Answered step by step

Verified Expert Solution

Question

1 Approved Answer

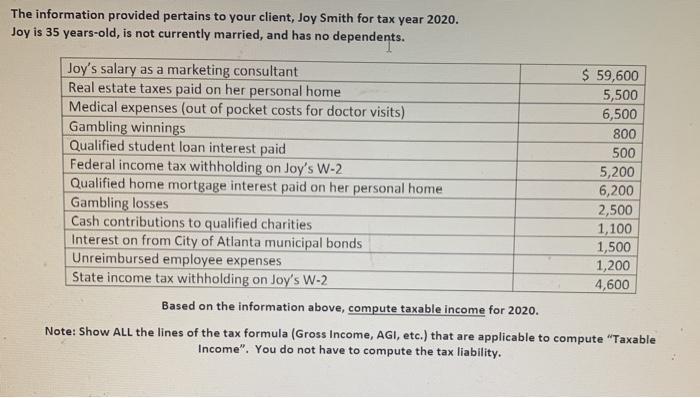

The information provided pertains to your client, Joy Smith for tax year 2020. Joy is 35 years-old, is not currently married, and has no

The information provided pertains to your client, Joy Smith for tax year 2020. Joy is 35 years-old, is not currently married, and has no dependents. Joy's salary as a marketing consultant Real estate taxes paid on her personal home Medical expenses (out of pocket costs for doctor visits) Gambling winnings Qualified student loan interest paid Federal income tax withholding on Joy's W-2 Qualified home mortgage interest paid on her personal home Gambling losses Cash contributions to qualified charities Interest on from City of Atlanta municipal bonds Unreimbursed employee expenses State income tax withholding on Joy's W-2 $ 59,600 5,500 6,500 800 500 5,200 6,200 2,500 1,100 1,500 1,200 4,600 Based on the information above, compute taxable income for 2020. Note: Show ALL the lines of the tax formula (Gross Income, AGI, etc.) that are applicable to compute "Taxable Income". You do not have to compute the tax liability.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Gross Income 59600 800 6200 54200 Adjusted Gross Income AGI 54...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started