Answered step by step

Verified Expert Solution

Question

1 Approved Answer

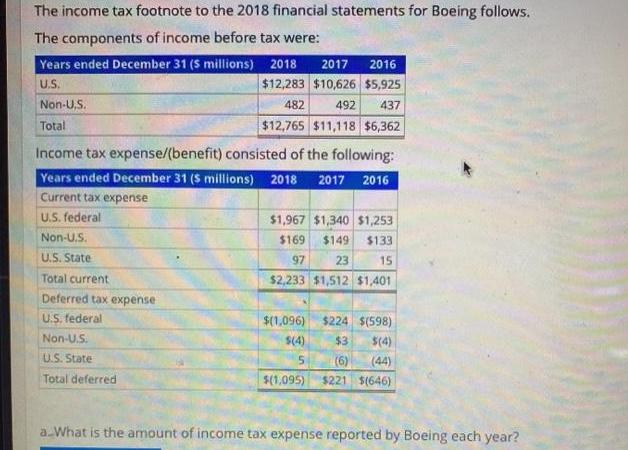

The income tax footnote to the 2018 financial statements for Boeing follows. The components of income before tax were: Years ended December 31 (5

The income tax footnote to the 2018 financial statements for Boeing follows. The components of income before tax were: Years ended December 31 (5 millions) 2018 2017 2016 U.S. $12,283 $10,626 $5,925 Non-U,S. 482 492 437 Total $12,765 $11,118 $6,362 Income tax expense/(benefit) consisted of the following: Years ended December 31 ($ millions) 2018 2017 2016 Current tax expense U.S. federal Non-U.S. U.S. State Total current Deferred tax expense U.S. federal Non-U.S. U.S. State Total deferred $1,967 $1,340 $1,253 $169 $149 $133 15 97 23 $2,233 $1,512 $1,401 $(1,096) $224 $(598) $3 $(4) (6) (44) $221 $(646) $(4) 5 $(1,095) a What is the amount of income tax expense reported by Boeing each year?

Step by Step Solution

★★★★★

3.34 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

The image contains financial data showing the components of income before tax and income tax expensebenefit for Boeing for the years 2018 2017 and 2016 To find the amount of income tax expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started