Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Fraser River Corporation has purchased a new piece of factory equipment on January 1, 2018, and wishes to compare three depreciation methods: straight-line, double-declining-balance,

The Fraser River Corporation has purchased a new piece of factory equipment on January 1, 2018, and wishes to compare three depreciation methods: straight-line, double-declining-balance, and units-of-production.

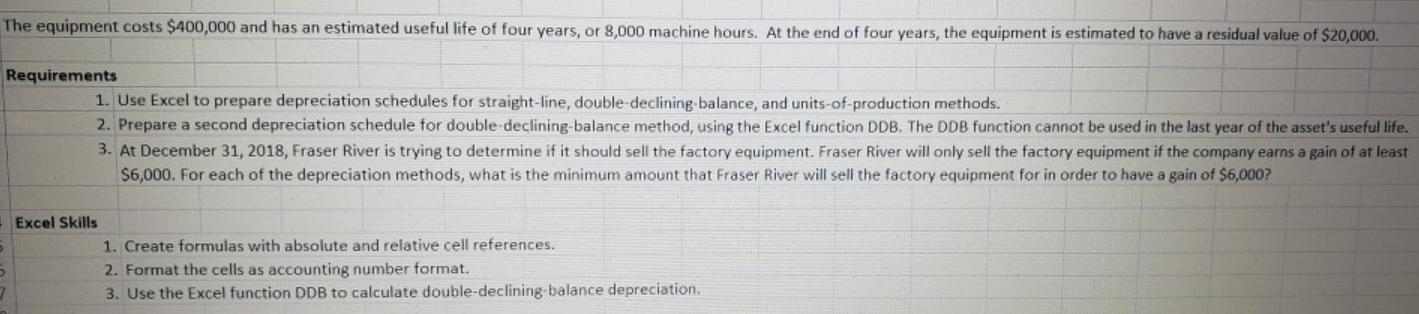

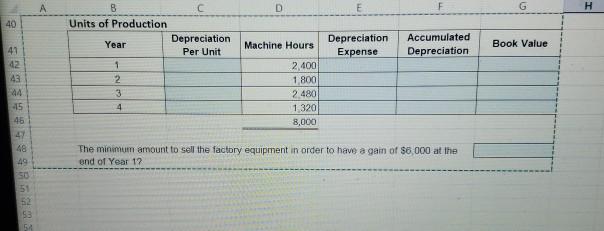

The equipment costs $400,000 and has an estimated useful life of four years, or 8,000 machine hours. At the end of four years, the equipment is estimated to have a residual value of $20,000. Requirements 1. Use Excel to prepare depreciation schedules for straight-line, double-declining-balance, and units-of-production methods. 2. Prepare a second depreciation schedule for double declining-balance method, using the Excel function DDB. The DDB function cannot be used in the last year of the asset's useful life. 3. At December 31, 2018, Fraser River is trying to determine if it should sell the factory equipment. Fraser River will only sell the factory equipment if the company earns a gain of at least $6,000. For each of the depreciation methods, what is the minimum amount that Fraser River will sell the factory equipment for in order to have a gain of $6,000? Excel Skills 1. Create formulas with absolute and relative cell references. 2. Format the cells as accounting number format. 3. Use the Excel function DDB to calculate double-declining-balance depreciation.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Straight line depreciation Cost of asset salvage value Life of the asset Depreciation expense 4000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started