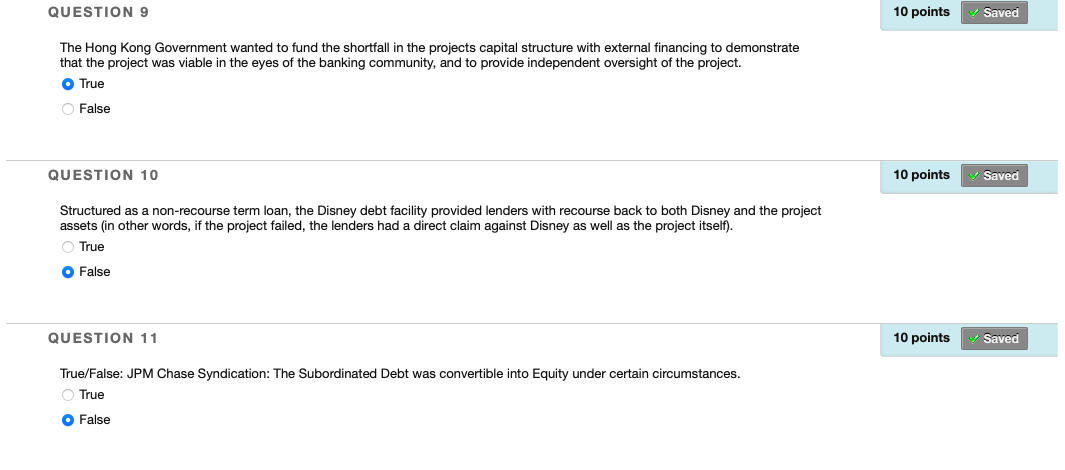

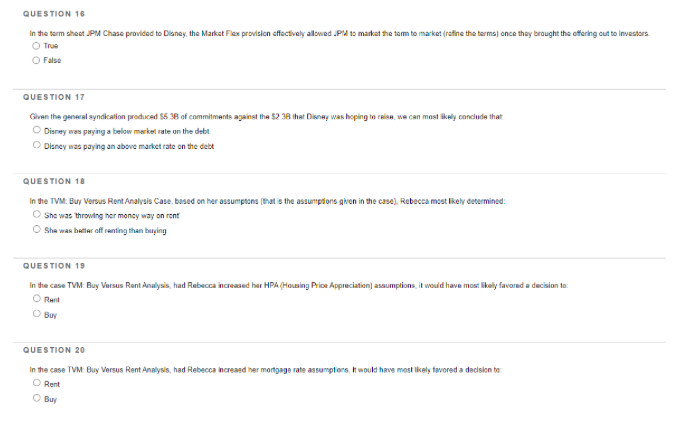

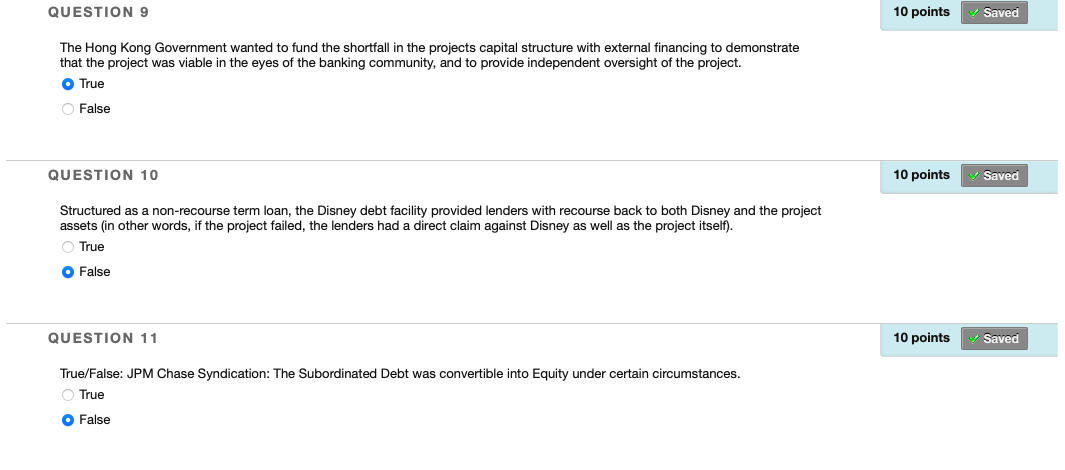

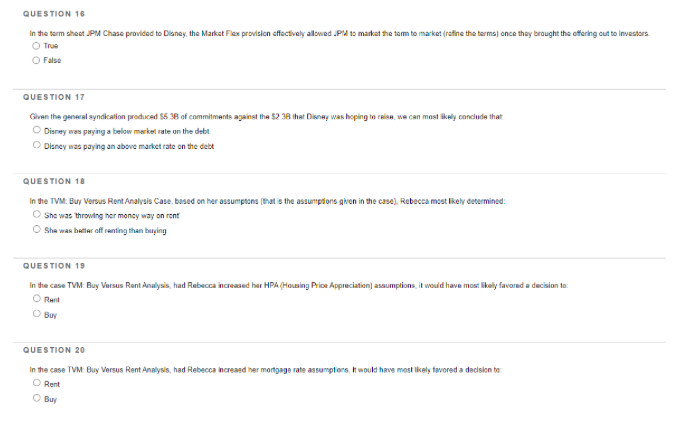

The Hong Kong Government wanted to fund the shortfall in the projects capital structure with external financing to demonstrate that the project was viable in the eyes of the banking community, and to provide independent oversight of the project. True False QUESTION 10 Structured as a non-recourse term loan, the Disney debt facility provided lenders with recourse back to both Disney and the projec assets (in other words, if the project failed, the lenders had a direct claim against Disney as well as the project itself). True False QUESTION 11 True/False: JPM Chase Syndication: The Subordinated Debt was convertible into Equity under certain circumstances. True False QUESTION 16 In the sarm sheot JPM Chase provided to Disney, the Markst Fiex provision sffectively allswed. .Pil 15 markst the tam to market (rsthe the tarms) ance they brought the offerhg cut to investsers True False QUESTION 17 Given the genecal syndication produced $538 of commitments againet the $238 that Disney was hoping to frisa. we can most ikely conclude that Disney was paying a below mokel rate on the debt. Discy was paying an above markst rate on the debt QUESTION 18 In the TVM: Buy Versus Rent Analysis Case, based on ber assumptens (that is the assumprons given in the case), Rebecea mast fkely deeermined: She was throwing her monsy way on rent She was betlar off rening than beying QUESTION 19 In the case TVM: Buy Versus Rent Andlysis, had Rabecca ncreased har HPA (Hecsing Prios Appreciation) assumptions, it would have most likely favored a decision to: Rant Buy QUESTION 20 In the case TVM. Buy Versus Rent Analysis, had Rebecca ncreasd her mortomes rate assemptions. H would have mest likely tavored a decisisn to: Rent Buy The Hong Kong Government wanted to fund the shortfall in the projects capital structure with external financing to demonstrate that the project was viable in the eyes of the banking community, and to provide independent oversight of the project. True False QUESTION 10 Structured as a non-recourse term loan, the Disney debt facility provided lenders with recourse back to both Disney and the projec assets (in other words, if the project failed, the lenders had a direct claim against Disney as well as the project itself). True False QUESTION 11 True/False: JPM Chase Syndication: The Subordinated Debt was convertible into Equity under certain circumstances. True False QUESTION 16 In the sarm sheot JPM Chase provided to Disney, the Markst Fiex provision sffectively allswed. .Pil 15 markst the tam to market (rsthe the tarms) ance they brought the offerhg cut to investsers True False QUESTION 17 Given the genecal syndication produced $538 of commitments againet the $238 that Disney was hoping to frisa. we can most ikely conclude that Disney was paying a below mokel rate on the debt. Discy was paying an above markst rate on the debt QUESTION 18 In the TVM: Buy Versus Rent Analysis Case, based on ber assumptens (that is the assumprons given in the case), Rebecea mast fkely deeermined: She was throwing her monsy way on rent She was betlar off rening than beying QUESTION 19 In the case TVM: Buy Versus Rent Andlysis, had Rabecca ncreased har HPA (Hecsing Prios Appreciation) assumptions, it would have most likely favored a decision to: Rant Buy QUESTION 20 In the case TVM. Buy Versus Rent Analysis, had Rebecca ncreasd her mortomes rate assemptions. H would have mest likely tavored a decisisn to: Rent Buy