Answered step by step

Verified Expert Solution

Question

1 Approved Answer

All these math are from costing for overhead. Overhead absorption: 1) is the process whereby overhead costs allocated and apportioned to production cost centres are

All these math are from costing for overhead.

Overhead absorption:

1) is the process whereby overhead costs allocated and apportioned to production cost centres are added to unit, job or batch costs.

2) is sometimes called overhead recovery.

Overheads are usually added to cost units using a predetermined overhead absorption rate, which is calculated from budgets.

Overheads absorbed = predetermined OAR xActuallevel of activity

POAR = (Budgeted overheads/Budgeted level of activities)

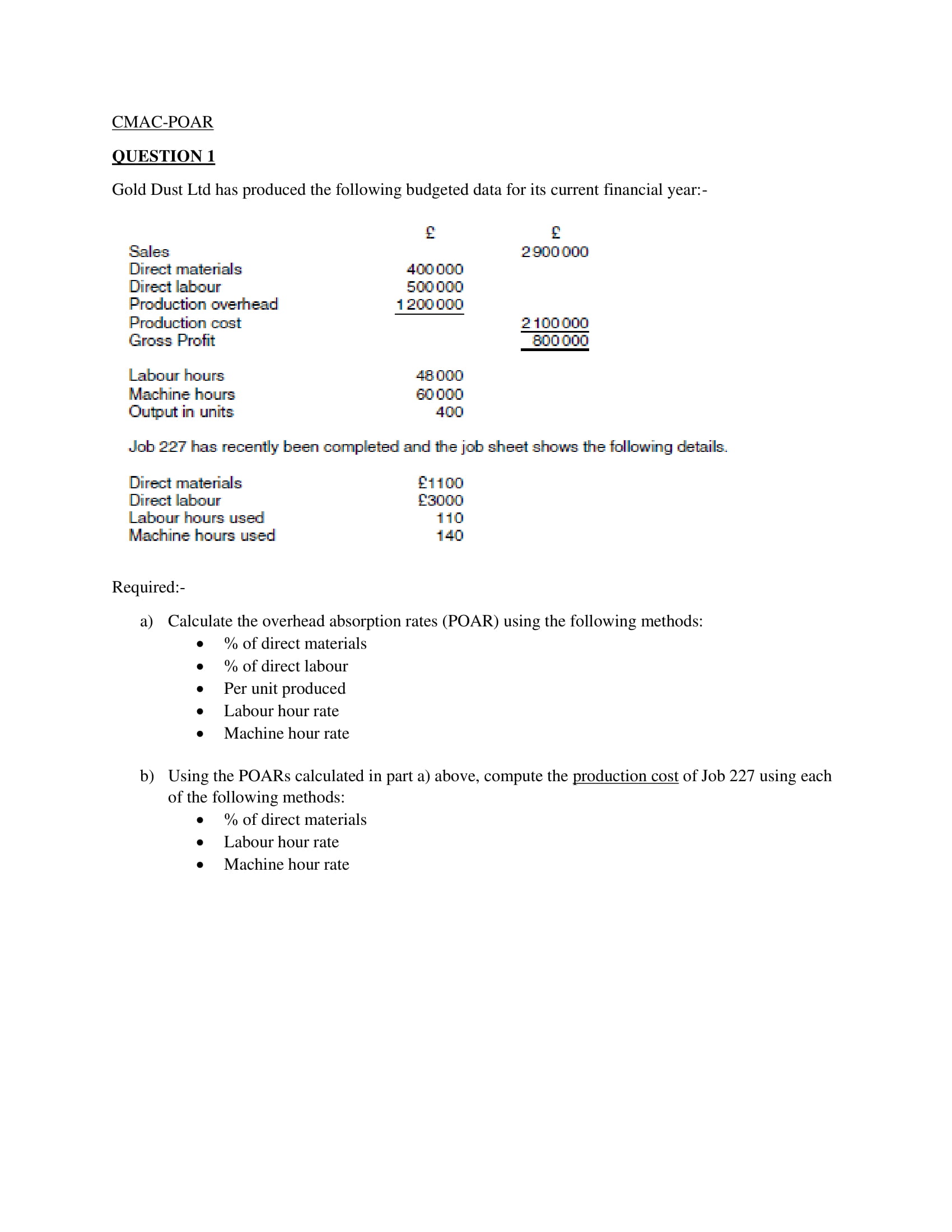

CMAC-POAR QUESTION 1 Gold Dust Ltd has produced the following budgeted data for its current financial year:- Sales 2900 000 Direct materials Direct labour 400000 500000 Production overhead 1200000 Production cost Gross Profit 2100000 800000 Labour hours 48000 Machine hours 60000 400 Output in units Job 227 has recently been completed and the job sheet shows the following details. Direct materials Direct labour Labour hours used Machine hours used 1100 3000 110 140 Required:- a) Calculate the overhead absorption rates (POAR) using the following methods: . % of direct materials % of direct labour . Per unit produced Labour hour rate . Machine hour rate b) Using the POARS calculated in part a) above, compute the production cost of Job 227 using each of the following methods: % of direct materials Labour hour rate Machine hour rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started