Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The goal of this project is to explore the topic of capital budgeting. The project requires you to work in Excel with the provided spreadsheet.

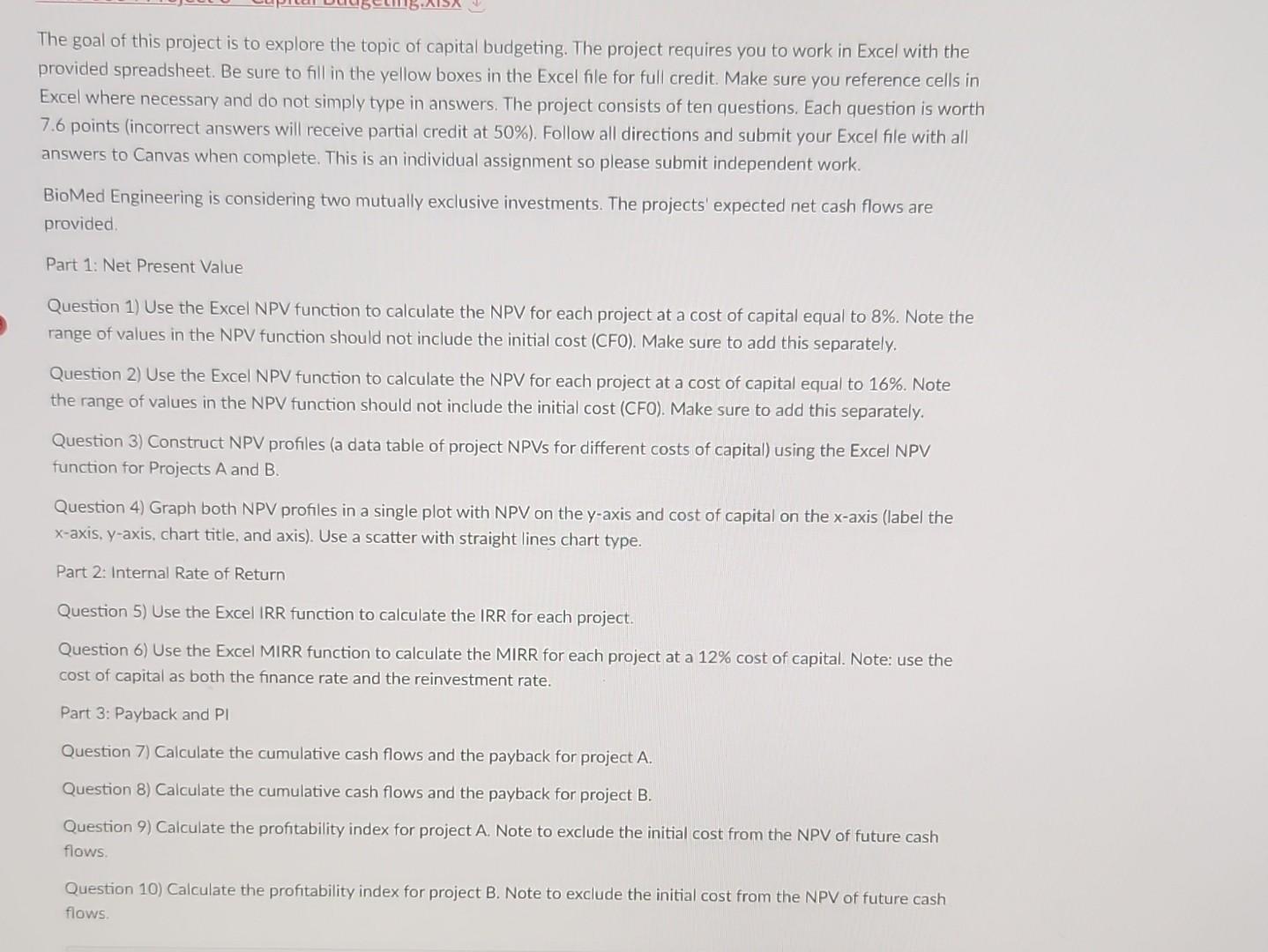

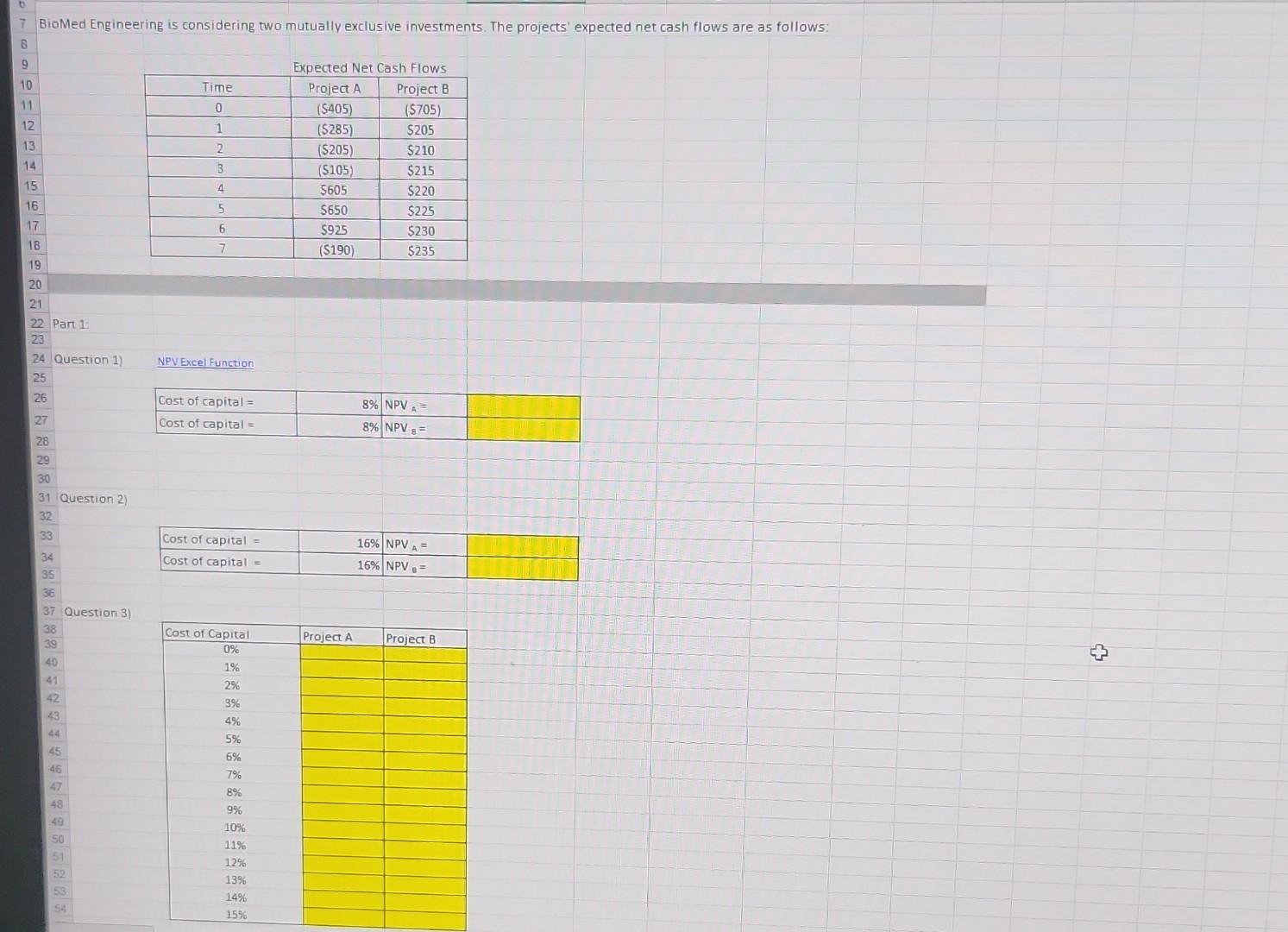

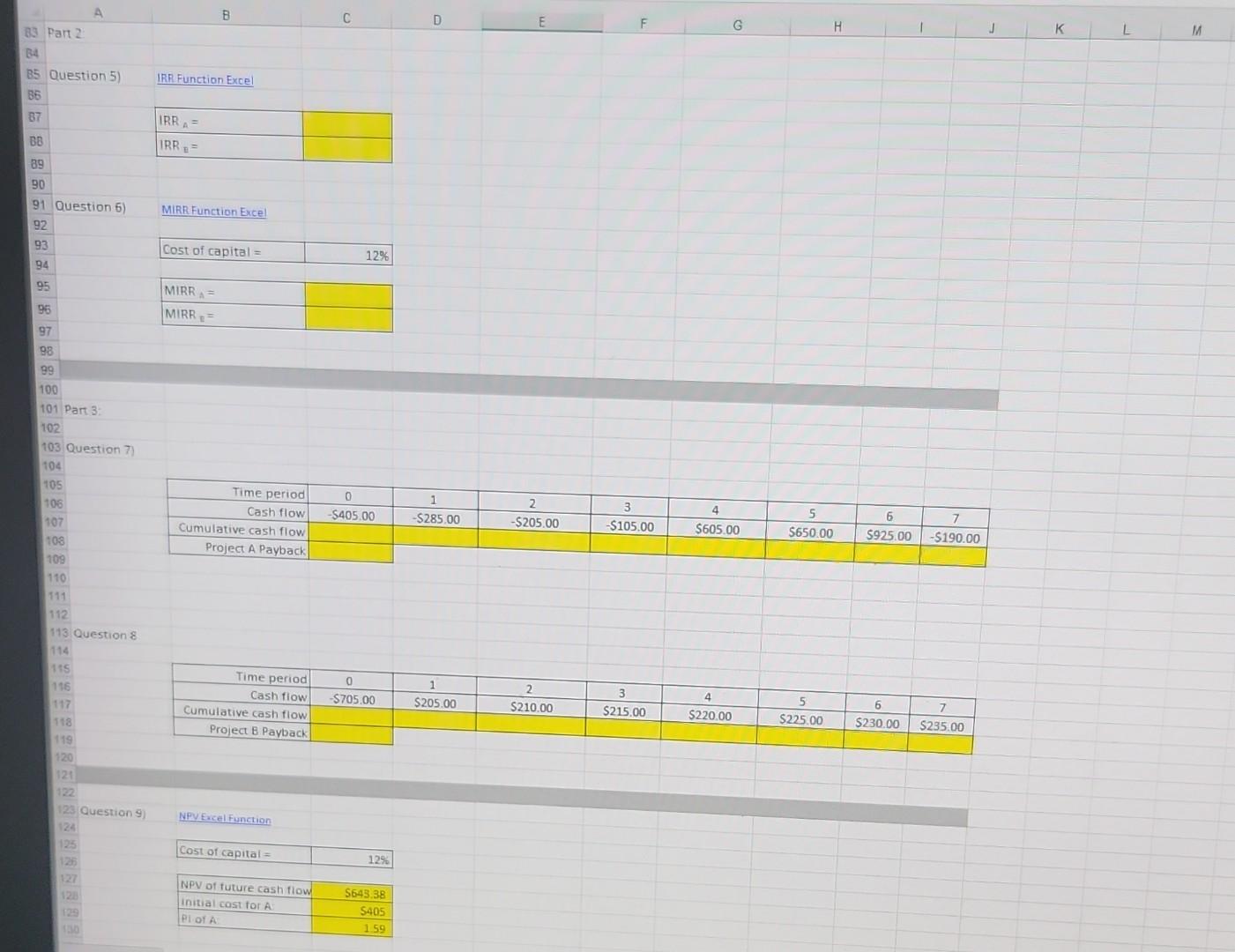

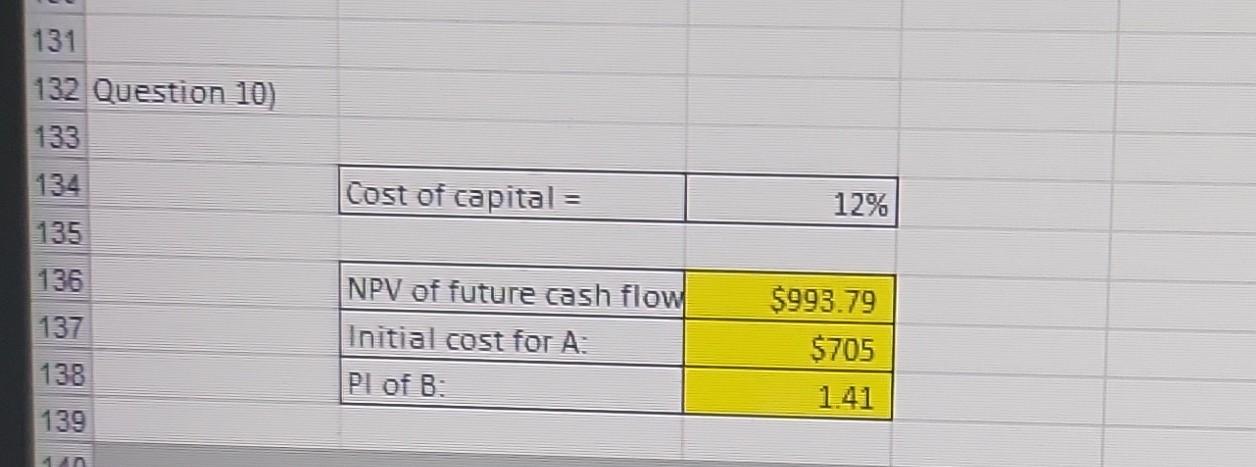

The goal of this project is to explore the topic of capital budgeting. The project requires you to work in Excel with the provided spreadsheet. Be sure to fill in the yellow boxes in the Excel file for full credit. Make sure you reference cells in Excel where necessary and do not simply type in answers. The project consists of ten questions. Each question is worth 7.6 points (incorrect answers will receive partial credit at 50\%). Follow all directions and submit your Excel file with all answers to Canvas when complete. This is an individual assignment so please submit independent work. BioMed Engineering is considering two mutually exclusive investments. The projects' expected net cash flows are provided. Part 1: Net Present Value Question 1) Use the Excel NPV function to calculate the NPV for each project at a cost of capital equal to 8%. Note the range of values in the NPV function should not include the initial cost (CF0). Make sure to add this separately. Question 2) Use the Excel NPV function to calculate the NPV for each project at a cost of capital equal to 16\%. Note the range of values in the NPV function should not include the initial cost (CF0). Make sure to add this separately. Question 3) Construct NPV profiles (a data table of project NPVs for different costs of capital) using the Excel NPV function for Projects A and B. Question 4) Graph both NPV profiles in a single plot with NPV on the y-axis and cost of capital on the x-axis (label the x-axis, y-axis, chart title, and axis). Use a scatter with straight lines chart type. Part 2: Internal Rate of Return Question 5) Use the Excel IRR function to calculate the IRR for each project. Question 6) Use the Excel MIRR function to calculate the MIRR for each project at a 12% cost of capital. Note: use the cost of capital as both the finance rate and the reinvestment rate. Part 3: Payback and PI Question 7) Calculate the cumulative cash flows and the payback for project A. Question 8) Calculate the cumulative cash flows and the payback for project B. Question 9) Calculate the profitability index for project A. Note to exclude the initial cost from the NPV of future cash flows. Question 10) Calculate the profitability index for project B. Note to exclude the initial cost from the NPV of future cash flows. BioMed Engineering is considering two mutually exclusive investments. The projects' expected net cash flows are as follows: NPy Excel Function 132 Question 10) \begin{tabular}{|l|l|} \hline Cost of capital = & 12% \\ \hline \end{tabular} \begin{tabular}{|l|r|} \hline NPV of future cash flow & $993.79 \\ \hline Initial cost for A: & $705 \\ \hline Pl of B: & 1.41 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started