Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The goal is to understand the role of leverage and interconnectedness in creating fragility in wide-spread bank failures. This question will take significant time

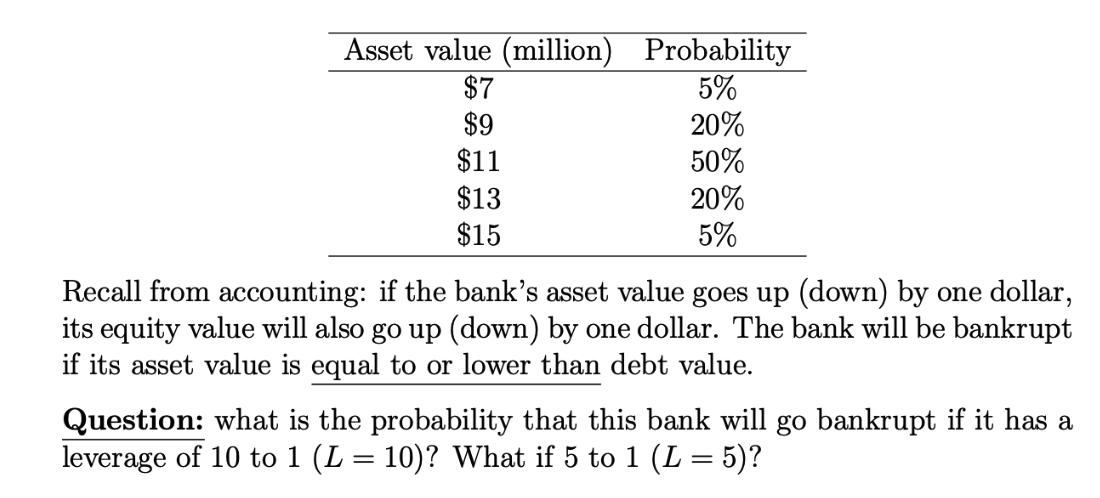

The goal is to understand the role of leverage and interconnectedness in creating fragility in wide-spread bank failures. This question will take significant time to solve. Please start early. (a) First, consider a single bank. Suppose it has $10 million in assets and $E million in equity, so the remaining $(10 E) is debt. Let's define leverage defined as L = 10/E (asset-to-equity ratio). Asset values fluctuate. Suppose the value of the bank's asset next year has the following probability distribution:2 *Created with help and feedback from Rachel Nelson. You may find leverage ratio defined in other ways, such as the leverage/equity ratio (rather than asset/equity ratio, as we do here). Ignore those alternative definitions. 2For instance, there is a 5% chance that the asset value will be $7 million next period.ctivate Windows Go to Settings to activate Windo Asset value (million) $7 $9 $11 $13 $15 Probability 5% 20% 50% 20% 5% Recall from accounting: if the bank's asset value goes up (down) by one dollar, its equity value will also go up (down) by one dollar. The bank will be bankrupt if its asset value is equal to or lower than debt value. Question: what is the probability that this bank will go bankrupt if it has a leverage of 10 to 1 (L = 10)? What if 5 to 1 (L = 5)?

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started