Question

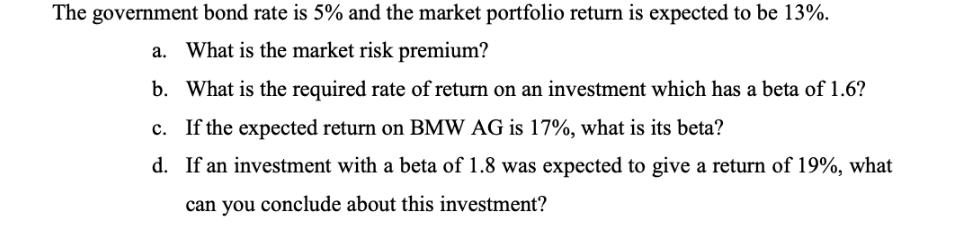

The government bond rate is 5% and the market portfolio return is expected to be 13%. a. What is the market risk premium? b.

The government bond rate is 5% and the market portfolio return is expected to be 13%. a. What is the market risk premium? b. What is the required rate of return on an investment which has a beta of 1.6? c. If the expected return on BMW AG is 17%, what is its beta? d. If an investment with a beta of 1.8 was expected to give a return of 19%, what can you conclude about this investment?

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

This question refers to concepts from financial theory particularly the Capital Asset Pricing Model CAPM which describes the relationship between risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory And Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

3rd Canadian Edition

017658305X, 978-0176583057

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App