Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Hotel Conneaut is considering 3 the following capital budgeting projects: A new computer and software system for $ 1 0 , 0 0 0

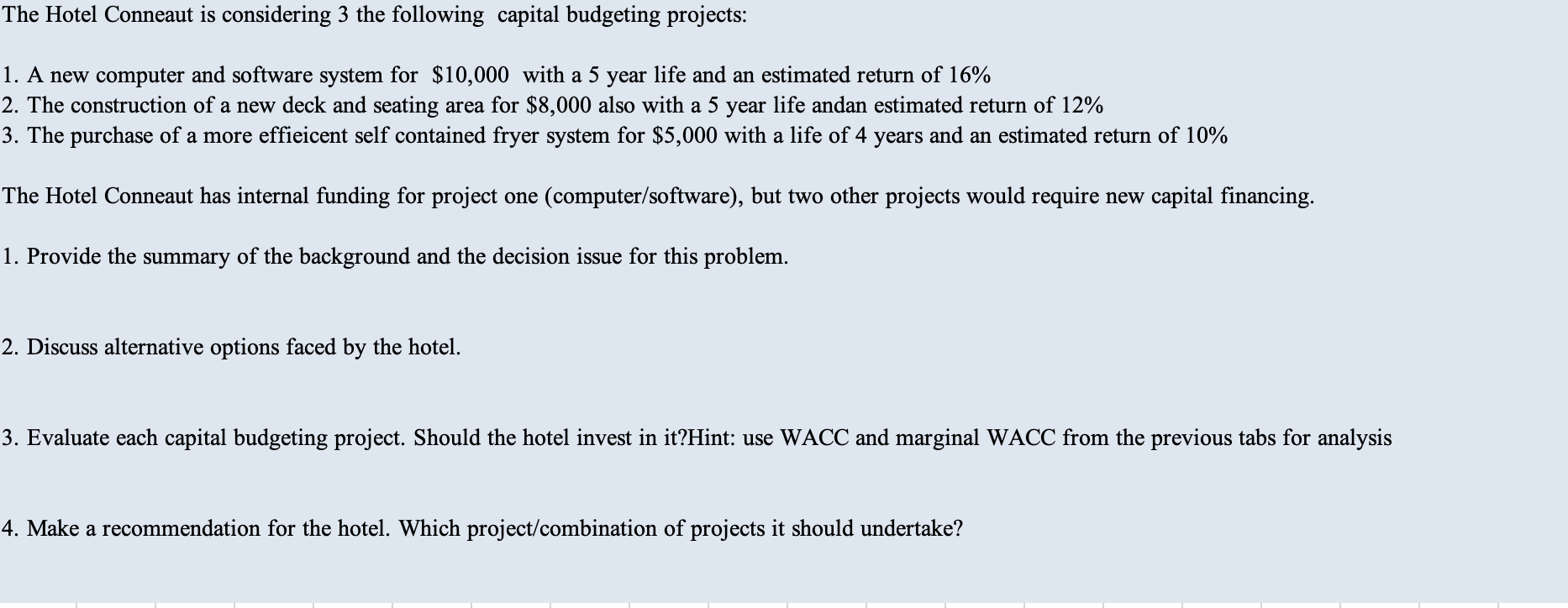

The Hotel Conneaut is considering the following capital budgeting projects:

A new computer and software system for $ with a year life and an estimated return of

The construction of a new deck and seating area for $ also with a year life andan estimated return of

The purchase of a more effieicent self contained fryer system for $ with a life of years and an estimated return of

The Hotel Conneaut has internal funding for project one computersoftware but two other projects would require new capital financing.

Provide the summary of the background and the decision issue for this problem.

Discuss alternative options faced by the hotel.

Evaluate each capital budgeting project. Should the hotel invest in itHint: use WACC and marginal WACC from the previous tabs for analysis

Make a recommendation for the hotel. Which projectcombination of projects it should undertake?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started