Answered step by step

Verified Expert Solution

Question

1 Approved Answer

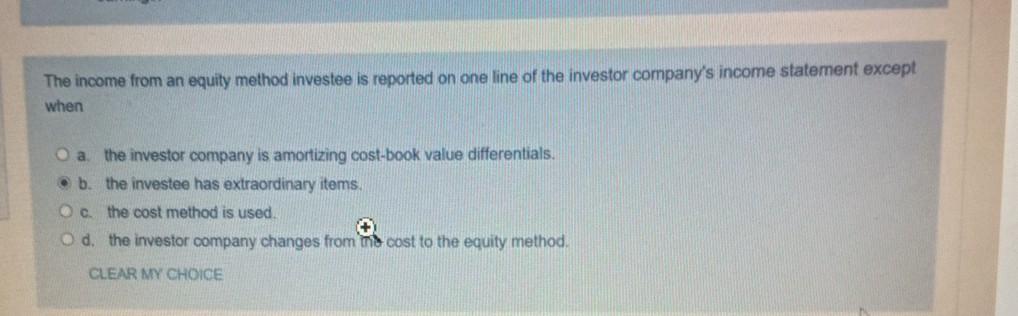

The income from an equity method investee is reported on one line of the investor company's income statement except when the investor company is amortizing

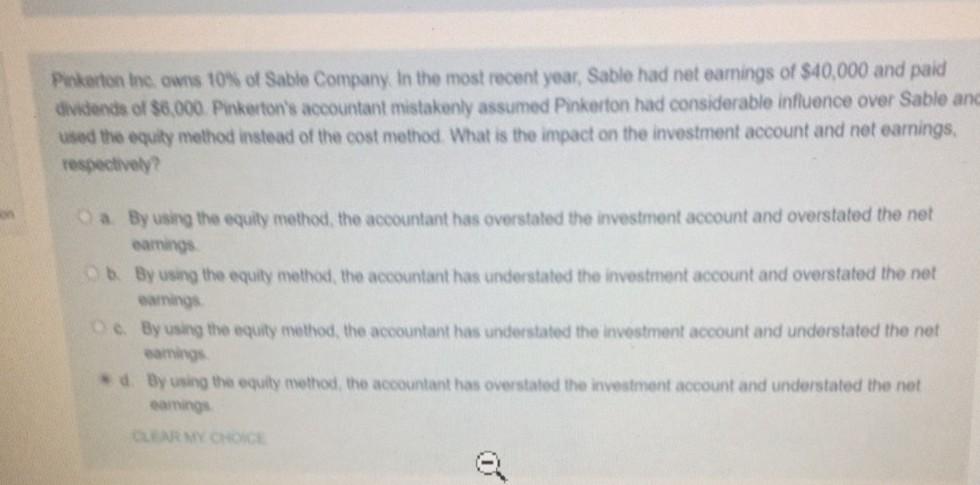

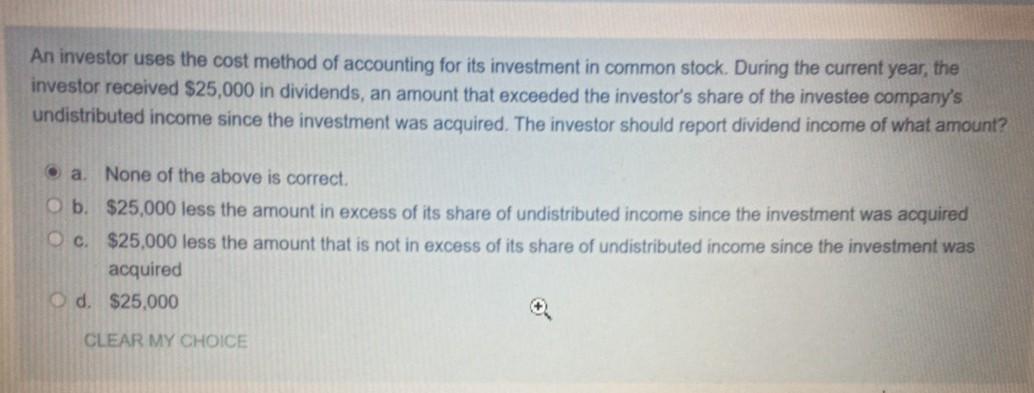

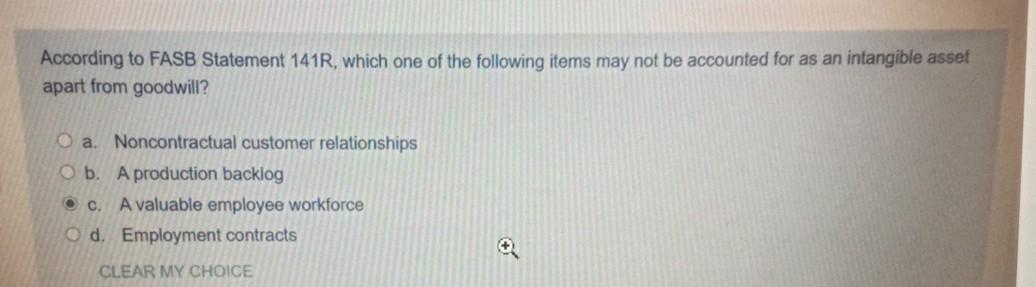

The income from an equity method investee is reported on one line of the investor company's income statement except when the investor company is amortizing cost-book value differentials. . b. the investee has extraordinary items. Oc the cost method is used Od the investor company changes from the cost to the equity method CLEAR MY CHOICE Pinkerton Inc. owns 10% of Sable Company in the most recent year, Sable had net earnings of $40,000 and paid dividends of $6.000. Pinkerton's accountant mistakenly assumed Pinkerton had considerable influence over Sable and used the equity method instead of the cost method. What is the impact on the investment account and not earnings, respectively Oa By using the equity method, the accountant has overstated the investment account and overstated the net By using the equity method, the accountant has understated the investment account and overstated the net TM e. By using the equity method, the accountant has understated the investment account and understated the net aming d. By using the equity method the accountant has overstated the investment account and understated the net aming CLEARAY CHOICE e An investor uses the cost method of accounting for its investment in common stock. During the current year, the investor received $25,000 in dividends, an amount that exceeded the investor's share of the investee company's undistributed income since the investment was acquired. The investor should report dividend income of what amount? a. None of the above is correct. ob. $25,000 less the amount in excess of its share of undistributed income since the investment was acquired c. $25.000 less the amount that is not in excess of its share of undistributed income since the investment was acquired d. $25,000 CLEAR MY CHOICE According to FASB Statement 141R, which one of the following items may not be accounted for as an intangible asset apart from goodwill? O a. Noncontractual customer relationships O b. A production backlog OC. A valuable employee workforce O d. Employment contracts + CLEAR MY CHOICE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started