Answered step by step

Verified Expert Solution

Question

1 Approved Answer

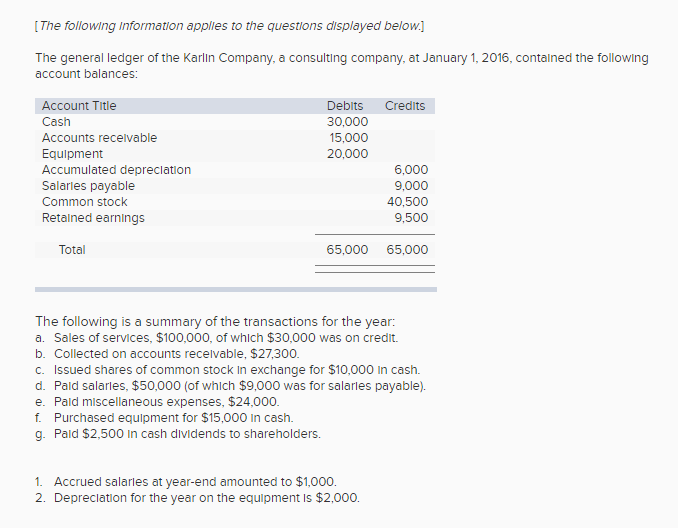

The general ledger of the Karlin Company, a consulting company, at January 1, 2016, contained the following account balances: Prepare the summary, adjusting and closing

| The general ledger of the Karlin Company, a consulting company, at January 1, 2016, contained the following account balances: |

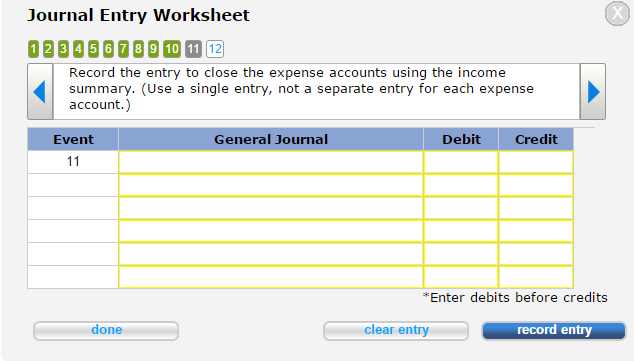

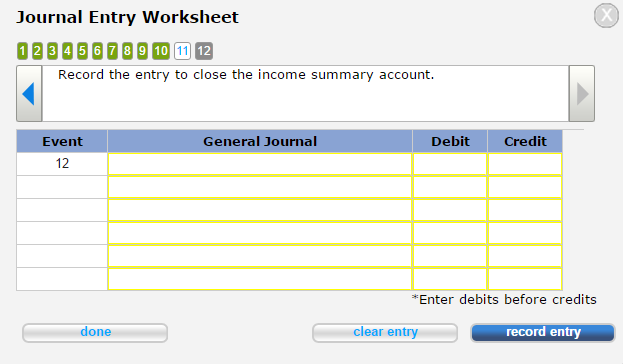

Prepare the summary, adjusting and closing entries for each of the transactions listed.

(If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Please focus on those two below!!! problem about income summary

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started