Question

The information below represents the beginning and ending inventory amounts along with the production and sales for the month in umbrella units. Beginning Inventory: 0

The information below represents the beginning and ending inventory amounts along with the production and sales for the month in umbrella units.

Beginning Inventory: 0 Umbrellas

Production: 80,000 Umbrellas

Sales: 60,000 Umbrellas

Ending Inventory: 20,000 Umbrellas

Using the information provided above and the costs and sales information provided in Section I, complete the following in the Hampshire Company Spreadsheet in order to assist you in responding to all components of Section II:

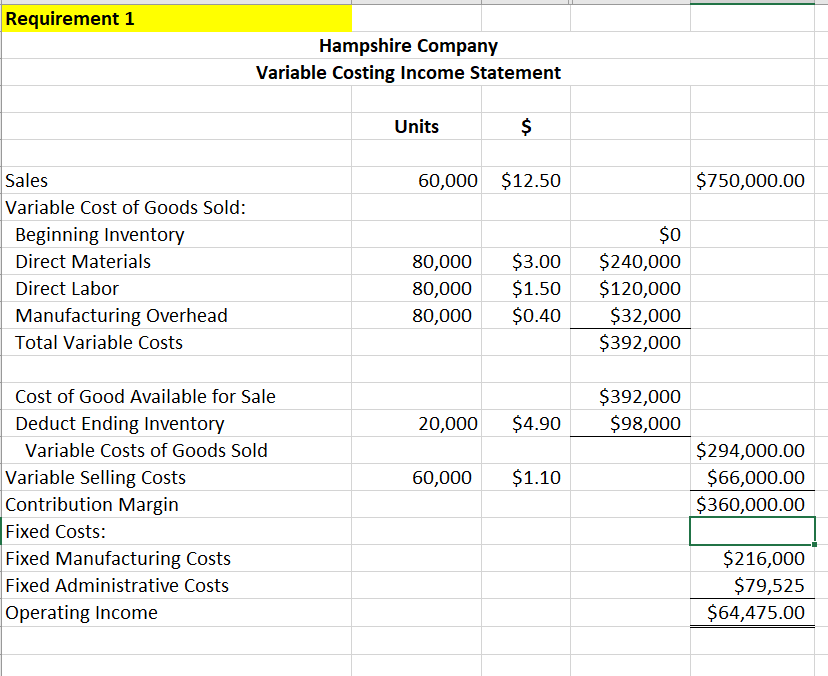

- Prepare the variable costing income statement.

- Prepare the absorption costing income statement.

I tried the Variable Costing Income Statement, not sure I did it correctly. Looking for clarification on that and help on the Absorption Costing IS.

Attached are pictures of everything completed (including my attempt at the VC IS) prior to this question.

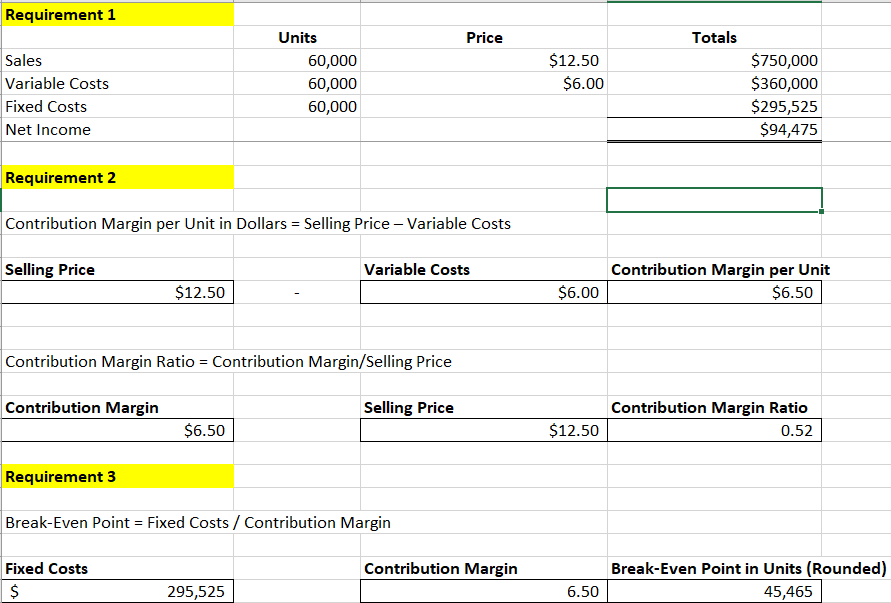

Requirement 1 Sales Variable Costs Fixed Costs Net Income Units Price Totals 60,000 60,000 $12.50 $6.00 $750,000 $360,000 60,000 $295,525 $94,475 Requirement 2 Contribution Margin per Unit in Dollars = Selling Price - Variable Costs Selling Price $12.50 Variable Costs Contribution Margin Ratio = Contribution Margin/Selling Price Contribution Margin $6.50 Requirement 3 $6.00 Contribution Margin per Unit $6.50 Selling Price Contribution Margin Ratio $12.50 0.52 Break-Even Point = Fixed Costs / Contribution Margin Fixed Costs $ 295,525 Contribution Margin Break-Even Point in Units (Rounded) 6.50 45,465

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started