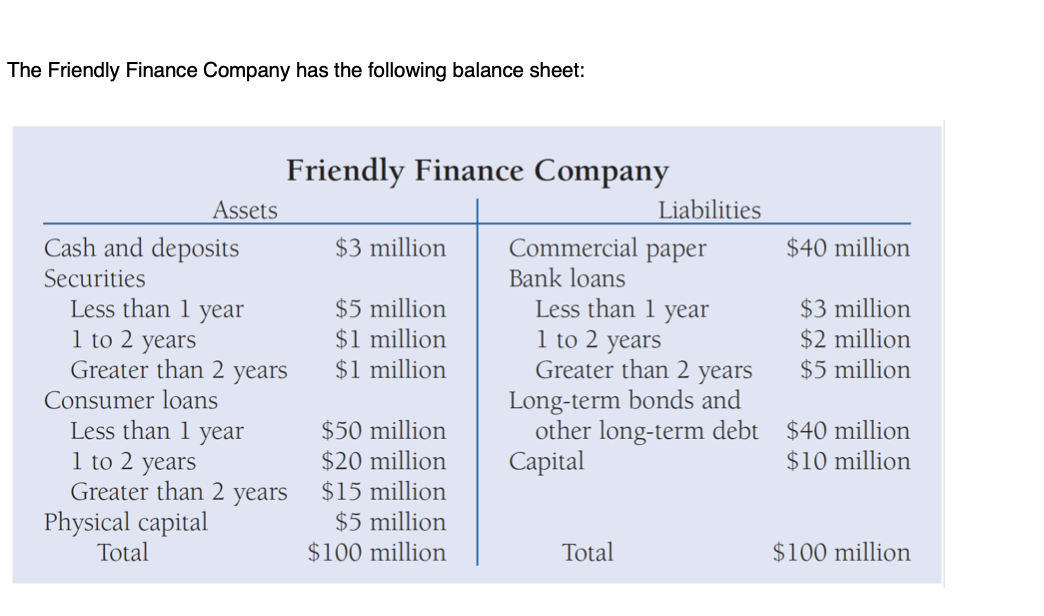

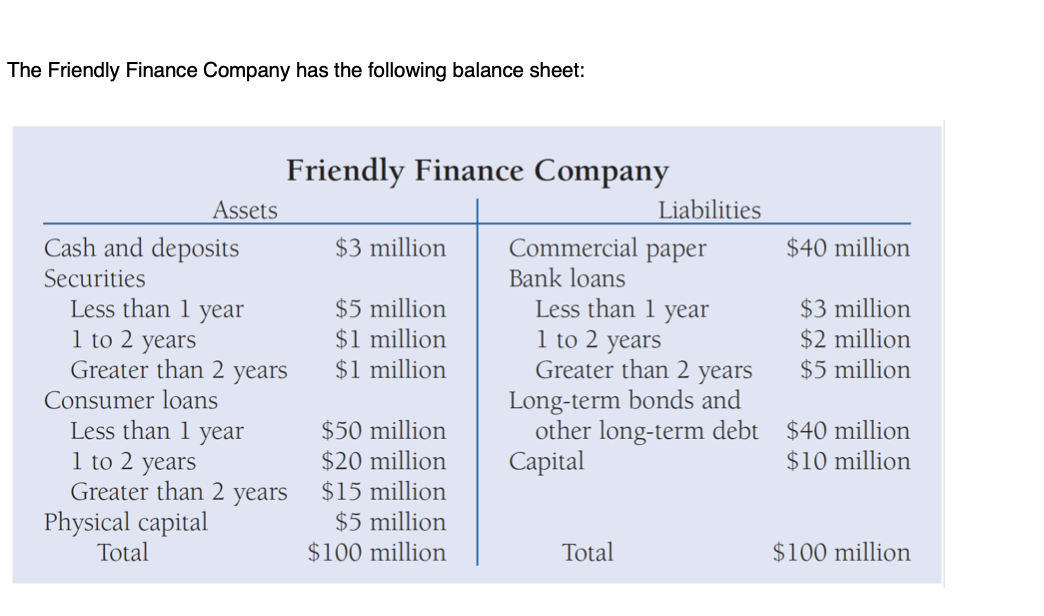

The Friendly Finance Company has the following balance sheet: 1 to 2 years Friendly Finance Company Assets Liabilities Cash and deposits $3 million Commercial paper $40 million Securities Bank loans Less than 1 year $5 million Less than 1 year $3 million $1 million 1 to 2 years $2 million Greater than 2 years $1 million Greater than 2 years $5 million Consumer loans Long-term bonds and Less than 1 year $50 million other long-term debt $40 million $20 million Capital $10 million Greater than 2 years $15 million Physical capital $5 million Total $100 million Total $100 million 1 to 2 years Q8: (Strategies for Managing Interest Rate Risk) The bank manager might decide to eliminate the income gap by increasing the amount of rate-sensitive assets to equal rate-sensitive liabilities. Or the manager could reduce rate-sensitive liabilities to equal rate-sensitive assets. In either case, the income gap would now be zero, so a change in interest rates would have no effect on bank profits in the coming year. Analyze these two situations and consider costs and benefits. The Friendly Finance Company has the following balance sheet: 1 to 2 years Friendly Finance Company Assets Liabilities Cash and deposits $3 million Commercial paper $40 million Securities Bank loans Less than 1 year $5 million Less than 1 year $3 million $1 million 1 to 2 years $2 million Greater than 2 years $1 million Greater than 2 years $5 million Consumer loans Long-term bonds and Less than 1 year $50 million other long-term debt $40 million $20 million Capital $10 million Greater than 2 years $15 million Physical capital $5 million Total $100 million Total $100 million 1 to 2 years Q8: (Strategies for Managing Interest Rate Risk) The bank manager might decide to eliminate the income gap by increasing the amount of rate-sensitive assets to equal rate-sensitive liabilities. Or the manager could reduce rate-sensitive liabilities to equal rate-sensitive assets. In either case, the income gap would now be zero, so a change in interest rates would have no effect on bank profits in the coming year. Analyze these two situations and consider costs and benefits