Question

The Green Field Foundation was setup in 1998 by philanthropist James Morrison with the objective of providing agricultural aid and education across the emerging markets.

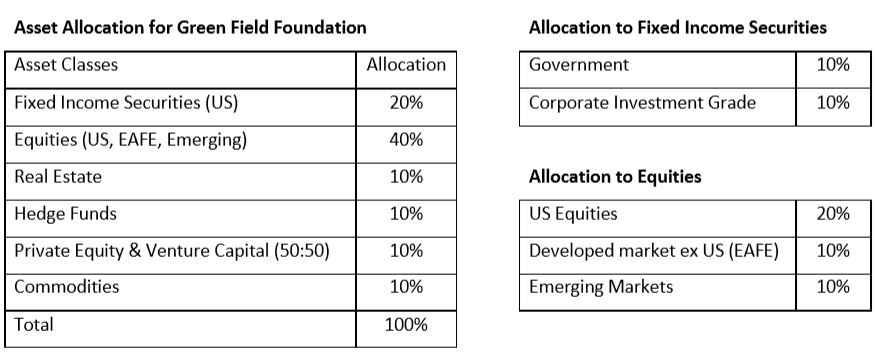

The Green Field Foundation was setup in 1998 by philanthropist James Morrison with the objective of providing agricultural aid and education across the emerging markets. The foundation is tax exempt and is currently worth US$100m. Current portfolio was allocated as below.

The foundation investment objectives are to generate real return of 4% per annum over a rolling 3-year period. A spending rule of 3% of the average of last 3 years fund value (as of 31st December) was established by the previous portfolio manager who also charged a standard (for the industry) 0.5% per annum of the funds end- of-the-year value. Analysis of the spending policy shows that the amount received by the Foundation was highly variable. The foundation fund committee has concluded a 35:65 [defence:growth] bias is adequate to ensure long term growth as well as maintain appropriate risk to achieve those investment objectives without impacting the real value of the fund over a 3 year rolling period. The committee would like to grow the fund in real terms but not at the expense of substantial increase in risk.

Question) Provide a clear investment return and risk objective.

Asset Allocation for Green Field Foundation Allocation to Fixed Income Securities Asset Classes Allocation Government 10% 20% Corporate Investment Grade 10% 40% Fixed Income Securities (US) Equities (US, EAFE, Emerging) Real Estate Hedge Funds Private Equity & Venture Capital (50:50) 10% Allocation to Equities 10% US Equities 20% 10% 10% Developed market ex US (EAFE) Emerging Markets Commodities 10% 10% Total 100% Asset Allocation for Green Field Foundation Allocation to Fixed Income Securities Asset Classes Allocation Government 10% 20% Corporate Investment Grade 10% 40% Fixed Income Securities (US) Equities (US, EAFE, Emerging) Real Estate Hedge Funds Private Equity & Venture Capital (50:50) 10% Allocation to Equities 10% US Equities 20% 10% 10% Developed market ex US (EAFE) Emerging Markets Commodities 10% 10% Total 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started