Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The German stock market is measured by which market index? Multiple Choice Nikkel DAX FTSE Dow Jones 3 0 An investor purchases one municipal bond

The German stock market is measured by which market index?

Multiple Choice

Nikkel

DAX

FTSE

Dow Jones

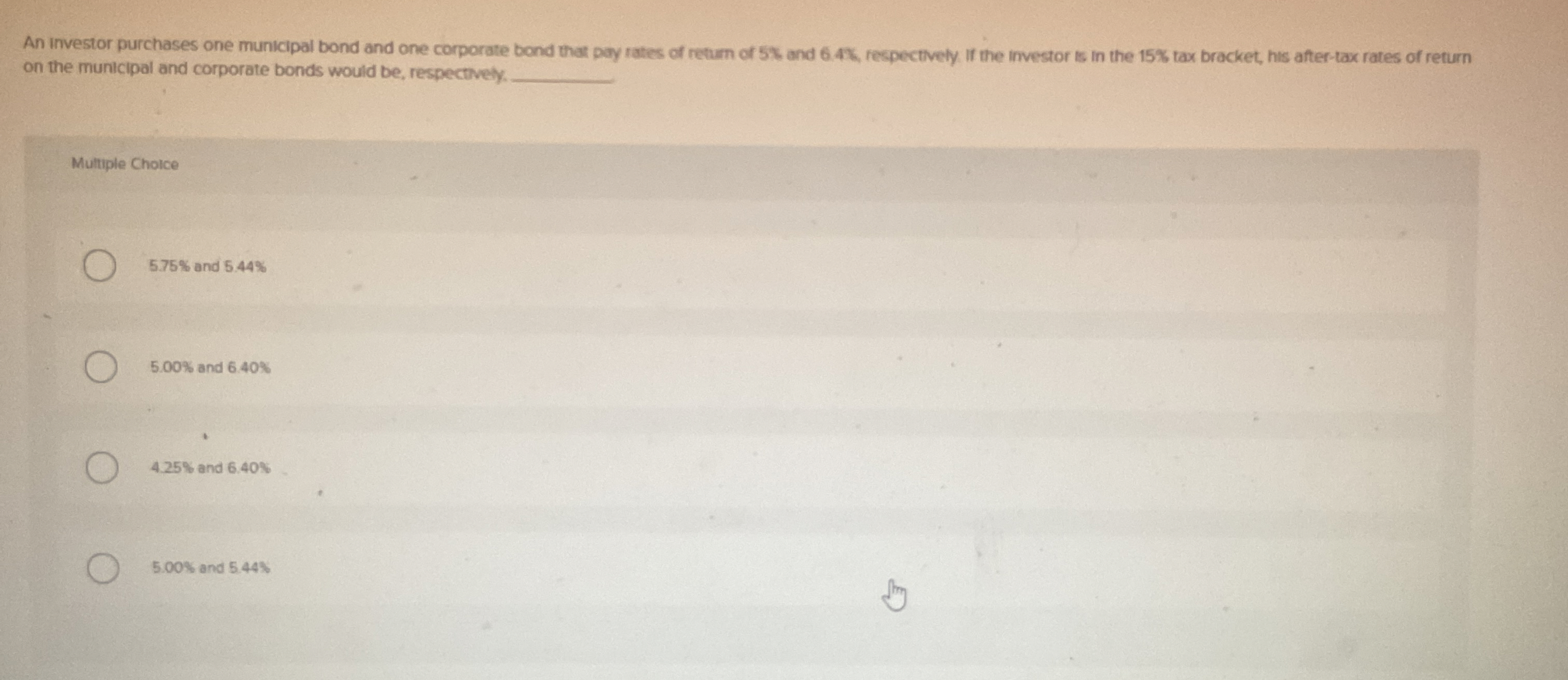

An investor purchases one municipal bond and one corporate bond that pay rates of return of and respectively if the investor is in the tax bracket, his aftertax rates of return

on the muntcipal and corporate bonds would be respectively

Muttiple Choice

and

and

and

and

An investor purchases one municipal bond and one corporate bond that pay rates of return of and respectively if the investor is in the tax bracket, his aftertax rates of return

on the muntcipal and corporate bonds would be respectively

Muttiple Choice

and

and

and

and

An investor purchases one municipal bond and one corporate bond that pay rates of return of and respectively if the investor is in the tax bracket, his aftertax rates of return

on the muntcipal and corporate bonds would be respectively

Muttiple Choice

and

and

and

and

An investor purchases one municipal bond and one corporate bond that pay rates of return of and respectively if the investor is in the tax bracket, his aftertax rates of return

on the muntcipal and corporate bonds would be respectively

Muttiple Choice

and

and

and

and

An investor purchases one municipal bond and one corporate bond that pay rates of return of and respectively if the investor is in the tax bracket, his aftertax rates of return

on the muntcipal and corporate bonds would be respectively

Muttiple Choice

and

and

and

and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started