Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The information related to manufacturing and selling and administrative overhead is as follows: Variable manufacturing overhead: $0.60 per unit produced Annual fixed manufacturing overhead: $12,000

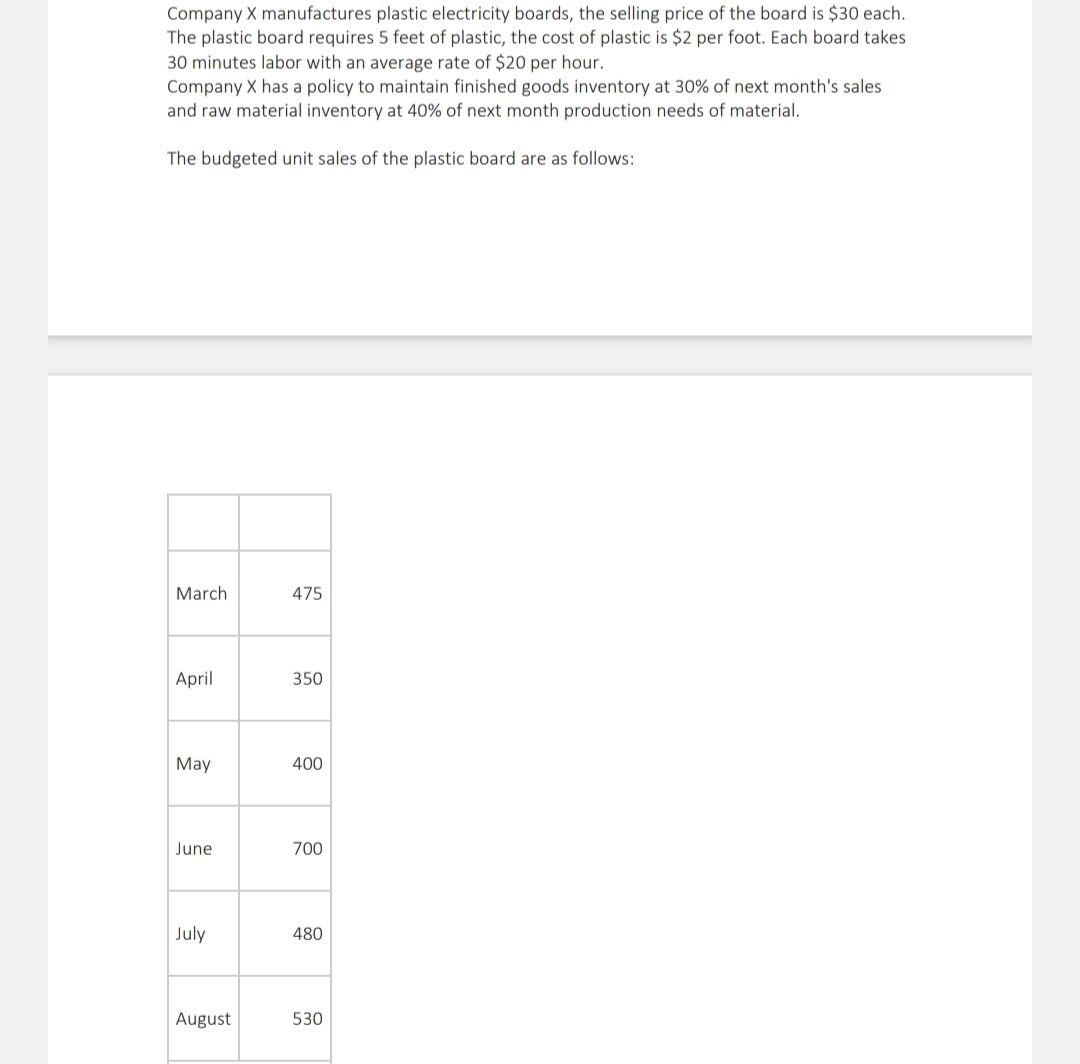

The information related to manufacturing and selling and administrative overhead is as follows: Variable manufacturing overhead: $0.60 per unit produced Annual fixed manufacturing overhead: $12,000 (Includes depreciation $300 per month) Selling and administrative expenses: $500+$0.50 per unit sold The information related to the collection of sales is as follows: (i) 75% of sales are cash sales (ii) 25% are credit sales of which 60% were collected during the month of sales and 40% collected in the next month of sales. The information related to payment is as follows: 60% paid during the month of purchase and 40% paid in the following month. Raw materials purchases for March 1 totaled $6,000. All operating expenses are paid in the month in which it incurred. The cash in hand on April 1 is $12,000. Requirement: 1) Prepare the schedule of budgeted cash receipts 2) Prepare the schedule of budgeted cash payments 3) Prepare a cash budget of 2nd Quarter for company X (Company X wants to maintain $15,000 minimum cash balance for which the company can borrow and repay in multiple of 500 only) Company X manufactures plastic electricity boards, the selling price of the board is $30 each. The plastic board requires 5 feet of plastic, the cost of plastic is $2 per foot. Each board takes 30 minutes labor with an average rate of $20 per hour. Company X has a policy to maintain finished goods inventory at 30% of next month's sales and raw material inventory at 40% of next month production needs of material. The budgeted unit sales of the plastic board are as follows

The information related to manufacturing and selling and administrative overhead is as follows: Variable manufacturing overhead: $0.60 per unit produced Annual fixed manufacturing overhead: $12,000 (Includes depreciation $300 per month) Selling and administrative expenses: $500+$0.50 per unit sold The information related to the collection of sales is as follows: (i) 75% of sales are cash sales (ii) 25% are credit sales of which 60% were collected during the month of sales and 40% collected in the next month of sales. The information related to payment is as follows: 60% paid during the month of purchase and 40% paid in the following month. Raw materials purchases for March 1 totaled $6,000. All operating expenses are paid in the month in which it incurred. The cash in hand on April 1 is $12,000. Requirement: 1) Prepare the schedule of budgeted cash receipts 2) Prepare the schedule of budgeted cash payments 3) Prepare a cash budget of 2nd Quarter for company X (Company X wants to maintain $15,000 minimum cash balance for which the company can borrow and repay in multiple of 500 only) Company X manufactures plastic electricity boards, the selling price of the board is $30 each. The plastic board requires 5 feet of plastic, the cost of plastic is $2 per foot. Each board takes 30 minutes labor with an average rate of $20 per hour. Company X has a policy to maintain finished goods inventory at 30% of next month's sales and raw material inventory at 40% of next month production needs of material. The budgeted unit sales of the plastic board are as follows Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started