Question

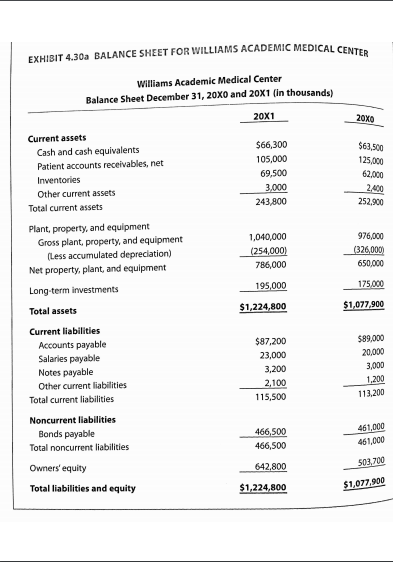

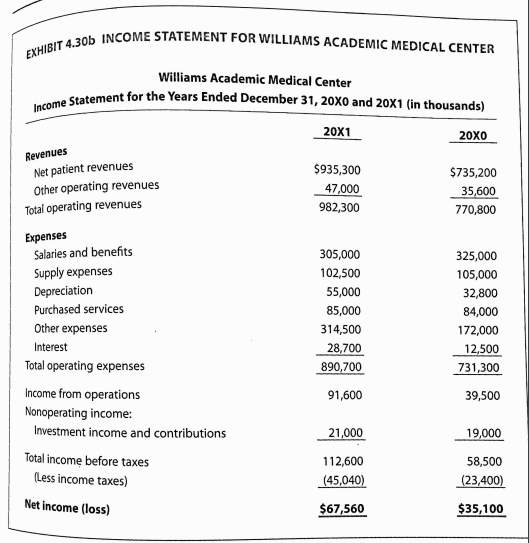

The Income Statement and Balance Sheet for the 660-bed Williams Academic Medical Center for the years 20X0 and 20X1 are shown in Exhibit 4.30a and

The Income Statement and Balance Sheet for the 660-bed Williams Academic Medical Center for the years 20X0 and 20X1 are shown in Exhibit 4.30a and 4.30b. Assume that principle payments each year come to $5,500,000, and that adjusted discharges are $120,000 for 20X0 and $125,000 for 20X1. 1. Perform full horizontal and vertical analysis on the income statement 2. Perform full horizontal and vertical analysis on the balance sheet 3. Calculate every ratio described in the formula table for both years, and compare these ratios with the benchmark (Exhibit 4.16a) Discuss Williamss current financial position and future outlook based on these results. Make the basis for the vertical analysis the year 20X0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started