Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Gould Group Limited (Gould) is a publicly listed organization based in Germany. Gould manufacturers and sells high quality jewelry. Gould's fiscal year end is

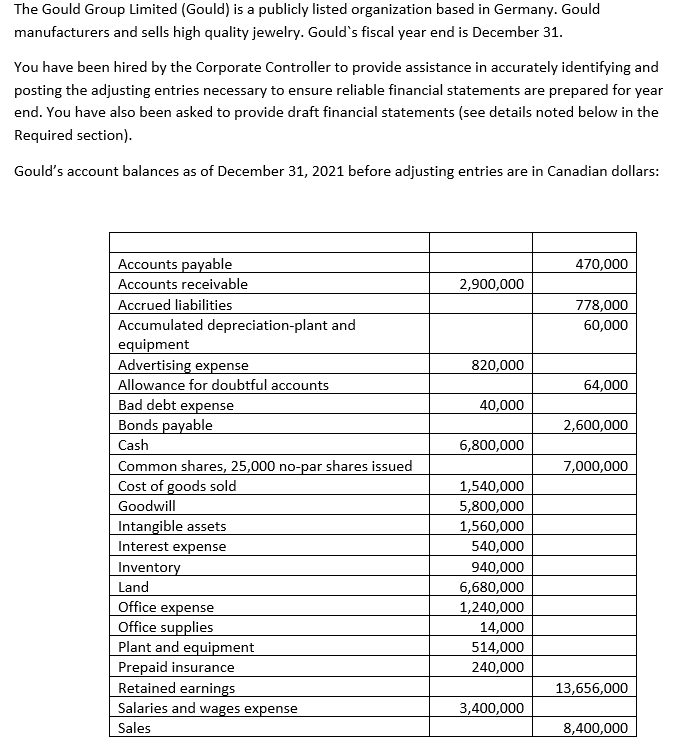

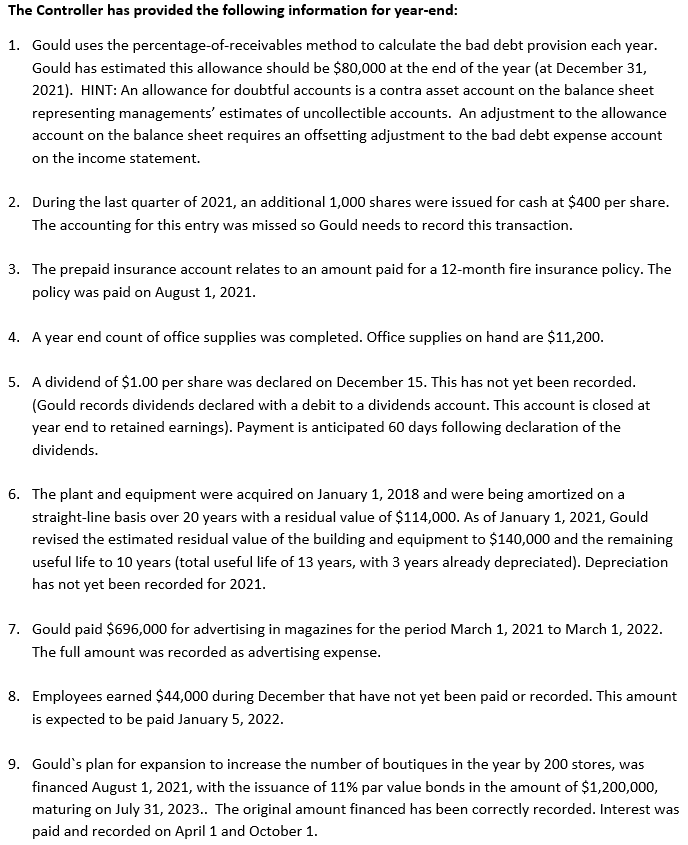

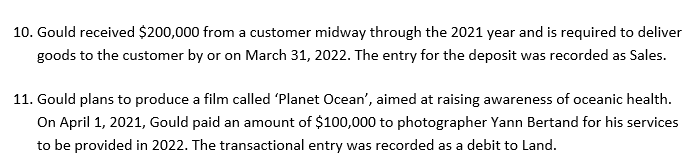

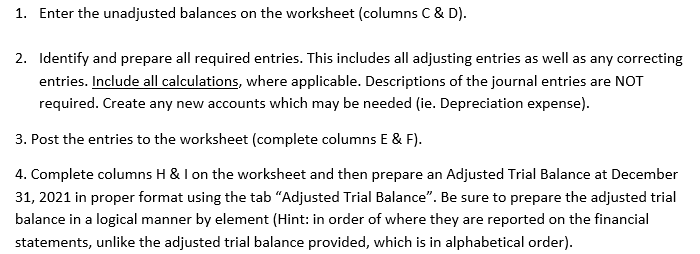

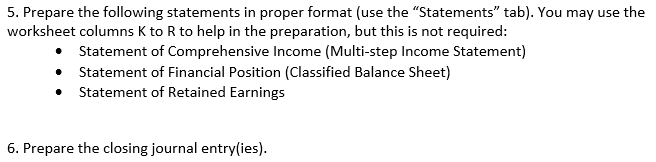

The Gould Group Limited (Gould) is a publicly listed organization based in Germany. Gould manufacturers and sells high quality jewelry. Gould's fiscal year end is December 31. You have been hired by the Corporate Controller to provide assistance in accurately identifying and posting the adjusting entries necessary to ensure reliable financial statements are prepared for year end. You have also been asked to provide draft financial statements (see details noted below in the Required section). Gould's account balances as of December 31, 2021 before adjusting entries are in Canadian dollars: 1. Gould uses the percentage-of-receivables method to calculate the bad debt provision each year. Gould has estimated this allowance should be $80,000 at the end of the year (at December 31 , 2021). HINT: An allowance for doubtful accounts is a contra asset account on the balance sheet representing managements' estimates of uncollectible accounts. An adjustment to the allowance account on the balance sheet requires an offsetting adjustment to the bad debt expense account on the income statement. 2. During the last quarter of 2021 , an additional 1,000 shares were issued for cash at $400 per share. The accounting for this entry was missed so Gould needs to record this transaction. 3. The prepaid insurance account relates to an amount paid for a 12-month fire insurance policy. The policy was paid on August 1, 2021. 4. A year end count of office supplies was completed. Office supplies on hand are \$11,200. 5. A dividend of $1.00 per share was declared on December 15 . This has not yet been recorded. (Gould records dividends declared with a debit to a dividends account. This account is closed at year end to retained earnings). Payment is anticipated 60 days following declaration of the dividends. 6. The plant and equipment were acquired on January 1, 2018 and were being amortized on a straight-line basis over 20 years with a residual value of $114,000. As of January 1,2021 , Gould revised the estimated residual value of the building and equipment to $140,000 and the remaining useful life to 10 years (total useful life of 13 years, with 3 years already depreciated). Depreciation has not yet been recorded for 2021 . 7. Gould paid \$696,000 for advertising in magazines for the period March 1, 2021 to March 1, 2022. The full amount was recorded as advertising expense. 8. Employees earned $44,000 during December that have not yet been paid or recorded. This amount is expected to be paid January 5,2022. 9. Gould's plan for expansion to increase the number of boutiques in the year by 200 stores, was financed August 1,2021 , with the issuance of 11% par value bonds in the amount of $1,200,000, maturing on July 31, 2023.. The original amount financed has been correctly recorded. Interest was paid and recorded on April 1 and October 1. 10. Gould received $200,000 from a customer midway through the 2021 year and is required to deliver goods to the customer by or on March 31, 2022. The entry for the deposit was recorded as Sales. 11. Gould plans to produce a film called 'Planet Ocean', aimed at raising awareness of oceanic health. On April 1, 2021, Gould paid an amount of $100,000 to photographer Yann Bertand for his services to be provided in 2022 . The transactional entry was recorded as a debit to Land. 1. Enter the unadjusted balances on the worksheet (columns C \& D). 2. Identify and prepare all required entries. This includes all adjusting entries as well as any correcting entries. Include all calculations, where applicable. Descriptions of the journal entries are NOT required. Create any new accounts which may be needed (ie. Depreciation expense). 3. Post the entries to the worksheet (complete columns E \& F). 4. Complete columns H \& I on the worksheet and then prepare an Adjusted Trial Balance at December 31, 2021 in proper format using the tab "Adjusted Trial Balance". Be sure to prepare the adjusted trial balance in a logical manner by element (Hint: in order of where they are reported on the financial statements, unlike the adjusted trial balance provided, which is in alphabetical order). 5. Prepare the following statements in proper format (use the "Statements" tab). You may use the worksheet columns K to R to help in the preparation, but this is not required: - Statement of Comprehensive Income (Multi-step Income Statement) - Statement of Financial Position (Classified Balance Sheet) - Statement of Retained Earnings 6. Prepare the closing journal entry(ies). The Gould Group Limited (Gould) is a publicly listed organization based in Germany. Gould manufacturers and sells high quality jewelry. Gould's fiscal year end is December 31. You have been hired by the Corporate Controller to provide assistance in accurately identifying and posting the adjusting entries necessary to ensure reliable financial statements are prepared for year end. You have also been asked to provide draft financial statements (see details noted below in the Required section). Gould's account balances as of December 31, 2021 before adjusting entries are in Canadian dollars: 1. Gould uses the percentage-of-receivables method to calculate the bad debt provision each year. Gould has estimated this allowance should be $80,000 at the end of the year (at December 31 , 2021). HINT: An allowance for doubtful accounts is a contra asset account on the balance sheet representing managements' estimates of uncollectible accounts. An adjustment to the allowance account on the balance sheet requires an offsetting adjustment to the bad debt expense account on the income statement. 2. During the last quarter of 2021 , an additional 1,000 shares were issued for cash at $400 per share. The accounting for this entry was missed so Gould needs to record this transaction. 3. The prepaid insurance account relates to an amount paid for a 12-month fire insurance policy. The policy was paid on August 1, 2021. 4. A year end count of office supplies was completed. Office supplies on hand are \$11,200. 5. A dividend of $1.00 per share was declared on December 15 . This has not yet been recorded. (Gould records dividends declared with a debit to a dividends account. This account is closed at year end to retained earnings). Payment is anticipated 60 days following declaration of the dividends. 6. The plant and equipment were acquired on January 1, 2018 and were being amortized on a straight-line basis over 20 years with a residual value of $114,000. As of January 1,2021 , Gould revised the estimated residual value of the building and equipment to $140,000 and the remaining useful life to 10 years (total useful life of 13 years, with 3 years already depreciated). Depreciation has not yet been recorded for 2021 . 7. Gould paid \$696,000 for advertising in magazines for the period March 1, 2021 to March 1, 2022. The full amount was recorded as advertising expense. 8. Employees earned $44,000 during December that have not yet been paid or recorded. This amount is expected to be paid January 5,2022. 9. Gould's plan for expansion to increase the number of boutiques in the year by 200 stores, was financed August 1,2021 , with the issuance of 11% par value bonds in the amount of $1,200,000, maturing on July 31, 2023.. The original amount financed has been correctly recorded. Interest was paid and recorded on April 1 and October 1. 10. Gould received $200,000 from a customer midway through the 2021 year and is required to deliver goods to the customer by or on March 31, 2022. The entry for the deposit was recorded as Sales. 11. Gould plans to produce a film called 'Planet Ocean', aimed at raising awareness of oceanic health. On April 1, 2021, Gould paid an amount of $100,000 to photographer Yann Bertand for his services to be provided in 2022 . The transactional entry was recorded as a debit to Land. 1. Enter the unadjusted balances on the worksheet (columns C \& D). 2. Identify and prepare all required entries. This includes all adjusting entries as well as any correcting entries. Include all calculations, where applicable. Descriptions of the journal entries are NOT required. Create any new accounts which may be needed (ie. Depreciation expense). 3. Post the entries to the worksheet (complete columns E \& F). 4. Complete columns H \& I on the worksheet and then prepare an Adjusted Trial Balance at December 31, 2021 in proper format using the tab "Adjusted Trial Balance". Be sure to prepare the adjusted trial balance in a logical manner by element (Hint: in order of where they are reported on the financial statements, unlike the adjusted trial balance provided, which is in alphabetical order). 5. Prepare the following statements in proper format (use the "Statements" tab). You may use the worksheet columns K to R to help in the preparation, but this is not required: - Statement of Comprehensive Income (Multi-step Income Statement) - Statement of Financial Position (Classified Balance Sheet) - Statement of Retained Earnings 6. Prepare the closing journal entry(ies)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started