Question

The Happy Daze drug company is considering developing a new tranquilizer: a compound known as DRZ4321G.It is more commonly know around headquarters as Happy Hippo.

The Happy Daze drug company is considering developing a new tranquilizer: a compound known as DRZ4321G.It is more commonly know around headquarters as "Happy Hippo."

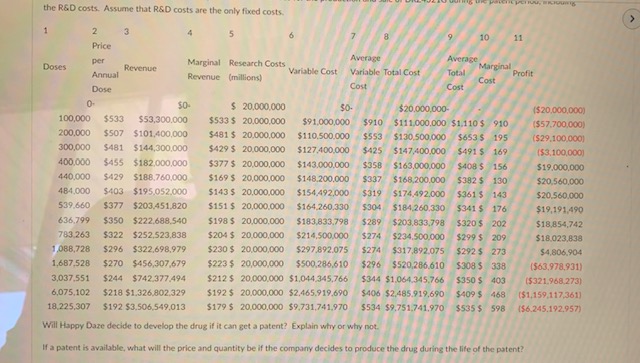

The company estimates that it will cost $400 million for research and development to bring the drug to market,if it decides to do so.It will have patent protection (a government-granted monopoly) for 20 years after the drug goes on the market.Therefore, it must recover an average of $20 millionper year(ignore interest costs if you are an accounting major) during the life of the patent.

When the patent expires, the fixed costs for Happy Daze and any competitors, will drop to zero.

Of course, if the company decides not to do the research and development, it will have no costs, no patent, and no drug to sell.

Look at the spreadsheetestimating the annual costs and revenues for the production and sale of DRZ4321G during the patent period, including the R&D costs.Assume that R&D

costs are the only fixed costs.

Will Happy Daze decide to develop the drug if it can get a patent?Explain why or why not.

If a patent is available, what will the price and quantity be if the company decides to produce the drug during the life of the patent?

Would your conclusion change if the R&D costs were $50,000,000 annually?

If there is no patent law, do you think the drug will be cheaper?Explain why or why not.

About how much will the drug cost after the patent expires?How many will be sold?Explain your reasoning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started