Answered step by step

Verified Expert Solution

Question

1 Approved Answer

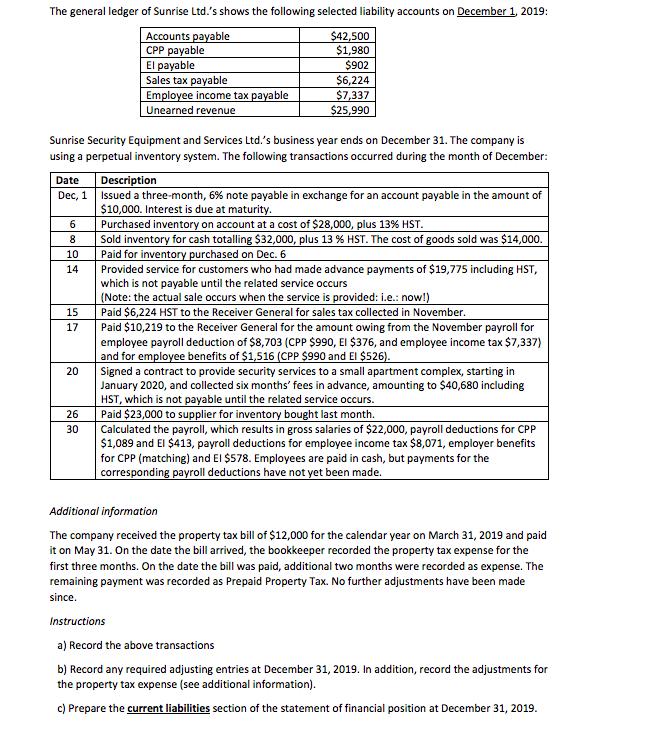

The general ledger of Sunrise Ltd.'s shows the following selected liability accounts on December 1, 2019: Accounts payable CPP payable El payable Sales tax

The general ledger of Sunrise Ltd.'s shows the following selected liability accounts on December 1, 2019: Accounts payable CPP payable El payable Sales tax payable Date Dec, 1 Sunrise Security Equipment and Services Ltd.'s business year ends on December 31. The company is using a perpetual inventory system. The following transactions occurred during the month of December: 6 8 10 14 15 17 20 Employee income tax payable Unearned revenue 26 30 $42,500 $1,980 $902 $6,224 $7,337 $25,990 Description Issued a three-month, 6% note payable in exchange for an account payable in the amount of $10,000. Interest is due at maturity. Purchased inventory on account at a cost of $28,000, plus 13% HST. Sold inventory for cash totalling $32,000, plus 13 % HST. The cost of goods sold was $14,000. Paid for inventory purchased on Dec. 6 Provided service for customers who had made advance payments of $19,775 including HST, which is not payable until the related service occurs (Note: the actual sale occurs when the service is provided: i.e.: now!) Paid $6,224 HST to the Receiver General for sales tax collected in November. Paid $10,219 to the Receiver General for the amount owing from the November payroll for employee payroll deduction of $8,703 (CPP $990, EI $376, and employee income tax $7,337) and for employee benefits of $1,516 (CPP $990 and El $526). Signed a contract to provide security services to a small apartment complex, starting in January 2020, and collected six months' fees in advance, amounting to $40,680 including HST, which is not payable until the related service occurs. Paid $23,000 to supplier for inventory bought last month. Calculated the payroll, which results in gross salaries of $22,000, payroll deductions for CPP $1,089 and El $413, payroll deductions for employee income tax $8,071, employer benefits for CPP (matching) and El $578. Employees are paid in cash, but payments for the corresponding payroll deductions have not yet been made. Additional information The company received the property tax bill of $12,000 for the calendar year on March 31, 2019 and paid it on May 31. On the date the bill arrived, the bookkeeper recorded the property tax expense for the first three months. On the date the bill was paid, additional two months were recorded as expense. The remaining payment was recorded as Prepaid Property Tax. No further adjustments have been made since. Instructions a) Record the above transactions b) Record any required adjusting entries at December 31, 2019. In addition, record the adjustments for the property tax expense (see additional information). c) Prepare the current liabilities section of the statement of financial position at December 31, 2019.

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Date Dec 2 6 8 8 10 14 22 Particulass Account Payable AKC R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started