Question

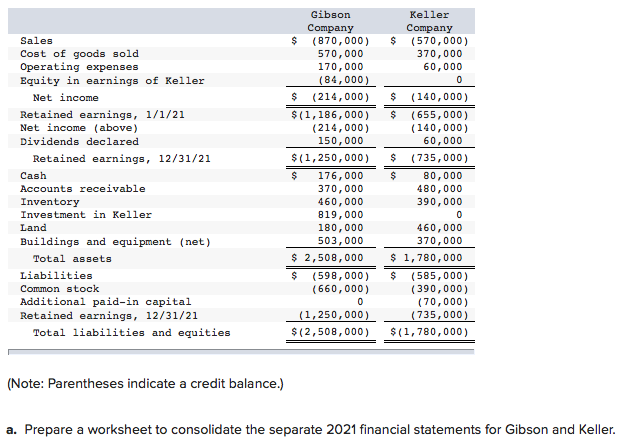

The individual financial statements for Gibson Company and Keller Company for the year ending December 31, 2021, follow. Gibson acquired a 60 percent interest in

The individual financial statements for Gibson Company and Keller Company for the year ending December 31, 2021, follow. Gibson acquired a 60 percent interest in Keller on January 1, 2020, in exchange for various considerations totaling $480,000. At the acquisition date, the fair value of the noncontrolling interest was $320,000 and Kellers book value was $630,000. Keller had developed internally a customer list that was not recorded on its books but had an acquisition-date fair value of $170,000. This intangible asset is being amortized over 20 years. Gibson uses the partial equity method to account for its investment in Keller.

Gibson sold Keller land with a book value of $80,000 on January 2, 2020, for $160,000. Keller still holds this land at the end of the current year.

Keller regularly transfers inventory to Gibson. In 2020, it shipped inventory costing $154,000 to Gibson at a price of $220,000. During 2021, intra-entity shipments totaled $270,000, although the original cost to Keller was only $175,500. In each of these years, 20 percent of the merchandise was not resold to outside parties until the period following the transfer. Gibson owes Keller $40,000 at the end of 2021.

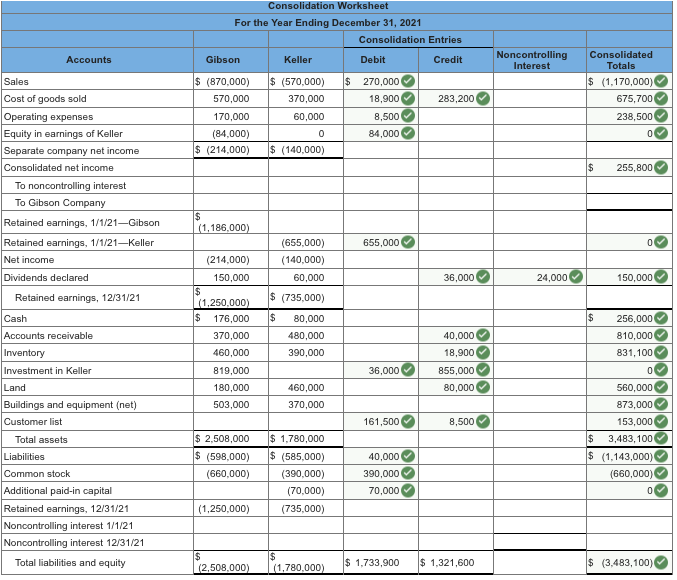

Sales Cost of goods sold Operating expenses Equity in earnings of Keller Net income Retained earnings, 1/1/21 Net income (above) Dividends declared Retained earnings, 12/31/21 Cash Accounts receivable Inventory Investment in Keller Land Buildings and equipment (net) Total assets Liabilities Common stock Additional paid-in capital Retained earnings, 12/31/21 Total liabilities and equities Gibson Company (870,000) 570,000 170,000 (84,000) $ (214,000) $(1,186,000) (214,000) 150,000 $(1,250,000) $ 176,000 370,000 460,000 819,000 180,000 503,000 $ 2,508,000 $ (598,000) (660,000) 0 (1,250,000) $(2,508,000) Keller Company $ (570,000) 370,000 60,000 0 $ (140,000) $ (655,000) (140,000) 60,000 $ (735,000) $ 80,000 480,000 390,000 0 460,000 370,000 $ 1,780,000 $ (585,000) (390,000) (70,000) (735,000) $(1,780,000) (Note: Parentheses indicate a credit balance.) a. Prepare a worksheet to consolidate the separate 2021 financial statements for Gibson and Keller. Consolidation Worksheet For the Year Ending December 31, 2021 Consolidation Entries Accounts Gibson Keller Debit Credit Noncontrolling Interest $ $ (870,000) 570,000 170,000 (84,000) $ (214,000) 283,200 $ (570,000) 370,000 60,000 0 $ (140,000) Consolidated Totals $ (1,170,000) 675,700 238,500 270,000 18,900 8,500 84,000 $ 255,800 $ (1,186,000) 655,000 Sales Cost of goods sold Operating expenses Equity in earnings of Keller Separate company net income Consolidated net income To noncontrolling interest To Gibson Company Retained earnings, 1/1/21Gibson Retained earnings, 1/1/21Keller Net income Dividends declared Retained earnings, 12/31/21 Cash Accounts receivable Inventory Investment in Keller Land Buildings and equipment (net) Customer list (655,000) (140,000) 60,000 $ (735,000) 36,000 24,000 150,000 (214,000) 150,000 $ (1.250.000) $ 176,000 370,000 460,000 $ $ 80,000 480,000 390,000 40,000 18,900 256,000 810,000 831,100 36,000 819,000 180,000 503,000 855,000 80,000 460,000 370,000 161,500 8,500 560,000 873,000 153,000 $ 3,483, 100 $ (1,143,000) (660,000) Total assets $ 2,508,000 $ (598,000) (660,000) ISIS $ 1.780,000 $ (585,000) (390,000) (70,000) (735,000) 40,000 390,000 70,000 Liabilities Common stock Additional paid-in capital Retained earnings, 12/31/21 Noncontrolling interest 1/1/21 Noncontrolling interest 12/31/21 Total liabilities and equity 0 (1,250,000) $ (2.508.000) $ (1,780,000) $ 1,733,900 $ 1,321,600 $ (3,483,100) Sales Cost of goods sold Operating expenses Equity in earnings of Keller Net income Retained earnings, 1/1/21 Net income (above) Dividends declared Retained earnings, 12/31/21 Cash Accounts receivable Inventory Investment in Keller Land Buildings and equipment (net) Total assets Liabilities Common stock Additional paid-in capital Retained earnings, 12/31/21 Total liabilities and equities Gibson Company (870,000) 570,000 170,000 (84,000) $ (214,000) $(1,186,000) (214,000) 150,000 $(1,250,000) $ 176,000 370,000 460,000 819,000 180,000 503,000 $ 2,508,000 $ (598,000) (660,000) 0 (1,250,000) $(2,508,000) Keller Company $ (570,000) 370,000 60,000 0 $ (140,000) $ (655,000) (140,000) 60,000 $ (735,000) $ 80,000 480,000 390,000 0 460,000 370,000 $ 1,780,000 $ (585,000) (390,000) (70,000) (735,000) $(1,780,000) (Note: Parentheses indicate a credit balance.) a. Prepare a worksheet to consolidate the separate 2021 financial statements for Gibson and Keller. Consolidation Worksheet For the Year Ending December 31, 2021 Consolidation Entries Accounts Gibson Keller Debit Credit Noncontrolling Interest $ $ (870,000) 570,000 170,000 (84,000) $ (214,000) 283,200 $ (570,000) 370,000 60,000 0 $ (140,000) Consolidated Totals $ (1,170,000) 675,700 238,500 270,000 18,900 8,500 84,000 $ 255,800 $ (1,186,000) 655,000 Sales Cost of goods sold Operating expenses Equity in earnings of Keller Separate company net income Consolidated net income To noncontrolling interest To Gibson Company Retained earnings, 1/1/21Gibson Retained earnings, 1/1/21Keller Net income Dividends declared Retained earnings, 12/31/21 Cash Accounts receivable Inventory Investment in Keller Land Buildings and equipment (net) Customer list (655,000) (140,000) 60,000 $ (735,000) 36,000 24,000 150,000 (214,000) 150,000 $ (1.250.000) $ 176,000 370,000 460,000 $ $ 80,000 480,000 390,000 40,000 18,900 256,000 810,000 831,100 36,000 819,000 180,000 503,000 855,000 80,000 460,000 370,000 161,500 8,500 560,000 873,000 153,000 $ 3,483, 100 $ (1,143,000) (660,000) Total assets $ 2,508,000 $ (598,000) (660,000) ISIS $ 1.780,000 $ (585,000) (390,000) (70,000) (735,000) 40,000 390,000 70,000 Liabilities Common stock Additional paid-in capital Retained earnings, 12/31/21 Noncontrolling interest 1/1/21 Noncontrolling interest 12/31/21 Total liabilities and equity 0 (1,250,000) $ (2.508.000) $ (1,780,000) $ 1,733,900 $ 1,321,600 $ (3,483,100)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started