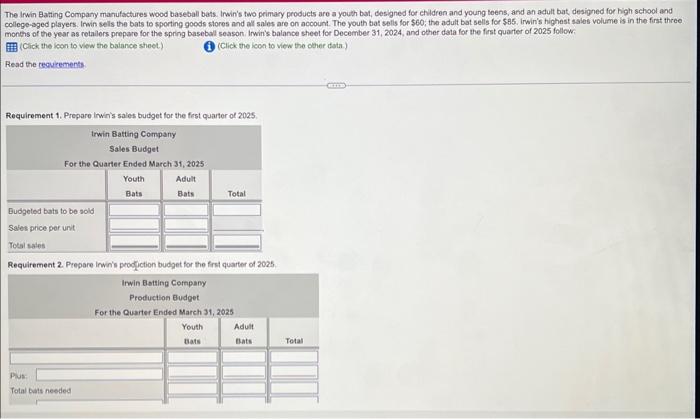

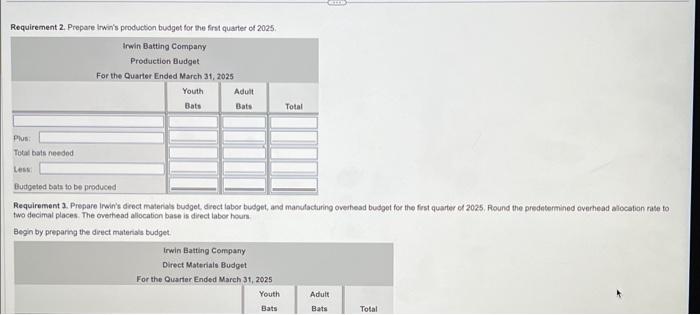

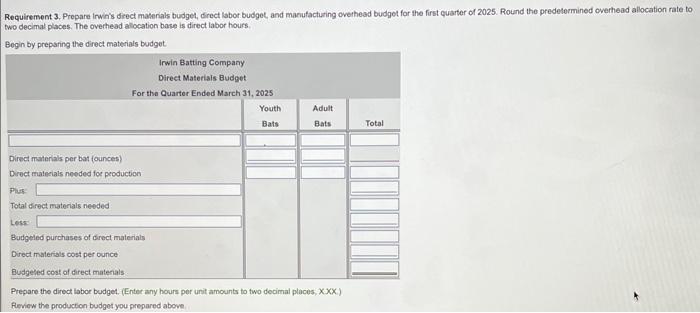

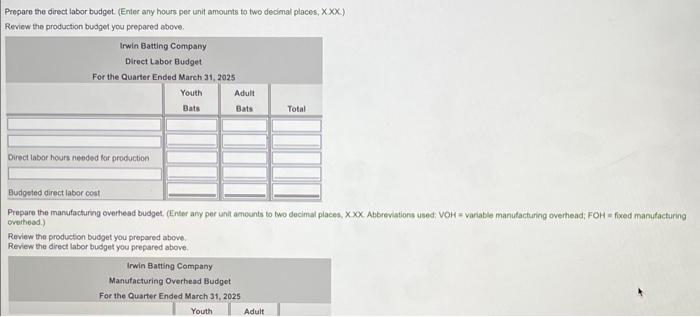

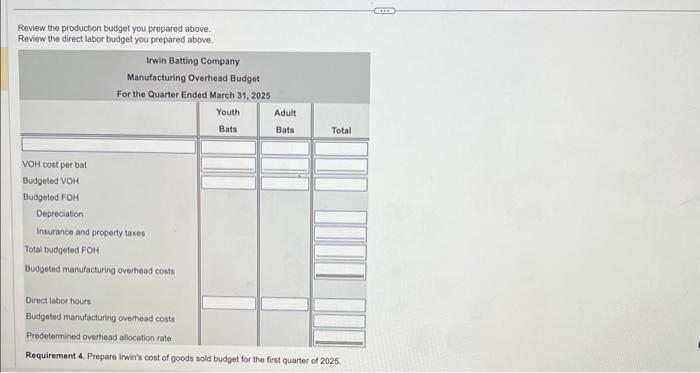

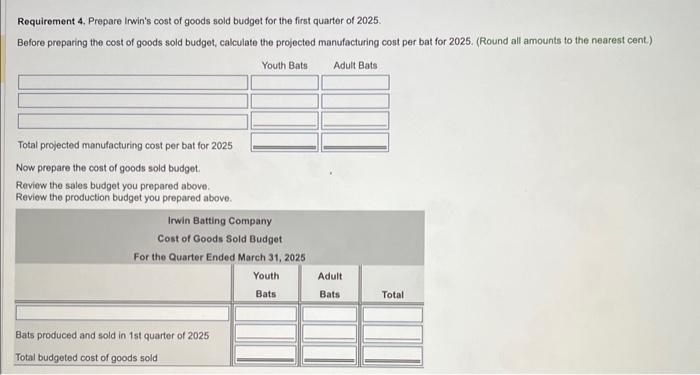

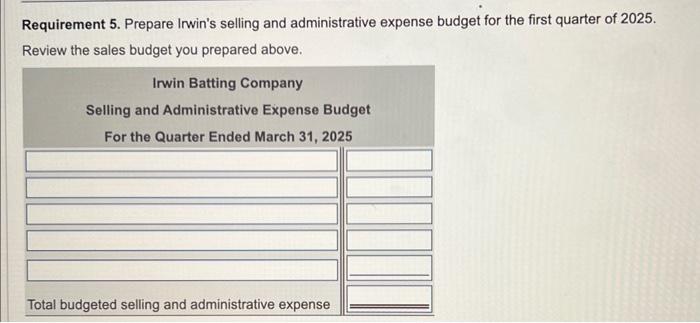

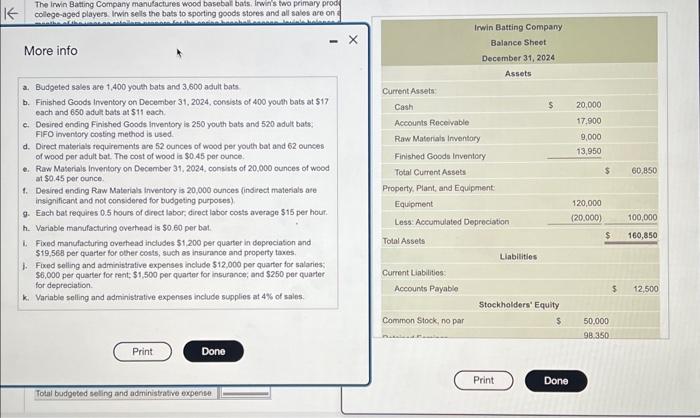

The Ifwin Bating Company manufactures wood baseball bats. Inwin's two primacy products are a youth bat, designed for children and young toens, and an adult bat, designed for high school and college-sged players. Inwin sels the bats to sporting goods stores and all sales are on account. The youth bat splis for $60; the adult bat sells for $85. Irwin's highest sales volume is in the first three months of the year as retailers prepare for the spring baseball season. Irwin's balance sheet for December 31 , 2024, and other data for the first quarter of 2025 follow. (Click the icon to view the baiance steet) (i) (Click the lecon to view the cther data) Read the requirements. Requirement 1. Prepare inwin's sales budget for the fest quarter of 2025 . Requirement 2. Prepare invin's prodiction budget for the frst quarter of 2025 . Requirement 2. Prepate inwin's producton budget for the first quarter of 2025 . two decimal places. The overtiead allocabion base is direct laber hours Begin by preparing the drect materias budget. Requirement 3. Prepare irwin's diect materials budgel, direct labor budgel, and manufacturing overhead budget for the first quarter of 2025 . Round the predetormined overhead allocation rate to wo decimal places. The overhead alocation base is direct labor hours. Beain bv brebsina the direct materials budoet: Prepare the direct labor budged. (Enter any hours per unit amounts to two decimal places, .) Reviow the production budgot you prepared above. Prepare the direct labor budgot. (Enter any hours per unit amounts to two decimal places, XX ) Review the production budget you peepared above. Prepare the manufacturng overhead budget. (Enter any per unt amounts to two decimal places, x. . Abbreviations usedi: voH = variable manufacturing overhead; FOH = fixed manufacturing overtinead.) Review the production bucget you propared above. Review the direct labor budget you prepared above. Review the production budget you propared above. Review the direct labor budoet vou bresared abown. Requirement 4. Prepare irwiri's cost of goods sold budget for the first quarter of 2025. Requirement 4. Prepare Irwin's cost of goods sold budget for the first quarter of 2025. Before preparing the cost of goods sold budget, calculate the projected manufacturing cost per bat for 2025 . (Round all amounts to the nearest cent.) Requirement 5. Prepare Irwin's selling and administrative expense budget for the first quarter of 2025 . Review the sales budget you prepared above. a. Budgeled sales are 1,400 youth bats and 3,600 adult bats b. Finishod Goods Inventory on December 31,2024 , consists of 400 youth bats at 517 each and 650 adull bats at $11 each. c. Dosired ending Finiehed Goods inventary is 250 youth bats and 520 adult bats: FIFO imventory costing method is used. d. Direct materials requirements are 52 ounces of wood per youth bal and 62 ounces of wood per adult bat. The cost of wood is $0.45 per ounce. e. Raw Materials inventory on December 31, 2024, consints of 20,000 ounces of wood at 90.45 por ounce. 1. Desired ending Raw Materials inventory is 20,000 ounces findizect materials are insignificant and not considered for budgeting purposes) 9. Each bat requetes 0.5 hours of drect labor, direct labor costs average $15 per houf. h. Variable marufacturing oveshead is $0.60 per bat. 1. Fixed manufacturing overthead includes 51,200 per quarter in doprociation and 519,568 per quarter for other costs, such as insuracico and property taxes. 1. Foxed solling and administrative expenses include 512,000 per quarter for salaries: $6,000 per quaster for rent; $1,500 per quarter for insurance; and $250 per quarter for depreciation. k. Variable selling and administrative expenses include supplies at 4% of saies