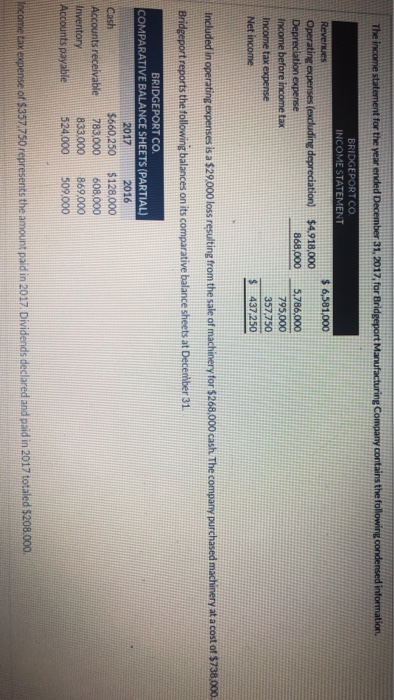

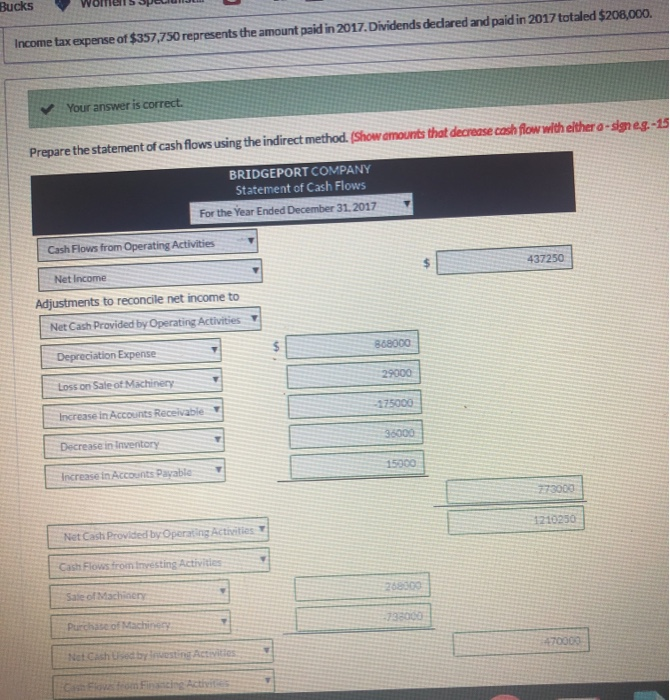

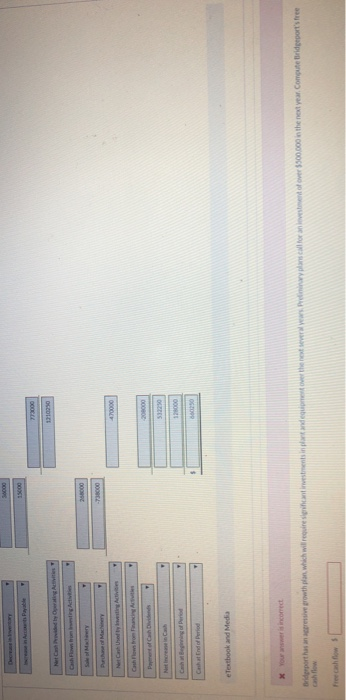

The income statement for the year ended December 31, 2017 for Bridgeport Manufacturing Company contains the following condensed information $ 6,581,000 BRIDGEPORT CO. INCOME STATEMENT Revenues Operating expenses (excluding depreciation) $4.918,000 Depreciation expense 868,000 Income before income tax Income tax expense Net income 5,786,000 795,000 357,750 437 250 $ Included in operating expenses is a $29.000 loss resulting from the sale of machinery for $268,000 cash. The company purchased machinery at a cost of $738.000 Bridgeport reports the following balances on its comparative balance sheets at December 31, BRIDGEPORT CO. COMPARATIVE BALANCE SHEETS (PARTIAL) 2017 2016 Cash $660.250 $128,000 Accounts receivable 783.000 608.000 Inventory 833.000 869.000 Accounts payable 524.000 509.000 Income tax expense of $357.750 represents the amount paid in 2017 Dividends declared and paid in 2017 totaled $208.000 Income tax expense of $357,750 represents the amount paid in 2017. Dividends dedared and paid in 2017 totaled $208,000. Your answer is correct. Prepare the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a sign eg.- BRIDGEPORT COMPANY Statement of Cash Flows For the Year Ended December 31, 2017 - Cash Flows from Operating Activities Net Income 437250 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense 868000 Loss on Saleot Machinery Increase in Accounts Receivable -175000 Decrease in Inventory 36000 Increase in Accounts Payable 15900 Net Cash Provided by Operating Activities 1210250 Cash Flows fronteresting Activities Sale of Machinery Purchase of Machine 720 Net Cash Used from Fine Acth e Textbook and Media x your answer is incorrect 3. Preliminary plans call for an lovestment of over $500.000 in the next year. Compute Bridgeport's free Bridgeport has an active growth plan which will requires cash flow The income statement for the year ended December 31, 2017 for Bridgeport Manufacturing Company contains the following condensed information $ 6,581,000 BRIDGEPORT CO. INCOME STATEMENT Revenues Operating expenses (excluding depreciation) $4.918,000 Depreciation expense 868,000 Income before income tax Income tax expense Net income 5,786,000 795,000 357,750 437 250 $ Included in operating expenses is a $29.000 loss resulting from the sale of machinery for $268,000 cash. The company purchased machinery at a cost of $738.000 Bridgeport reports the following balances on its comparative balance sheets at December 31, BRIDGEPORT CO. COMPARATIVE BALANCE SHEETS (PARTIAL) 2017 2016 Cash $660.250 $128,000 Accounts receivable 783.000 608.000 Inventory 833.000 869.000 Accounts payable 524.000 509.000 Income tax expense of $357.750 represents the amount paid in 2017 Dividends declared and paid in 2017 totaled $208.000 Income tax expense of $357,750 represents the amount paid in 2017. Dividends dedared and paid in 2017 totaled $208,000. Your answer is correct. Prepare the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a sign eg.- BRIDGEPORT COMPANY Statement of Cash Flows For the Year Ended December 31, 2017 - Cash Flows from Operating Activities Net Income 437250 Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense 868000 Loss on Saleot Machinery Increase in Accounts Receivable -175000 Decrease in Inventory 36000 Increase in Accounts Payable 15900 Net Cash Provided by Operating Activities 1210250 Cash Flows fronteresting Activities Sale of Machinery Purchase of Machine 720 Net Cash Used from Fine Acth e Textbook and Media x your answer is incorrect 3. Preliminary plans call for an lovestment of over $500.000 in the next year. Compute Bridgeport's free Bridgeport has an active growth plan which will requires cash flow