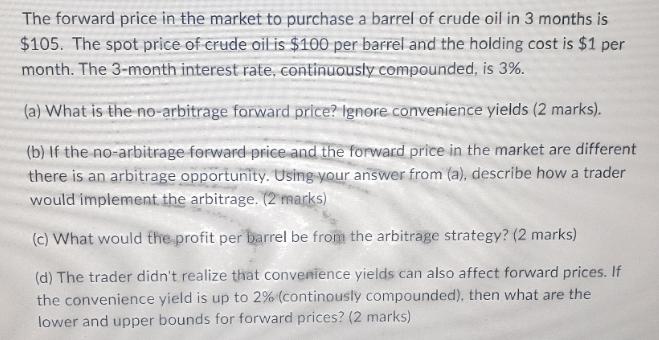

The forward price in the market to purchase a barrel of crude oil in 3 months is $105. The spot price of crude oil is $100 per barrel and the holding cost is $1 per month. The 3-month interest rate, continuously compounded, is 3%. (a) What is the no-arbitrage forward price? Ignore convenience yields (2 marks). (b) If the no-arbitrage forward price and the forward price in the market are different there is an arbitrage opportunity. Using your answer from (a), describe how a trader would implement the arbitrage. (2 marks) (c) What would the profit per barrel be from the arbitrage strategy? (2 marks) (d) The trader didn't realize that convenience yields can also affect forward prices. If the convenience yield is up to 2% (continously compounded), then what are the lower and upper bounds for forward prices? (2 marks)

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Crude Oil Forward Price Arbitrage a NoArbitrage Forward Price Ignoring convenience yieldsthe noarbit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started