Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the information in question 1 is needed to solve question 2. please solve question 2 2. An investor initiates a long position in each contract

the information in question 1 is needed to solve question 2. please solve question 2

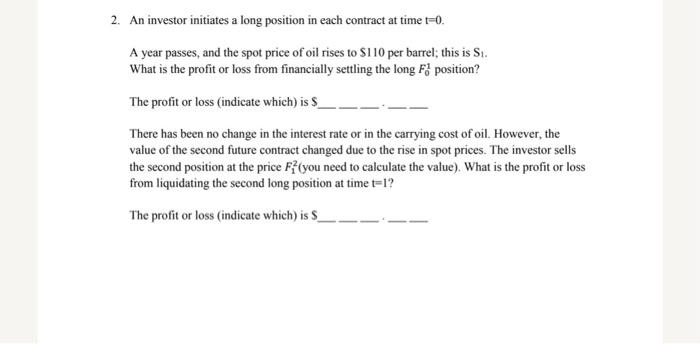

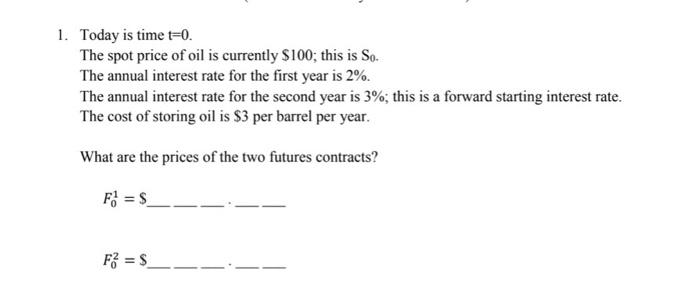

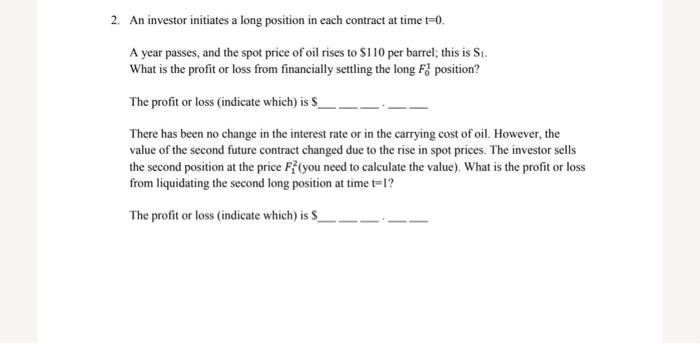

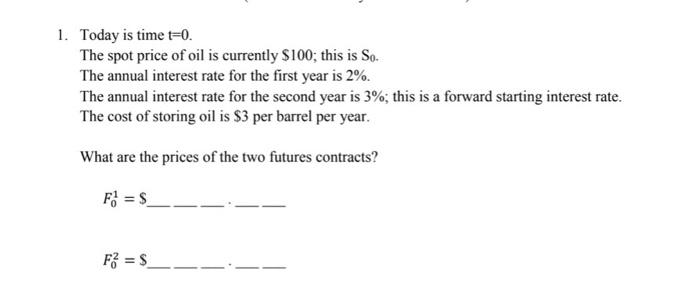

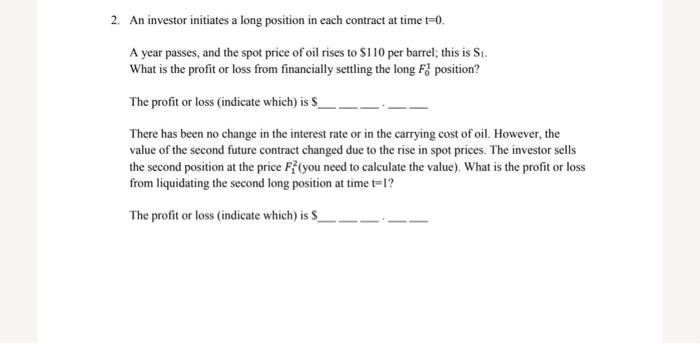

2. An investor initiates a long position in each contract at time t=0. A year passes, and the spot price of oil rises to S110 per barrel; this is St. What is the profit or loss from financially settling the long F) position? The profit or loss (indicate which) is $_ There has been no change in the interest rate or in the carrying cost of oil. However, the value of the second future contract changed due to the rise in spot prices. The investor sells the second position at the price f(you need to calculate the value). What is the profit or loss from liquidating the second long position at time t=1? The profit or loss (indicate which) is 1. Today is time t=0. The spot price of oil is currently $100; this is So. The annual interest rate for the first year is 2%. The annual interest rate for the second year is 3%; this is a forward starting interest rate. The cost of storing oil is $3 per barrel per year. What are the prices of the two futures contracts? Fo = $ F3 = $ 2. An investor initiates a long position in each contract at time t=0. A year passes, and the spot price of oil rises to S110 per barrel; this is St. What is the profit or loss from financially settling the long F) position? The profit or loss (indicate which) is $_ There has been no change in the interest rate or in the carrying cost of oil. However, the value of the second future contract changed due to the rise in spot prices. The investor sells the second position at the price f(you need to calculate the value). What is the profit or loss from liquidating the second long position at time t=1? The profit or loss (indicate which) is 2. An investor initiates a long position in each contract at time t=0. A year passes, and the spot price of oil rises to S110 per barrel; this is St. What is the profit or loss from financially settling the long F) position? The profit or loss (indicate which) is $_ There has been no change in the interest rate or in the carrying cost of oil. However, the value of the second future contract changed due to the rise in spot prices. The investor sells the second position at the price f(you need to calculate the value). What is the profit or loss from liquidating the second long position at time t=1? The profit or loss (indicate which) is 1. Today is time t=0. The spot price of oil is currently $100; this is So. The annual interest rate for the first year is 2%. The annual interest rate for the second year is 3%; this is a forward starting interest rate. The cost of storing oil is $3 per barrel per year. What are the prices of the two futures contracts? Fo = $ F3 = $ 2. An investor initiates a long position in each contract at time t=0. A year passes, and the spot price of oil rises to S110 per barrel; this is St. What is the profit or loss from financially settling the long F) position? The profit or loss (indicate which) is $_ There has been no change in the interest rate or in the carrying cost of oil. However, the value of the second future contract changed due to the rise in spot prices. The investor sells the second position at the price f(you need to calculate the value). What is the profit or loss from liquidating the second long position at time t=1? The profit or loss (indicate which) is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started