Question

The partnership reports a $30,000 profit at year-end December 31, 2024. Genevieve and Ben agree to share profit and losses by allocating yearly salary

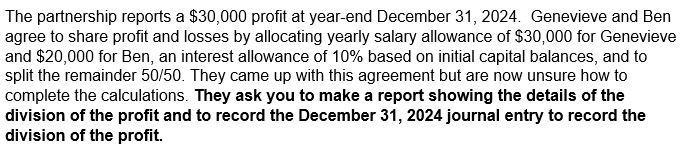

The partnership reports a $30,000 profit at year-end December 31, 2024. Genevieve and Ben agree to share profit and losses by allocating yearly salary allowance of $30,000 for Genevieve and $20,000 for Ben, an interest allowance of 10% based on initial capital balances, and to split the remainder 50/50. They came up with this agreement but are now unsure how to complete the calculations. They ask you to make a report showing the details of the division of the profit and to record the December 31, 2024 journal entry to record the division of the profit.

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To divide the profit we need to follow the agreement made by Genevieve and Ben Allocate yearly salar...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial accounting

Authors: Walter T. Harrison, Charles T. Horngren, William Bill Thomas

8th Edition

9780135114933, 136108865, 978-0136108863

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App