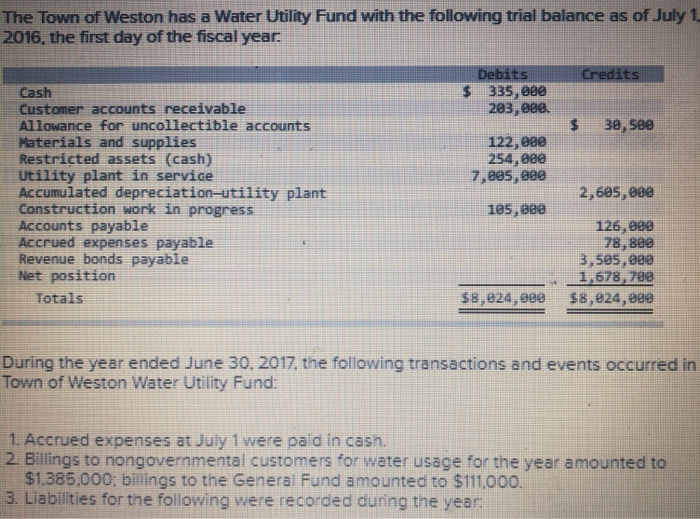

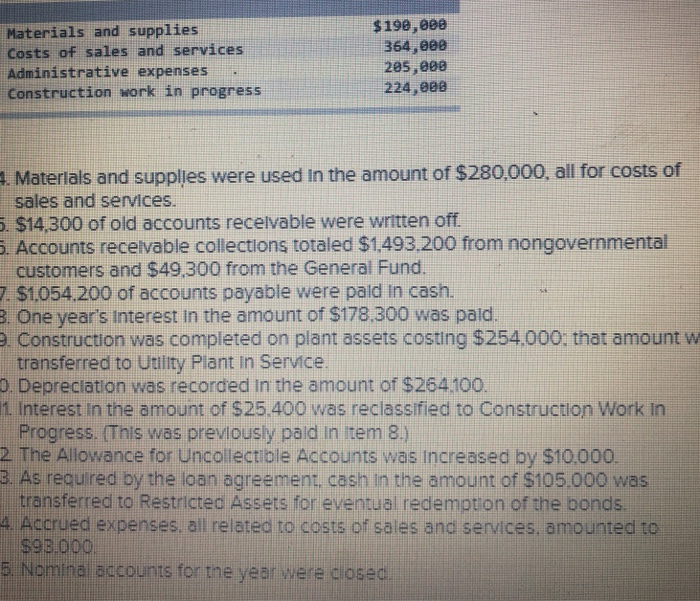

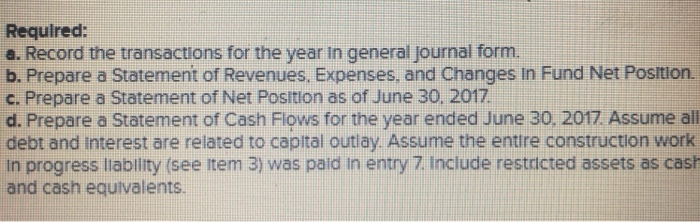

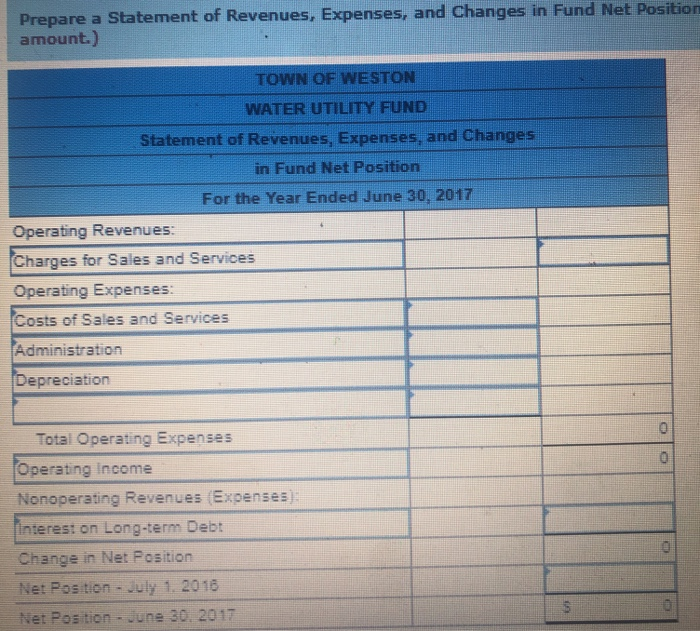

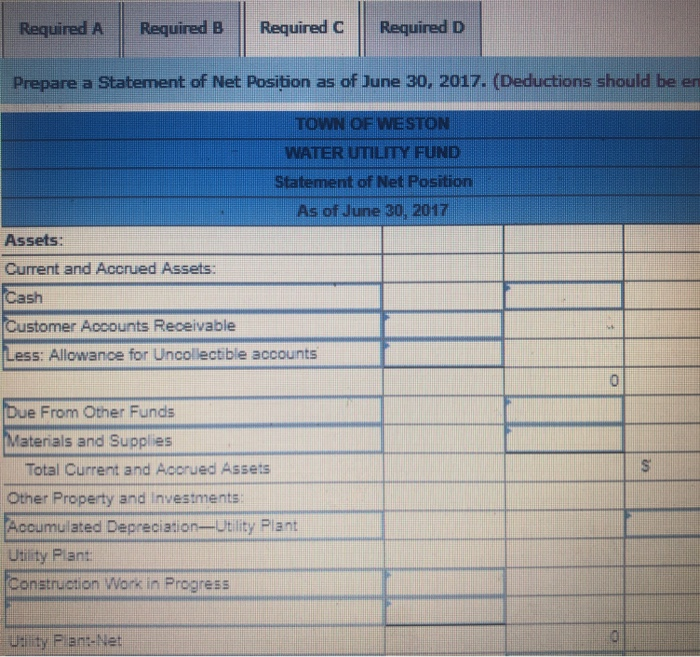

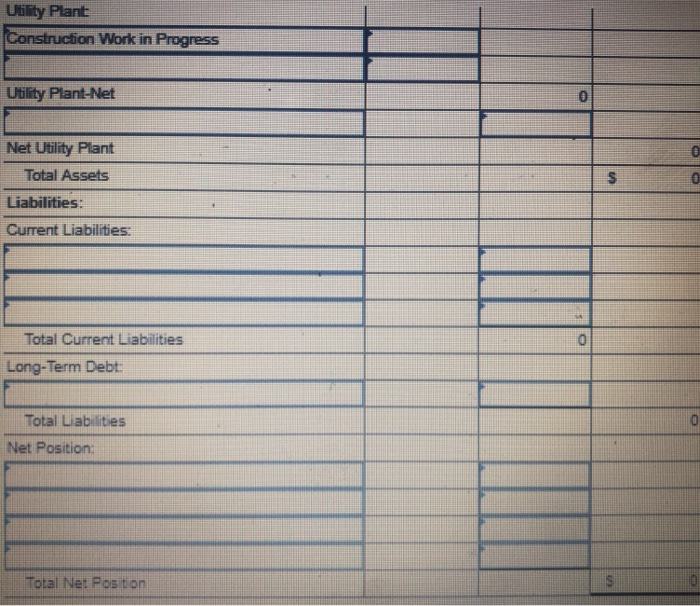

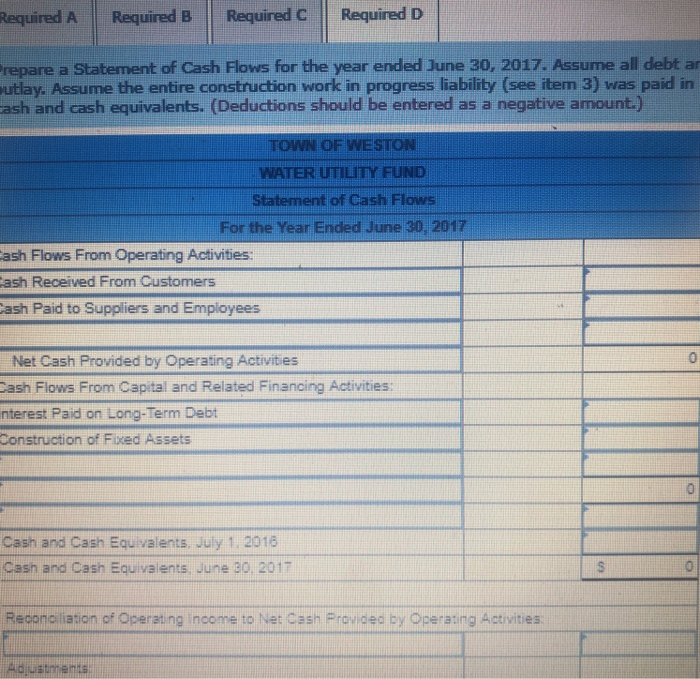

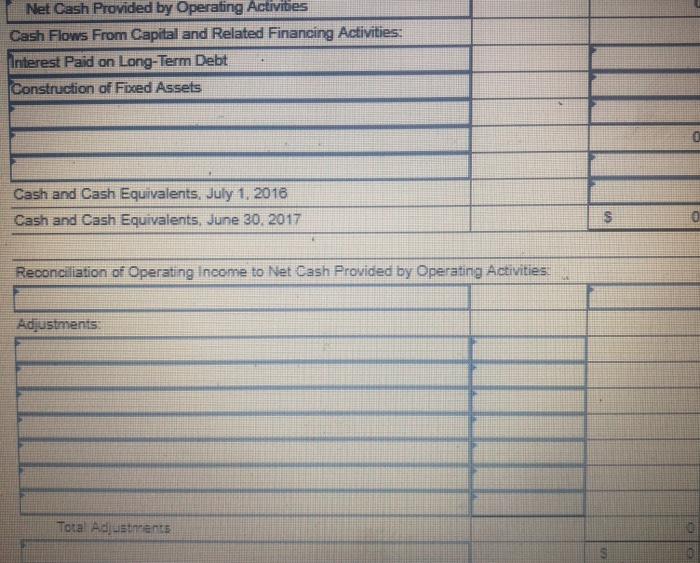

The Town of Weston has a Water Utility Fund with the following trial balance as of July 1 2016, the first day of the fiscal year DebitsCre $ 335,886 203, eee. Cash Customer accounts receivable Allowance for uncollectible accounts Materials and supplies Restricted assets (cash) Utility plant in service Accumulated depreciation-utility plant Construction work in progress Accounts payable Accrued expenses payable Revenue bonds payable Net position 1 30, see 122,680 254,886 7,8e5,8ee 2,685,8ee 185,e8e 126,88e 78,880 3,se5,88e 1,678,700 $8,824,88e $8,824,e8e 1 Totals During the year ended June 30, 2017, the following transactions and events occurred in Town of Weston Water Utility Fund: 1. Accrued expenses at July 1 were paid in cash. 2. Billings to nongovernmental customers for water usage for the year amounted to $1.385.000; billings to the General Fund amounted to $111,000. 3. Liabilities for the following were recorded during the year Materials and supplies Costs of sales and services Administrative expenses Construction work in progress $198,0ee 364,eee 205,0e8 224,888 Materials and suppljes were used in the amount of $280,000, all for costs of sales and services. . . $14,300 of old accounts recelvable were written off . Accounts recelvable collections totaled $1.493.200 from nongovernmental customers and $49,300 from the General Fund . $1054.200 of accounts payable were paid in cash. B. One year's Interest in the amount of $178.300 was pald. Construction was completed on plant assets costing $254000 that amount w transferred to Utility Plant In Servce o Depreciation was recorded in the amount of $264100. 1. Interest in the amount of $25.400 was reclassified to Construction Work In Progress. (This was previously paid in item 8) 3. As reguired by the loan agreement, cash in the amount of $105.000 was 4 Accrued expenses, ail related to costs of sales and services, amounted to The Allowance for Uncollectible Accounts was increased by $10.000 transferred to Restrictec Assets for eventual redemption of the bonds $9B.000 ominal adcounts for the year were closed Required: a. Record the transactions for the year in general journal form. b. Prepare a Statement of Revenues, Expenses, and Changes in Fund Net Postion. c. Prepare a Statement of Net Posltion as of June 30, 2017 d. Prepare a Statement of Cash Flows for the year ended June 30, 2017 Assume al debt and interest are related to capital outlay Assume the entlre construction work in progress lablity (see item 3) was paid in entry 7 include restricted assets as cash and cash equivalents Prepare a Statement of Revenues, Expenses, and Changes in Fund Net Position amount.) TOWN OF WESTON WATER UTILITY FUND Statement of Revenues, Expenses, and Changes in Fund Net Position For the Year Ended June 30, 2017 Operating Revenues: Charges for Sales and Services Operating Expenses Costs of Sales and Services Administration Depreciation Total Operating Expenses Operating income Nonoperating Revenues (Expenses interes: on Long-term Debt Change in Net Position Net Pos tion- July 1. 2018 et Poatian 'June 30, 2017 Required A Required B Required CRequired D Prepare a Statement of Net Position as of June 30, 2017. (Deductions should be en TOWN OF WESTON WATER UTILITY FUND Statement of Net Position As of June 30, 2017 Assets: Current and Accrued Assets: Cash stomer Accounts Receivable Less: Allowance for Uncollectble accounts Due From Other Funds Materials and Supplies Total Current and Accrued Assets Other Property and Investments Accumulated Depreciation-Utlity Plant Utility Plant Construction Work in Progress Utility Plan:-Net Utility Plant onstruction Work in Progress Utility Plant-Net 0 Net Utility Plant 0 0 Total Assets Liabilities: Current Liabilities Total Current Liabilities Long-Term Debt Total Liabilities Net Position: Total Net Fosition Required ARequired B Required C Required D repare a Statement of Cash Flows for the year ended June 30, 2017. Assume all debt a utlay. Assume the entire construction work in progress liability (see item 3) was paid in ash and cash equivalents. (Deductions should be entered as a negative amount.) TOWN OF WESTO WATER UTILITY FUND Statement of Cash Flows For the Year Ended June 30, 2017 ash Flows From Operating Activities ash Received From Customers ash Paid to Suppliers and Employees 0 Net Cash Provided by Operating Activities ash Flows From Capital and Related Financing Activities nterest Paid on Long-Term Debt Construction of Fixed Assets 0 Cash and Cash Equivalents. July 1. 2018 Cash and Cash Equivalents, June 30, 2017 Reconciliation of Operating income to Ner Cash Provided by Operaing Activities Adjuatmenta Cash Provided by Operating Activibes Net Cash Flows From Capital and Related Financing Activities: nterest Paid on Long-Term Debt Construction of Fixed Assets Cash and Cash Equivalents, July 1. 2016 Cash and Cash Equivalents, June 30, 2017 Reconciliation of Operating income to Net Cash Provided by Operating Activities Adjustments Total Adjustmments