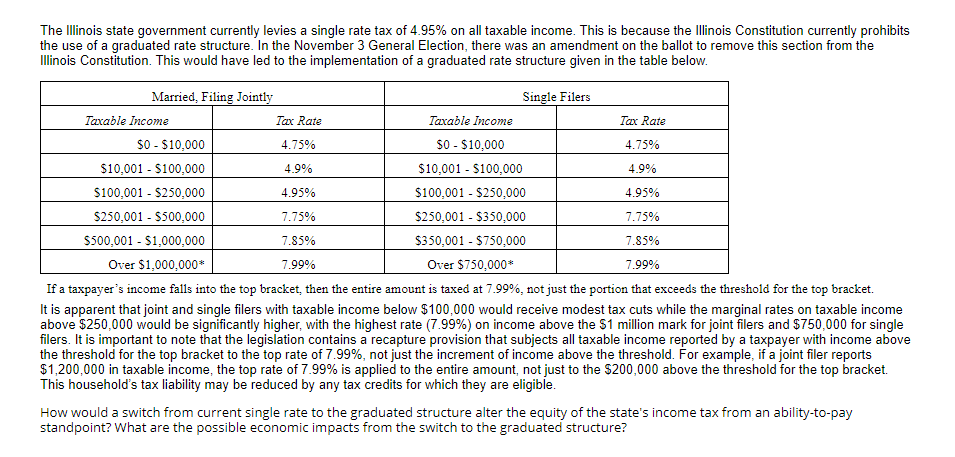

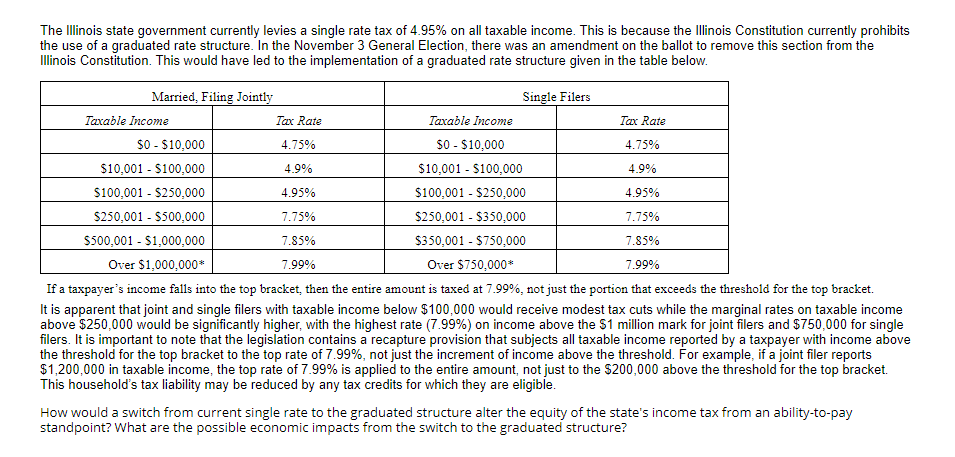

The Illinois state government currently levies a single rate tax of 4.95% on all taxable income. This is because the Illinois Constitution currently prohibits the use of a graduated rate structure. In the November 3 General Election, there was an amendment on the ballot to remove this section from the Illinois Constitution. This would have led to the implementation of a graduated rate structure given in the table below. Married, Filing Jointly Single Filers Taxable income Tax Rate Taxable income Tax Rate $0 - $10,000 4.75% $0 - $10,000 4.75% $10,001 - 5100,000 4.9% $10,001 - $100,000 4.9% $100,001 - 5250,000 4.95% $100,001 - $250,000 4.95% $250,001 - $500,000 7.75% $250,001 - $350,000 7.75% $500,001 - $1,000,000 7.85% $350,001 - $750,000 7.85% Over $1,000,000* 7.99% Over $750,000* If a taxpayer's income falls into the top bracket, then the entire amount is taxed at 7.99%, not just the portion that exceeds the threshold for the top bracket. It is apparent that joint and single filers with taxable income below $100,000 would receive modest tax cuts while the marginal rates on taxable income above $250,000 would be significantly higher, with the highest rate (7.99%) on income above the $1 million mark for joint filers and $750,000 for single filers. It is important to note that the legislation contains a recapture provision that subjects all taxable income reported by a taxpayer with income above the threshold for the top bracket to the top rate of 7.99%, not just the increment of income above the threshold. For example, if a joint filer reports $1,200,000 in taxable income, the top rate of 7.99% is applied to the entire amount, not just to the $200,000 above the threshold for the top bracket. This household's tax liability may be reduced by any tax credits for which they are eligible. How would a switch from current single rate to the graduated structure alter the equity of the state's income tax from an ability-to-pay standpoint? What are the possible economic impacts from the switch to the graduated structure? 7.99% The Illinois state government currently levies a single rate tax of 4.95% on all taxable income. This is because the Illinois Constitution currently prohibits the use of a graduated rate structure. In the November 3 General Election, there was an amendment on the ballot to remove this section from the Illinois Constitution. This would have led to the implementation of a graduated rate structure given in the table below. Married, Filing Jointly Single Filers Taxable income Tax Rate Taxable income Tax Rate $0 - $10,000 4.75% $0 - $10,000 4.75% $10,001 - 5100,000 4.9% $10,001 - $100,000 4.9% $100,001 - 5250,000 4.95% $100,001 - $250,000 4.95% $250,001 - $500,000 7.75% $250,001 - $350,000 7.75% $500,001 - $1,000,000 7.85% $350,001 - $750,000 7.85% Over $1,000,000* 7.99% Over $750,000* If a taxpayer's income falls into the top bracket, then the entire amount is taxed at 7.99%, not just the portion that exceeds the threshold for the top bracket. It is apparent that joint and single filers with taxable income below $100,000 would receive modest tax cuts while the marginal rates on taxable income above $250,000 would be significantly higher, with the highest rate (7.99%) on income above the $1 million mark for joint filers and $750,000 for single filers. It is important to note that the legislation contains a recapture provision that subjects all taxable income reported by a taxpayer with income above the threshold for the top bracket to the top rate of 7.99%, not just the increment of income above the threshold. For example, if a joint filer reports $1,200,000 in taxable income, the top rate of 7.99% is applied to the entire amount, not just to the $200,000 above the threshold for the top bracket. This household's tax liability may be reduced by any tax credits for which they are eligible. How would a switch from current single rate to the graduated structure alter the equity of the state's income tax from an ability-to-pay standpoint? What are the possible economic impacts from the switch to the graduated structure? 7.99%