Question

THE INFORMATION FOR QUESTIONS 18, 19 AND 20 ARE THE SAME. HOWEVER, EACH QUESTION ASKS YOU TO DO SOMETHING DIFFERENT WITH THE INFORMATION. You are

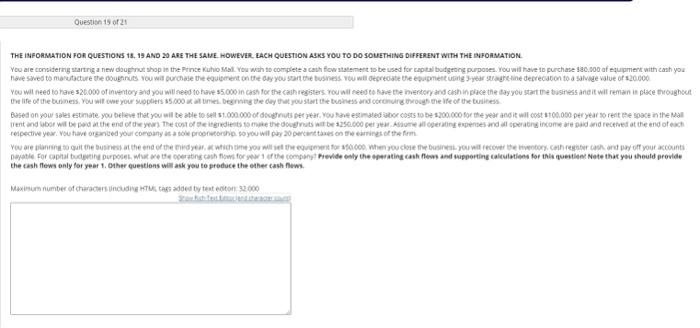

THE INFORMATION FOR QUESTIONS 18, 19 AND 20 ARE THE SAME. HOWEVER, EACH QUESTION ASKS YOU TO DO SOMETHING DIFFERENT WITH THE INFORMATION.

You are considering starting a new doughnut shop in the Prince Kunio Mall. You wish to complete a cash flow statement to be used for capital budgeting purposes. You will have to purchase $80,000 or equipment with cash you have saved to manufacture the doughnuts. You will purchase the equipment on the day you start the business. You will depreciate the equipment using 3-year straight-line depreciation to a salvage value of $20,000.

You will need to have $20,000 of inventory and you will need to have $5,000 in cash for the cash registers. You will need to have the inventory and cash in place the day you start the business and it will remain in place throughout the life of the business. You will owe your suppliers $5,000 at all times, beginning the day that you start the business and continuing through the life of the business.

Based on your sales estimate, you believe that you will be able to sell $1,000,000 of doughnuts per year. You have estimated labor costs to be $200,000 for the year and it will cost $100,000 per year to rent the space in the Mall (rent and labor will be paid at the end of the year). The cost of the ingredients to make the doughnuts will be $250,000 per year. Assume all operating expenses and all operating income are paid and received at the end of each respective year. You have organized your company as a sole proprietorship, so you will pay 20 percent taxes on the earnings of the firm.

You are planning to quit the business at the end of the third year, at which time you will sell the equipment for $50,000. When you close the business. you will recover the inventory, cash register cash, and pay off your accounts payable. For capital budgeting purposes, what are the operating cash flows for year 1 of the company? Provide only the operating cash flows and supporting calculations for this question! Note that you should provide the cash flows only for year 1. Other questions will ask you to produce the other cash flows.

THE INFORMATION FOR QUESTIONS 18, 19 AND 20 ARE THE SAME. HOWEVER, EACH QUESTION ASKS YOU TO DO SOMETHING DIFFERENT WITH THE INFORMATION.

You are considering starting a new doughnut shop in the Prince Kunio Mall. You wish to complete a cash flow statement to be used for capital budgeting purposes. You will have to purchase $80,000 or equipment with cash you have saved to manufacture the doughnuts. You will purchase the equipment on the day you start the business. You will depreciate the equipment using 3-year straight-line depreciation to a salvage value of $20,000.

You will need to have $20,000 of inventory and you will need to have $5,000 in cash for the cash registers. You will need to have the inventory and cash in place the day you start the business and it will remain in place throughout the life of the business. You will owe your suppliers $5,000 at all times, beginning the day that you start the business and continuing through the life of the business.

Based on your sales estimate, you believe that you will be able to sell $1,000,000 of doughnuts per year. You have estimated labor costs to be $200,000 for the year and it will cost $100,000 per year to rent the space in the Mall (rent and labor will be paid at the end of the year). The cost of the ingredients to make the doughnuts will be $250,000 per year. Assume all operating expenses and all operating income are paid and received at the end of each respective year. You have organized your company as a sole proprietorship, so you will pay 20 percent taxes on the earnings of the firm.

You are planning to quit the business at the end of the third year, at which time you will sell the equipment for $50,000. When you close the business. you will recover the inventory, cash register cash, and pay off your accounts payable. For capital budgeting purposes, what are the operating cash flows for year 1 of the company? Provide only the operating cash flows and supporting calculations for this question! Note that you should provide the cash flows only for year 1. Other questions will ask you to produce the other cash flows.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started