Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Grey and Redd Partnership was formed on January 2, 2020. Under the partnership agreement, each partner has an equal initial capital balance. Partnership net

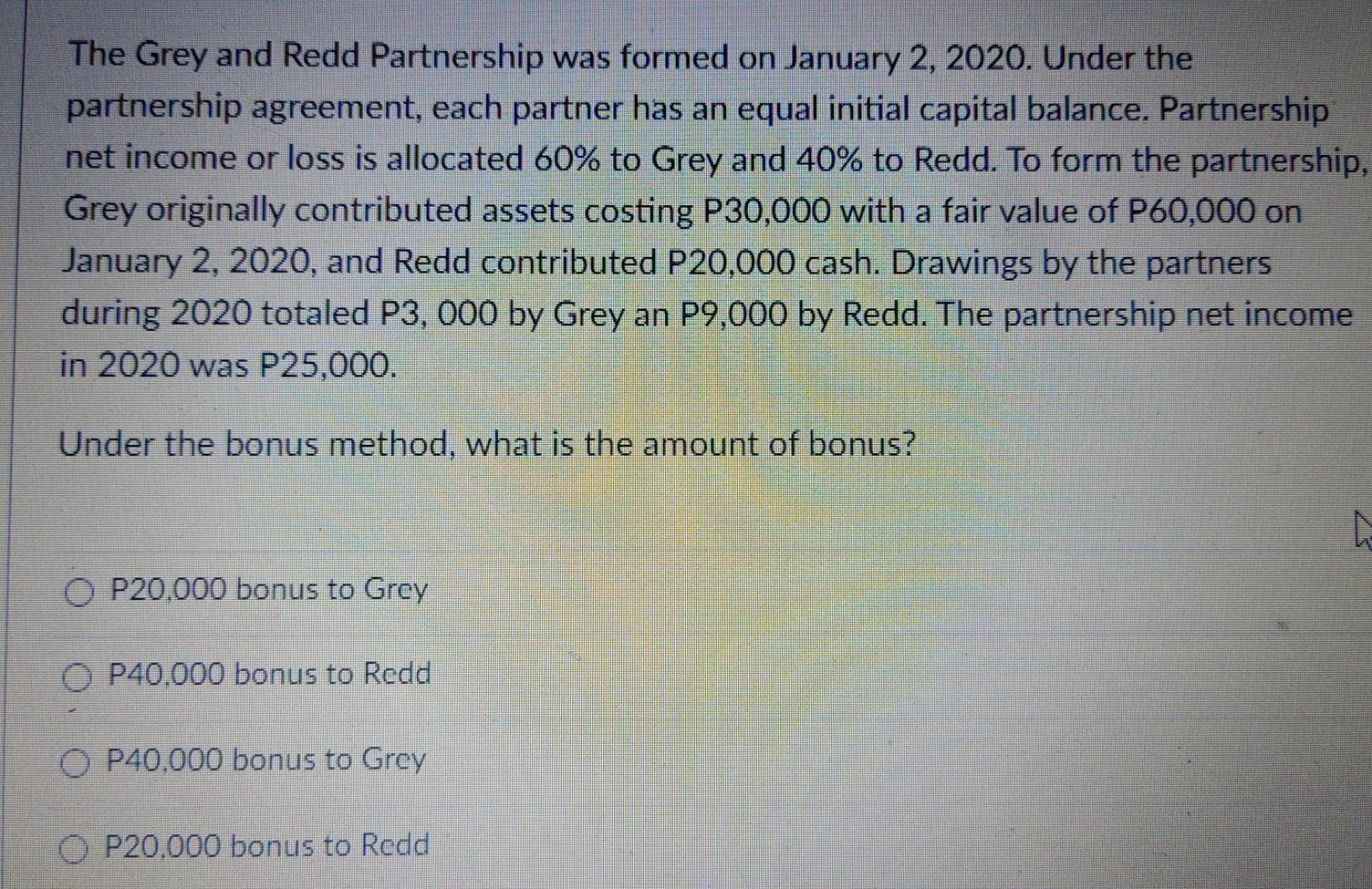

The Grey and Redd Partnership was formed on January 2, 2020. Under the partnership agreement, each partner has an equal initial capital balance. Partnership net income or loss is allocated 60% to Grey and 40% to Redd. To form the partnership, Grey originally contributed assets costing P30,000 with a fair value of P60,000 on January 2, 2020, and Redd contributed P20,000 cash. Drawings by the partners during 2020 totaled P3, 000 by Grey an P9,000 by Redd. The partnership net income in 2020 was P25,000. Under the bonus method, what is the amount of bonus? O P20,000 bonus to Grey O P40,000 bonus to Redd O P40.000 bonus to Grey O P20.000 bonus to Redd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started