Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The information below is relevant for both projects: All sales are expected to be cash sales, and all costs are expected to be paid

The information below is relevant for both projects:

All sales are expected to be cash sales, and all costs are expected to be paid for in cash as and when incurred.

Depreciation is charged on a straight-line basis over the economic life of each project.

Depreciation is the only adjustment difference between accounting profit and cash flows for each project.

Required:

(a)

(i) Calculate for each project the payback period (Assume that cash flows will occur evenly throughout the year).

(ii) Advise the management of Smith limited as to which to which project to select in (a) (i) above.

(b

(i) Calculate the NPV of Project B using a cost of capital of 9%. (Assume that all cash flows occur at the year-end).

(ii) Comment on the viability of the project.

(c) For Project B: calculate the breakeven point in sales revenue for year 3.

(d) In the third year of Project B, 700 units of the product were budgeted to be produced and sold.

(i) Calculate for the third year the unit cost of the product under marginal costing and absorption costing.

(ii) What would be the impact of the difference in unit costs calculated in (d) (i) on the year-end profit under the two costing methods?

(iii) If the production exceeds sales, explain which method would expect to show the higher profit, marginal costing or absorption costing.

All sales are expected to be cash sales, and all costs are expected to be paid for in cash as and when incurred.

Depreciation is charged on a straight-line basis over the economic life of each project.

Depreciation is the only adjustment difference between accounting profit and cash flows for each project.

Required:

(a)

(i) Calculate for each project the payback period (Assume that cash flows will occur evenly throughout the year).

(ii) Advise the management of Smith limited as to which to which project to select in (a) (i) above.

(b

(i) Calculate the NPV of Project B using a cost of capital of 9%. (Assume that all cash flows occur at the year-end).

(ii) Comment on the viability of the project.

(c) For Project B: calculate the breakeven point in sales revenue for year 3.

(d) In the third year of Project B, 700 units of the product were budgeted to be produced and sold.

(i) Calculate for the third year the unit cost of the product under marginal costing and absorption costing.

(ii) What would be the impact of the difference in unit costs calculated in (d) (i) on the year-end profit under the two costing methods?

(iii) If the production exceeds sales, explain which method would expect to show the higher profit, marginal costing or absorption costing.

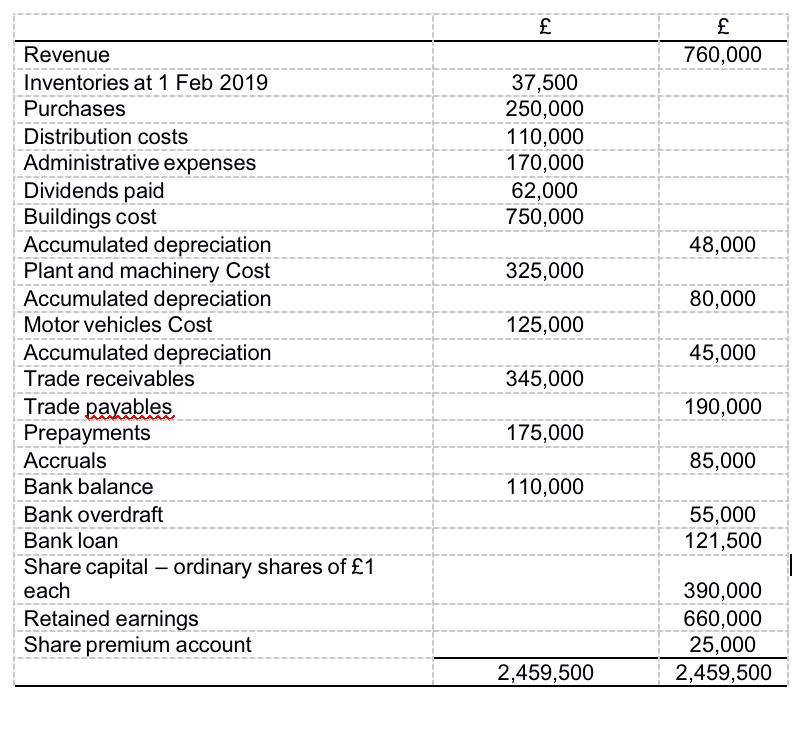

Revenue Inventories at 1 Feb 2019 Purchases Distribution costs Administrative expenses Dividends paid Buildings cost Accumulated depreciation Plant and machinery Cost Accumulated depreciation Motor vehicles Cost Accumulated depreciation Trade receivables Trade payables Prepayments Accruals Bank balance Bank overdraft Bank loan Share capital - ordinary shares of 1 each Retained earnings Share premium account 37,500 250,000 110,000 170,000 62,000 750,000 325,000 125,000 345,000 175,000 110,000 2,459,500 760,000 48,000 80,000 45,000 190,000 85,000 55,000 121,500 390,000 660,000 25,000 2,459,500

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer a i To calculate the payback period for each project we need to determine the time it takes for the initial investment to be recovered from the projects cash flows Project A Initial Investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started