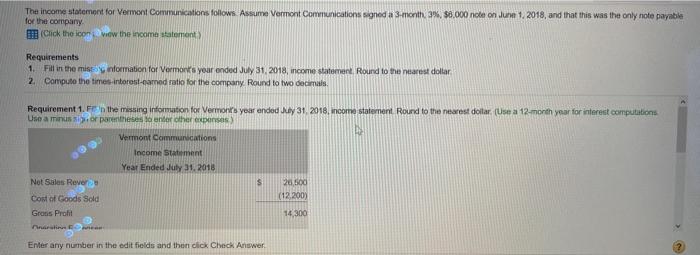

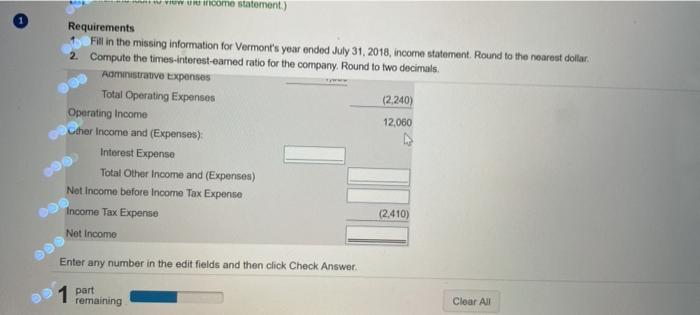

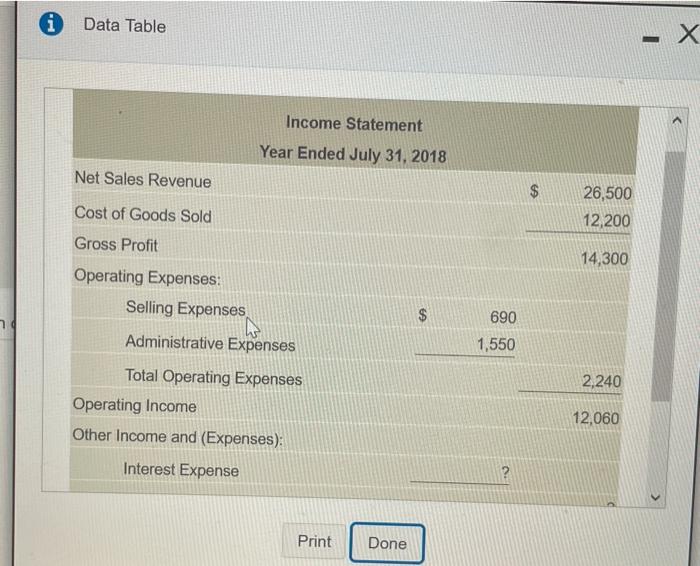

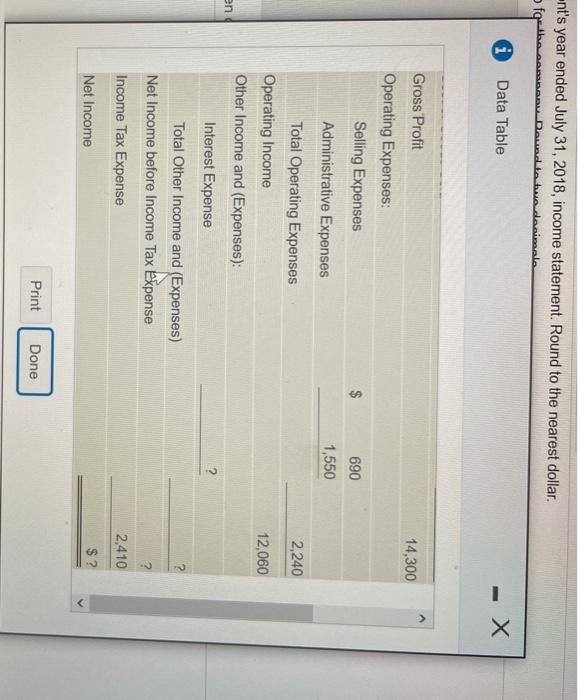

The income statement for Vermont Communications follows Assume Vermont Communications signed a 3-month 3%, 50.000 note on June 1. 2018, and that this was the only note payable for the company ! (Click the icon vw the income statement Requirements 1. Fill in the misformation for Vormont's your ended July 31, 2018, income statement, Round to the nearest dollar 2. Compute the times interest camned ratio for the company Round to two decimals Requirement 1. Frithe missing information for Vermont's year ended My 31, 2018, income statement Round to the nearest dollar (Use a 12-month year for interest computations Use a minusior parents to enter the expenses Vermont Communications Income Statement Year Ended July 21, 2018 S 20,500 (12.2001 Not Sales Rever Cost of Goods Sold Grans Profit ra 14.300 Enter any number in the edit fields and then click Check Answer 2 www income statement.) 12,060 Requirements Fill in the missing information for Vermont's year ended July 31, 2018, income statement. Round to the nearest dollar, 2. Compute the times-interest-eamed ratio for the company. Round to two decimals. Aministrative Expenses Total Operating Expenses (2.240) Operating Income Cher Income and (Expenses) Interest Expense Total Other Income and (Expenses) Not Income before Income Tax Expense (2.410) Income Tax Expense Net Income Enter any number in the edit fields and then click Check Answer part remaining Clear All Data Table Income Statement Year Ended July 31, 2018 Net Sales Revenue $ Cost of Goods Sold 26,500 12,200 Gross Profit 14,300 $ 690 1,550 Operating Expenses: Selling Expenses Administrative Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Expense 2,240 12,060 ? Print Done -nt's year ended July 31, 2018, income statement. Round to the nearest dollar. f i Data Table - X Gross Profit 14,300 $ 690 1,550 2,240 12,060 Operating Expenses: Selling Expenses Administrative Expenses Total Operating Expenses Operating Income Other Income and (Expenses): Interest Expense Total Other Income and (Expenses) Net Income before Income Tax Expense Income Tax Expense Net Income en ? ? 2,410 $? Print Done