The High Seas, Inc. manufactures water vessels and is organized into three large divisions: jet skis, fishing boats, and yachts. The following information presents

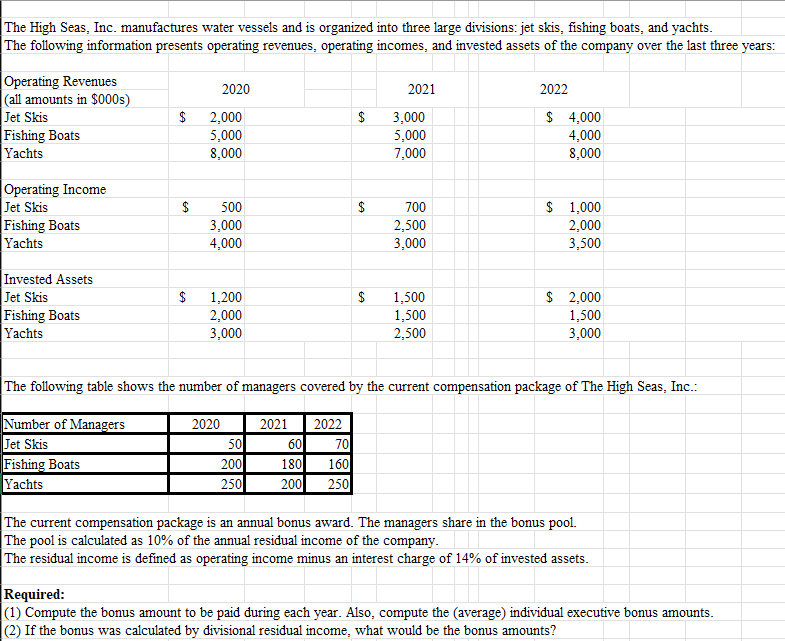

The High Seas, Inc. manufactures water vessels and is organized into three large divisions: jet skis, fishing boats, and yachts. The following information presents operating revenues, operating incomes, and invested assets of the company over the last three years: Operating Revenues 2020 (all amounts in $000s) Jet Skis $ 2,000 Fishing Boats 5,000 8,000 Yachts Operating Income Jet Skis Fishing Boats 2021 $ GA 3,000 5,000 7,000 2022 $ 4,000 4,000 8,000 EA $ 500 $ 700 $ 1,000 3,000 2,500 2,000 4,000 3,000 3,500 Yachts Invested Assets Jet Skis $ 1,200 $ 1,500 $ 2,000 Fishing Boats Yachts 2,000 3,000 1,500 2,500 1,500 3,000 The following table shows the number of managers covered by the current compensation package of The High Seas, Inc.: Number of Managers Jet Skis Fishing Boats Yachts 2020 2021 2022 50 60 70 200 180 160 250 200 250 The current compensation package is an annual bonus award. The managers share in the bonus pool. The pool is calculated as 10% of the annual residual income of the company. The residual income is defined as operating income minus an interest charge of 14% of invested assets. Required: (1) Compute the bonus amount to be paid during each year. Also, compute the (average) individual executive bonus amounts. (2) If the bonus was calculated by divisional residual income, what would be the bonus amounts?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainlylets analyze the provided data and calculate the bonus amounts 1 Bonus Amount and Average Individual Executive Bonus Step 1 Calculate Residual Income Year Operating Income Interest Charge 14 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started