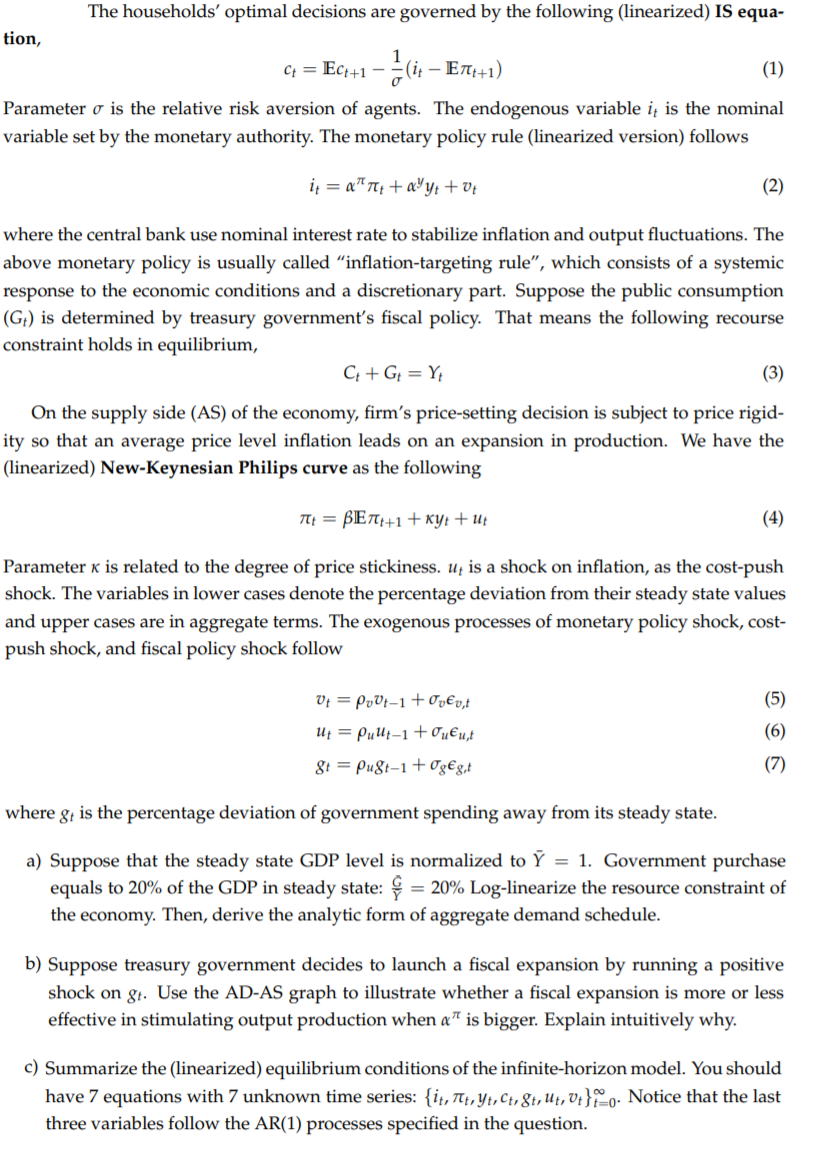

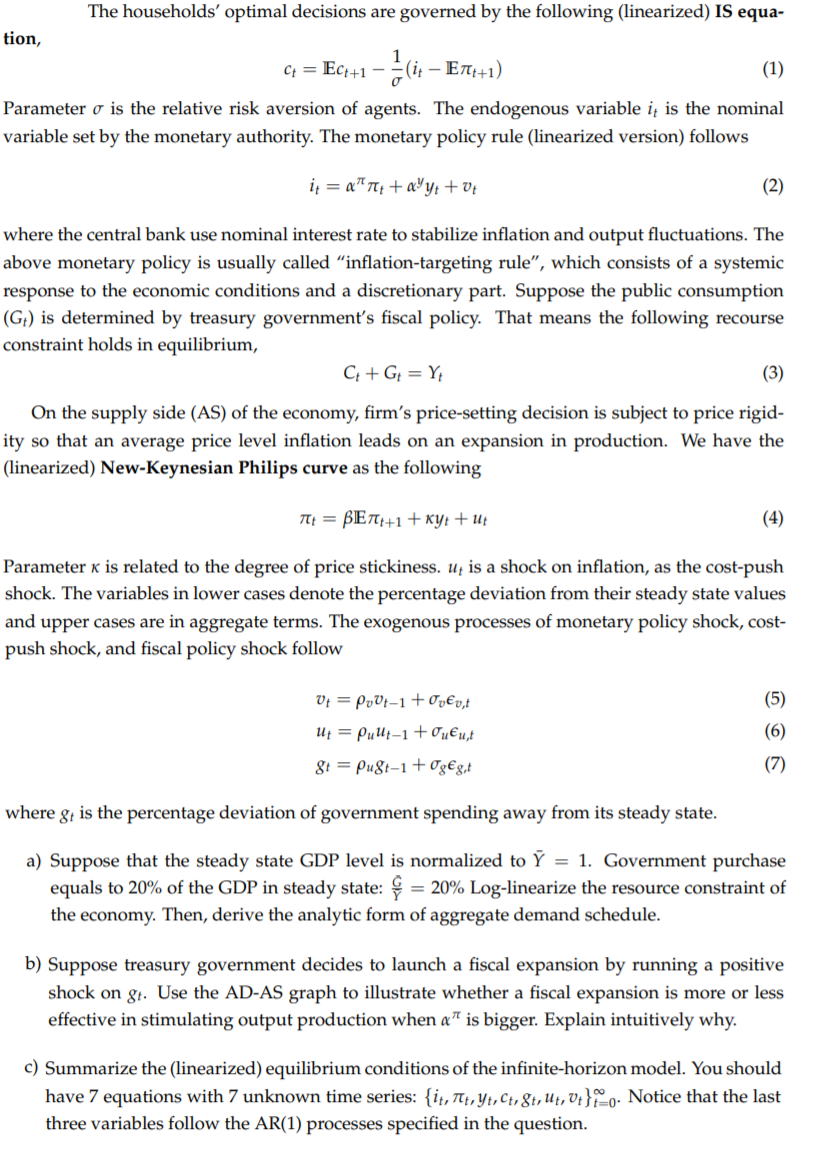

The households' optimal decisions are governed by the following (linearized) IS equa- tion, 6+ = Ec +1 (is En:+1) (1) Parameter o is the relative risk aversion of agents. The endogenous variable it is the nominal variable set by the monetary authority. The monetary policy rule (linearized version) follows in = a"7+ + ayt + 0 (2) where the central bank use nominal interest rate to stabilize inflation and output fluctuations. The above monetary policy is usually called inflation-targeting rule, which consists of a systemic response to the economic conditions and a discretionary part. Suppose the public consumption (Gt) is determined by treasury government's fiscal policy. That means the following recourse constraint holds in equilibrium, C++ G = Y (3) On the supply side (AS) of the economy, firm's price-setting decision is subject to price rigid- ity so that an average price level inflation leads on an expansion in production. We have the (linearized) New-Keynesian Philips curve as the following 7I+ = BE71 +1 + kyt + ut (4) Parameter x is related to the degree of price stickiness. Uz is a shock on inflation, as the cost-push shock. The variables in lower cases denote the percentage deviation from their steady state values and upper cases are in aggregate terms. The exogenous processes of monetary policy shock, cost- push shock, and fiscal policy shock follow (5) V+ = PV7-1 + 070,t ut = puu-1 + oueut (6) 8t = Pugt-1 + Og@g,t (7) where gt is the percentage deviation of government spending away from its steady state. a) Suppose that the steady state GDP level is normalized to Y = 1. Government purchase equals to 20% of the GDP in steady state: ( = 20% Log-linearize the resource constraint of the economy. Then, derive the analytic form of aggregate demand schedule. b) Suppose treasury government decides to launch a fiscal expansion by running a positive shock on gt. Use the AD-AS graph to illustrate whether a fiscal expansion is more or less effective in stimulating output production when a" is bigger. Explain intuitively why. c) Summarize the (linearized) equilibrium conditions of the infinite-horizon model. You should have 7 equations with 7 unknown time series: {it, Tt, Yt, Ct, gt, Ut, vt}=-0. Notice that the last three variables follow the AR(1) processes specified in the question. The households' optimal decisions are governed by the following (linearized) IS equa- tion, 6+ = Ec +1 (is En:+1) (1) Parameter o is the relative risk aversion of agents. The endogenous variable it is the nominal variable set by the monetary authority. The monetary policy rule (linearized version) follows in = a"7+ + ayt + 0 (2) where the central bank use nominal interest rate to stabilize inflation and output fluctuations. The above monetary policy is usually called inflation-targeting rule, which consists of a systemic response to the economic conditions and a discretionary part. Suppose the public consumption (Gt) is determined by treasury government's fiscal policy. That means the following recourse constraint holds in equilibrium, C++ G = Y (3) On the supply side (AS) of the economy, firm's price-setting decision is subject to price rigid- ity so that an average price level inflation leads on an expansion in production. We have the (linearized) New-Keynesian Philips curve as the following 7I+ = BE71 +1 + kyt + ut (4) Parameter x is related to the degree of price stickiness. Uz is a shock on inflation, as the cost-push shock. The variables in lower cases denote the percentage deviation from their steady state values and upper cases are in aggregate terms. The exogenous processes of monetary policy shock, cost- push shock, and fiscal policy shock follow (5) V+ = PV7-1 + 070,t ut = puu-1 + oueut (6) 8t = Pugt-1 + Og@g,t (7) where gt is the percentage deviation of government spending away from its steady state. a) Suppose that the steady state GDP level is normalized to Y = 1. Government purchase equals to 20% of the GDP in steady state: ( = 20% Log-linearize the resource constraint of the economy. Then, derive the analytic form of aggregate demand schedule. b) Suppose treasury government decides to launch a fiscal expansion by running a positive shock on gt. Use the AD-AS graph to illustrate whether a fiscal expansion is more or less effective in stimulating output production when a" is bigger. Explain intuitively why. c) Summarize the (linearized) equilibrium conditions of the infinite-horizon model. You should have 7 equations with 7 unknown time series: {it, Tt, Yt, Ct, gt, Ut, vt}=-0. Notice that the last three variables follow the AR(1) processes specified in the