Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Heinlein and Krampf Brokerage firm is instructed by a client to invest $250,000 among five possible asset classes as shown in the table below.

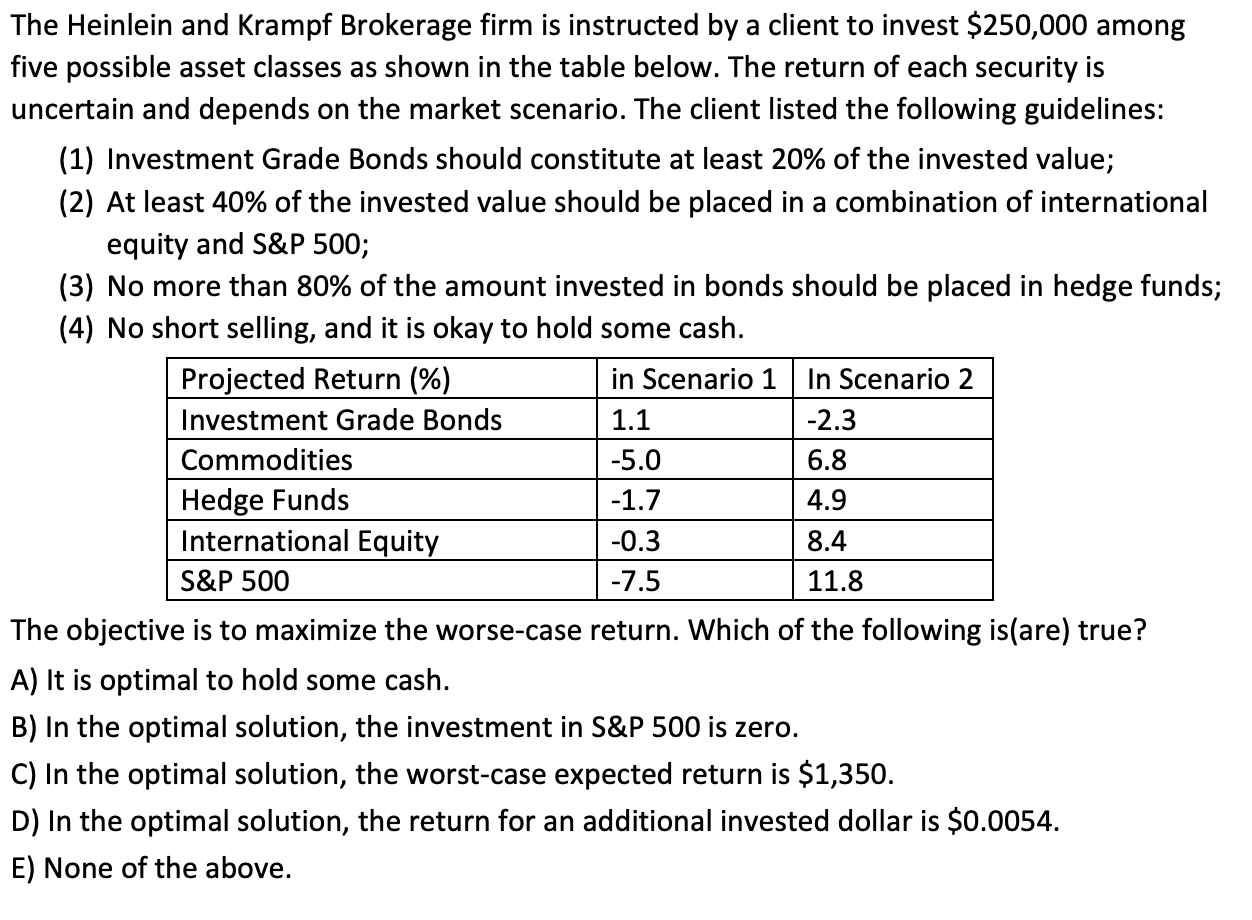

The Heinlein and Krampf Brokerage firm is instructed by a client to invest $250,000 among five possible asset classes as shown in the table below. The return of each security is uncertain and depends on the market scenario. The client listed the following guidelines: (1) Investment Grade Bonds should constitute at least 20% of the invested value; (2) At least 40% of the invested value should be placed in a combination of international equity and S\&P 500; (3) No more than 80% of the amount invested in bonds should be placed in hedge funds; (4) No short selling, and it is okay to hold some cash. The objective is to maximize the worse-case return. Which of the following is(are) true? A) It is optimal to hold some cash. B) In the optimal solution, the investment in S\&P 500 is zero. C) In the optimal solution, the worst-case expected return is $1,350. D) In the optimal solution, the return for an additional invested dollar is $0.0054. E) None of the above

The Heinlein and Krampf Brokerage firm is instructed by a client to invest $250,000 among five possible asset classes as shown in the table below. The return of each security is uncertain and depends on the market scenario. The client listed the following guidelines: (1) Investment Grade Bonds should constitute at least 20% of the invested value; (2) At least 40% of the invested value should be placed in a combination of international equity and S\&P 500; (3) No more than 80% of the amount invested in bonds should be placed in hedge funds; (4) No short selling, and it is okay to hold some cash. The objective is to maximize the worse-case return. Which of the following is(are) true? A) It is optimal to hold some cash. B) In the optimal solution, the investment in S\&P 500 is zero. C) In the optimal solution, the worst-case expected return is $1,350. D) In the optimal solution, the return for an additional invested dollar is $0.0054. E) None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started